I’m standing in a massive conference room, a CEO either side of me.

Both were inside company marketing booths, pitching their shares to anyone that drifted over to them.

Hundreds of potential investors wandered around the resource conference on the Gold Coast. It was 2017.

Little did I know that both men would go on to become millionaires many times over…

And all thanks to pretty much one company. Yep, Tesla!

The electric carmaker has risen 25,000% since 2010.

It’s also created millions for those within its orbit, such as raw material suppliers right here in Australia.

Look no further than Tim Goyder and Ken Brinsden — the two men from that conference.

Tim Goyder’s two companies, Chalice Mining and Liontown Resources, were 12 and 2 cents a share, respectively, back in 2017.

They are $7 and $1.40 now.

Tim Goyder is close to a billionaire now…or maybe he already is!

And Ken Brinsden, outgoing chief of lithium play Pilbara Minerals [ASX:PLS], owns over five million shares in PLS.

Pilbara was 15 cents a share in 2020. It’s around $2.69 now. That’s a rise of 1,693% in less than two years!

I’d call that hitting the jackpot, wouldn’t you?

Now the hunt is on for the next generation of what I call ‘potential ASX Tesla jackpots’.

These are companies that benefit from the rise of EVs…or could even deal with Tesla directly one day.

Look at these previous examples…

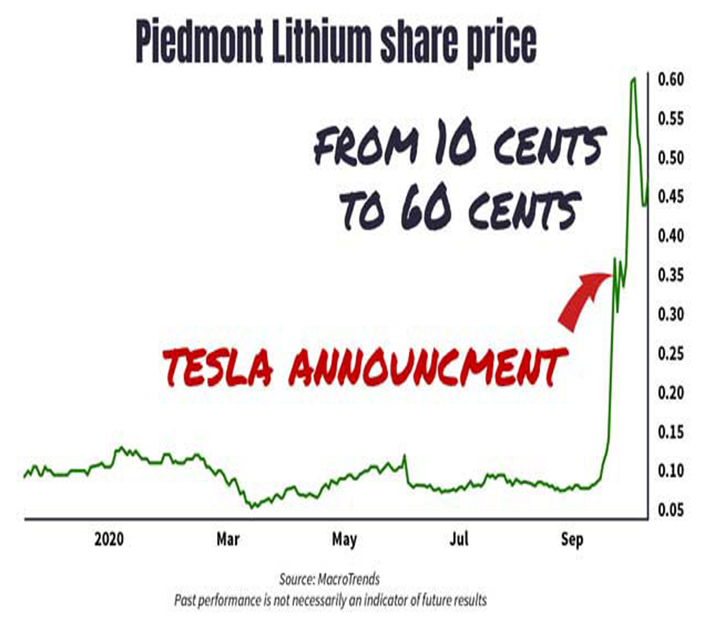

In 2020, ASX-listed stock Piedmont Lithium [ASX:PLL] soared more than 500% in under a month. Check it out:

|

|

| Source: Macrotrends |

The catalyst? A sales agreement with Tesla!

Just this year in February, multibillion-dollar lithium developer Liontown Resources [ASX:LTR] rallied 17% in a day after announcing a supply deal with Tesla too.

BHP has also entered into a nickel supply agreement with Tesla.

These examples show that Tesla’s clearly positioning in the resource space for its critical inputs.

That begs the question…which company could be next?

And even if it never happens, Tesla’s surging sales are lifting all companies on the same tide of electrification, batteries, renewables, and decarbonisation.

We want to be dancing here.

And I’ve found three potential plays for you!

More millions are up for grabs here

No doubt you’ve heard about the massive boom in lithium stocks and battery plays since 2020 here on the ASX.

It’s no wonder.

The lithium price is up a staggering 1,653% in the last 10 years.

Tesla sold only 2,650 sedans for the entire year in 2012. They delivered nearly a million in 2021!

They expect car sales to rise, on average, 50% per year.

You know what that means…

Batteries, batteries, batteries!

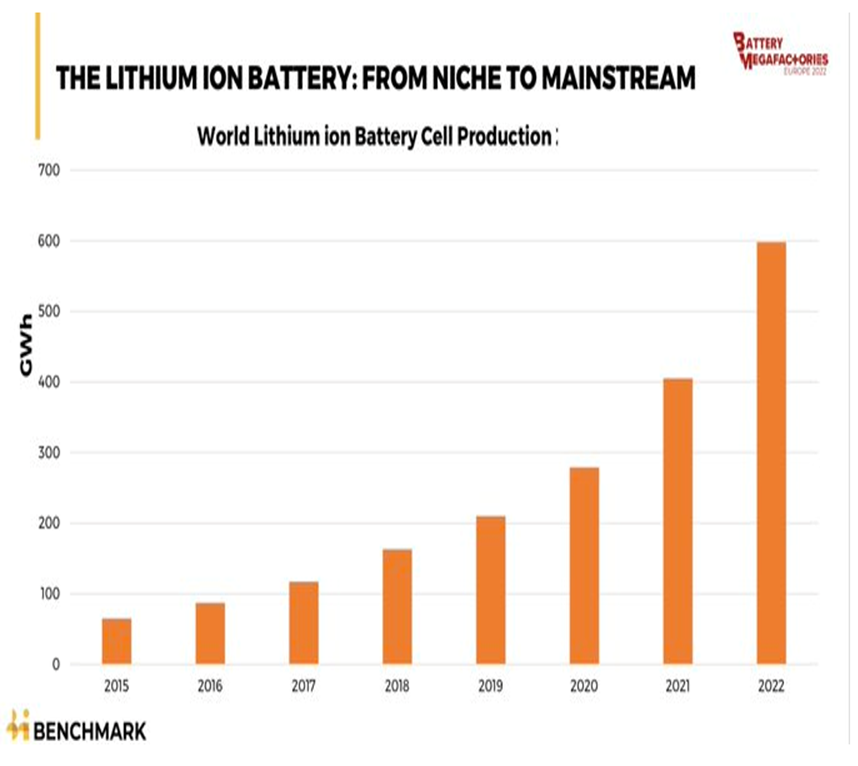

The volume of batteries has been on an upward march since 2015. See for yourself:

|

|

| Source: Benchmark Mineral Intelligence |

The difference today is that practically every carmaker in the world is now competing with Tesla.

They’re all bidding on a shrinking supply of battery metal assets and available supply. So…

Get ready for the bids to come

It’s a situation so tight that automakers might shift into buying mines directly.

Tesla CEO Elon Musk said it himself on 9 April, when he tweeted:

‘Price of lithium has gone to insane levels! Tesla might actually have to get into the mining & refining directly at scale, unless costs improve.’

Tesla has already announced deals with ASX companies BHP, Liontown Resources, Syrah Resources, and Piedmont Lithium.

I think there will be more!

And it won’t just be with Tesla either.

Mining.com also reported on 27 April:

‘“Henry Ford…was right,” according to current incumbent CEO of Ford Motors F.N, Jim Farley.

‘The most important thing is we vertically integrate.

‘The company intends to take control of its supply chains “all the way back to the mines.”’

The companies involved will be Australia’s mining companies and global chemical converters, battery makers, and auto firms.

That means we can expect more future offtake deals, takeover offers, joint ventures, and all sorts of corporate ‘battery metals’ action on the ASX…possibly for years to come.

After all…

The lithium decade is here, says ‘Mr Lithium’

You might not know the name Joe Lowry. He’s a US-based consultant and investor who specialises in lithium.

Joe’s been a vocal commentator on this space since at least 2015, but his lithium industry experience goes back decades.

Somewhere along the line, he got dubbed ‘Mr Lithium’. And deservedly so. He correctly called today’s boom back in lithium’s dark days of 2018–19.

What’s he saying now?

The Australian Financial Review quoted him last month:

‘In the next two years, even though there will be significant growth in supply, it will be less than demand, so the gap will just continue to grow.

‘It’s simple maths. It’s like, the bus in front of me is going 50 miles per hour, I’m going 45 mph, but I’m saying I’m gonna catch it in 2025.

‘I believe there will be a day in the future when lithium is in oversupply, but it won’t be in this decade.’

It’s an incredibly exciting dynamic. But we can’t be naïve, either.

Lithium stocks have been in a bull market since 2020. Here’s a tweet showing just how incredible the price rises have been:

Boom, boom, JACKPOT!

|

|

| Source: Twitter |

Almost all the valuations around lithium are sky-high already.

It’s hard to find hidden gems when so many investors are chasing a sector for so long.

But I believe I’ve found one…because the stock I’m talking about is hiding in another sector.

Let me explain…

You’ve been reading the latest edition of Australian Small-Cap Investigator.

All the best,

|

Callum Newman,

Editor, The Daily Reckoning Australia