Market analysts with a decade of experience have NO experience at all.

Well, technically that’s not true…but I needed an opening line.

They do have experience…it’s just that’s it’s limited to one side of the market cycle…the UP phase. And, contrary to popular belief, that’s a really BAD experience to have.

In the UP phase of the cycle, you only learn bad habits…even more so when it has been so aggressively sponsored by the US central bank.

Buy-the-dip has become accepted wisdom.

Really?

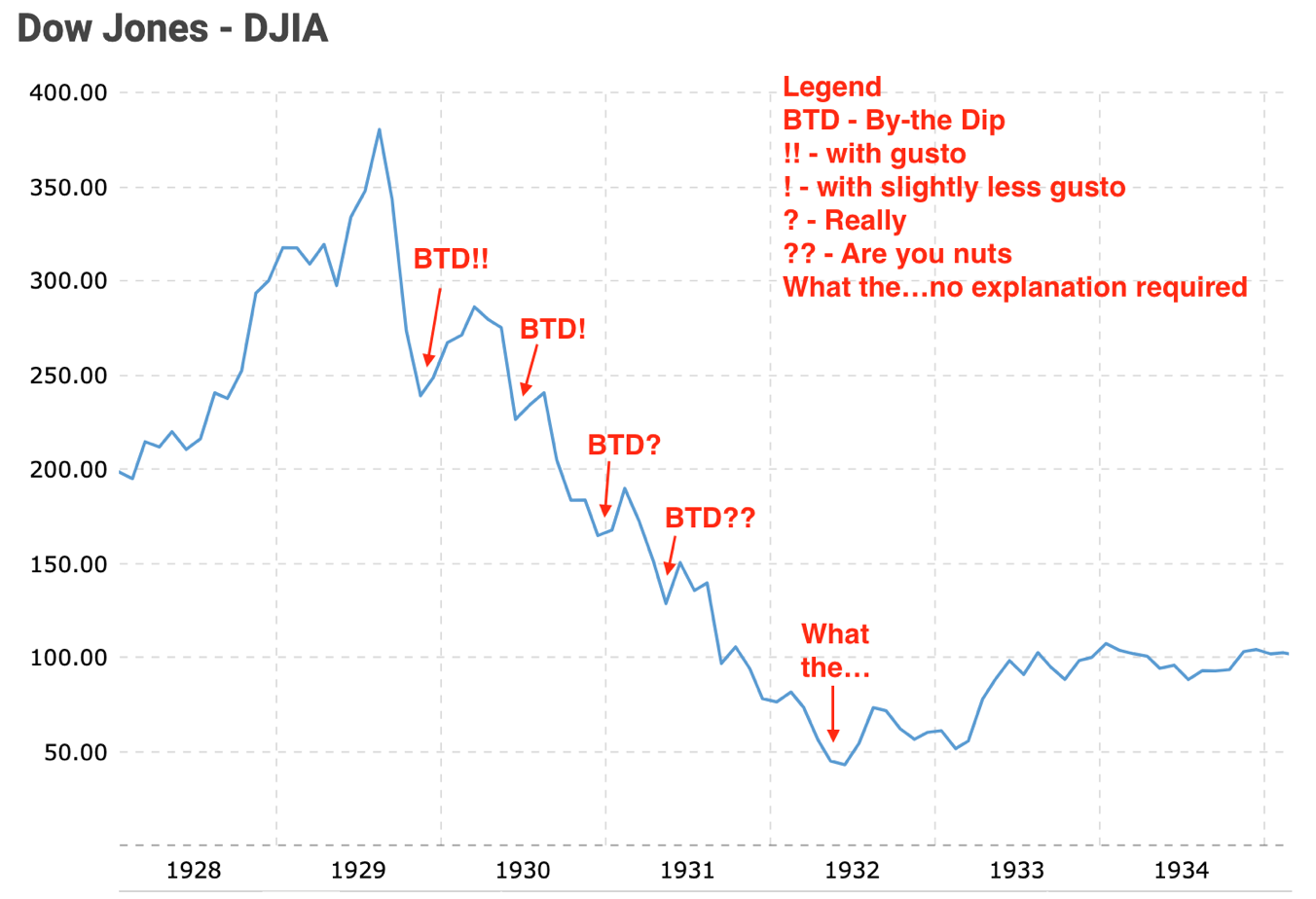

Here’s how that would have worked out between 1929 and 1932:

|

|

|

Source: Macrotrends |

Are we facing a 1930s-style market?

Maybe.

What I think I know is we’re going to see a Titanic struggle between two panicking forces.

On one side (trying to boost the market) will be an increasingly edgy and rattled central bank. On the other will be increasingly nervous investors who begin to question the Fed’s once-unquestionable omnipotence.

Who wins?

The market always wins.

The arm wrestle has already begun.

Wall Street has commenced its jagged journey to lower lows.

This bear market (which will be punctuated with so-called ‘recovery’ rallies) has the potential to be epic.

We are at the end of a very long cycle.

One that stretches back more than seven decades.

This is from the March 2022 issue of The Gowdie Letter:

‘On 1 March 2022, Ray Dalio (founder and Chairman of Bridgewater Associates) published this piece of thought-provoking research…

|

|

|

Source: Ray Dalio |

‘To quote from Dalio’s paper…

“I will focus most on the Big Cycle that began in 1945 and is now 77 years old. I will briefly review how the big cycle of external conflicts typically works in the context of the rises and declines of empires and world orders.”

‘The Big Cycle is the period we’ve all grown up in.’

My nearly four decades in this business has given me a very different perspective to the analysts who’ve only been around for the good times.

There are cycles within cycles within cycles.

Those who’ve only seen the good side of a market cycle, without understanding the context and interplay of demographic, debt, and valuation cycles, are like the speeding P-plate driver who only has eyes on his or her speedometer.

They are completely oblivious to the risks…both known and unknown.

The 8 November 2021 issue of The Gowdie Letter took a step or two back and looked at the bigger cycle that’s influenced all of our lives and conditioned our belief systems:

‘Since 1953, the Queen has been the one constant in our lives.

‘Presidents and prime ministers have come and gone.

‘And boy have there have been some greats she’s outlasted…JFK. Winston Churchill. Margaret Thatcher. Robert Menzies.

‘Can you imagine a world without Queen Elizabeth?

‘While it’s hard to fathom, we know one day that will be our reality.

‘Nothing lasts forever.

‘During the Queen’s reign, the other constant in our lifetime has been the cycle of asset price appreciation.

‘We’ve known no different.

‘There have been moments when the cycle hit a flat spot or two.

‘However, our living memory is not scarred with a Great Depression and/or world war experiences…a period when growth was on pause for almost two decades.

‘That concept is even more foreign to us then life without the Queen.

‘We have been conditioned by 70 years of constant progress. Believing this will be a constant in our lives.

‘Our belief system is a product of Ray Dalio’s ‘The Big Multigenerational Psychological Cycle’…specifically…

‘Stage 2: People and Their Countries Are Rich but Still Think of Themselves as Poor.

‘Stage 3: People and Their Countries Are Rich and Think of Themselves as Rich.

‘Stage 4: People and Their Countries Are Poorer and Still Think of Themselves as Rich.

‘In 1950, my educated guess is the US was on the cusp of late Stage 2/early Stage 3.

‘Now, by my reading of the generational psychological cycle, the US is now in late Stage 4.

‘Which means the next stage is…

‘Stage 5: People and Their Countries Are Poor and They Think of Themselves as Poor.

‘The prospect of that happening is beyond our comprehension. How could it be even remotely possible?

‘These charts show how this can occur.

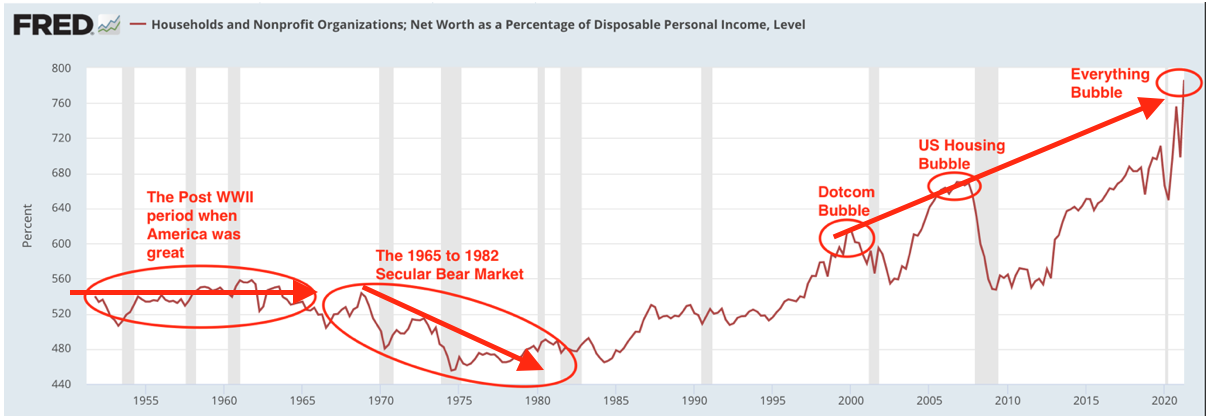

‘This chart — dating back to 1950 — shows US Household Net Worth as a percentage of Disposable Net Income:

|

|

|

Source: Federal Reserve Economic Data |

‘At the start of this cycle, the wealth-to-income percentage hovered around the 550% level.

‘During the high inflation 1970s it fell under 500%.

‘But, after 1980, with low inflation and more expansionary monetary policy, wealth-to-income migrated back towards 550%.

‘Then came the three bubbles…artificially (and temporarily) inflating wealth.

‘After the air went out of the two previous bubbles, wealth-to-income fell back into the 550% to 560% range.

‘Since 2009, the Fed’s concerted effort to create the “wealth effect”, has pushed the percentage to within a whisker of 800%.

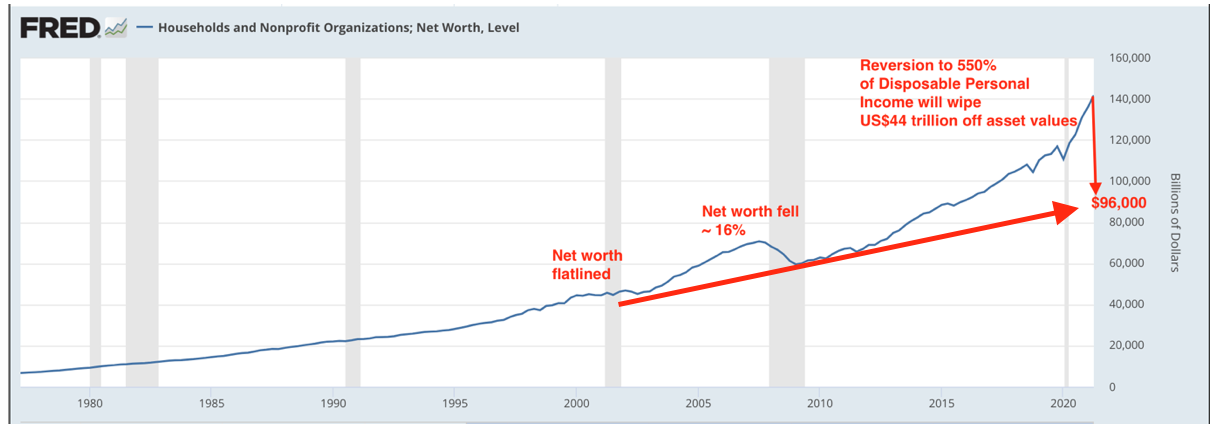

‘This next chart is what those percentages relate to in dollar terms.

‘The 2008/09 reversion to the wealth-to-income mean, wiped out US$11 trillion (80% of GDP) of illusory wealth.

‘That was enough to give us the worst economic downturn since the Great Depression.

‘Getting back to the MEAN from this latest bubble requires US$44 trillion (200% of GDP) to be shredded from Wall Street, US property market, and cryptos.

‘Getting back to the MEAN from this latest bubble requires US$44 trillion (200% of GDP) to be shredded from Wall Street, US property market, and cryptos.

|

|

|

Source: Federal Reserve Economic Data |

‘Loss of wealth on that scale — across all popular asset classes — will scar more than one generation.

‘Boomers. Gen X. Millennials. Centennials.

‘Each generation has (to varying degrees of speculation) participated in this massive experiment of artificial wealth creation.

‘This is…Stage 4: People and Their Countries Are Poorer and Still Think of Themselves as Rich.

‘The US government and the Fed have created the illusion of wealth and prosperity.

‘But underneath it all, the country is getting poorer.

‘Lower workforce participation. Ageing demographic profile. Increase welfare dependency. Record deficit spending. Rising debt-to-GDP levels.

‘The US economy and society (like the Queen) is no longer the same as it was in 1950s. The youthfulness is gone. It is older and more fragile.

‘When the percentage of wealth-to-income eventually mean reverts, I suspect, US citizens will no longer think of themselves as rich…a poor mindset is seeded.

‘That collective psychological shift robs the Fed of the willing accomplice it so desperately needs to recreate the wealth effect.

‘This [mind shift] will not happen overnight, but, if Japan is any guide, it will happen.

‘Given the spectacular decade in asset appreciation we’ve just had, the prospect of two decades of asset price deflation or stagnation borders on the farcical.

‘The 1920s in the US and the 1980s in Japan were also decades of truly remarkable (debt fuelled) asset price appreciation.

‘Yet, what would have been considered laughable at the time of peak euphoria, became all-too serious in the years to follow.

‘Nothing lasts forever.’

Seven weeks after writing this, the wealth-to-income mean reversion process commenced.

The S&P 500 Index has lost around 13%…this is beginning not the end.

Yes, there will be relief rallies.

Yes, we will be told the worst is over.

Yes, people will buy the dips.

And, yes, to those of us who’ve been around for more than one full (UP and DOWN) market cycle, this has an all-too-familiar ring about it.

If you think ‘time in the market’ is going to give you the psychological comfort needed to endure what’s coming, then it might be time for you to consider a Plan B.

Regards,

|

Vern Gowdie,

For The Daily Reckoning Australia