‘Excuse me mate, where’s the city?’

‘You just drove through it…!’

At least that’s how Dinse family folklore says the conversation went.

What am I on about?

And how is it relevant to one key investment opportunity today?

Let me explain…

One legendary decision is all it takes

It was 1953…

My grandad, fresh off the boat from Scotland, had just married my gran out in Yallourn, Victoria.

As the Narracan Shire Advocate reported:

‘Held at Gunn’s Gully Roadhouse, Newborough, the wedding breakfast was a bright gathering of Australian, Scottish, and Irish friends, under the chairmanship of Mr. P. ‘Neill, at which Mr. Edward McGuinness sang “Down in the Glen,” among other musical and vocal items.’

You can imagine it must have been some heck of a party!

Now, I never met my gran (who died a few months before I was born), so finding this article recently while researching my family tree was a very pleasant surprise.

And it reminded me of a story my dad used to tell.

You see, straight after the wedding, my grandparents moved out west to Perth.

They drove all the way from Melbourne, across the Nullarbor, and onward to Perth.

Can you imagine it back then?

A 3,460km journey across the continent over one solid week of driving.

Remember, there was no air con in cars back then and the desert roads would’ve seemed like an alien planet compared to the lush green fields of Scotland!

Anyway, as legend tells it, at the end of the journey, my grandad drove through the city of Perth without realising it, hitting the Indian Ocean on the other side of Australia.

It was there he had the famous encounter with a local who told him he’d driven straight through the city unaware!

I’ve no idea if this tale is true or not. My grandad was a bit of a joker, so it could’ve been his way of saying how small Perth was back then.

But the other thing he says at the end of that tale was true. He used to say there were small shacks dotted up and down the barely populated Indian Ocean coastline.

These small beaten-down shacks were holiday homes for farmers who toiled away inland on hot, dusty wheatfields for most of the year.

A few weeks of respite beside the sea air in the height of Perth’s scorching summer days.

Of course, that same feature is what drove the development of Perth along the stunning coastline over the next few decades as the city’s population grew.

Today, most of the oceanside properties are prestige multimillion-dollar mansions. Even ‘ocean views’ are highly in demand.

‘If only he’d bought a big block of land on the cheap like you could back then. We’d be sitting on a fortune by now,’ my own dad would sometimes ruefully declare!

Properties by the ocean command a steep premium due to one important fact.

Namely, scarcity…

Imagining the future

I told you this story today to point out two things.

First is the value of scarcity.

I don’t think I need to go into that too deeply. The simple point is that something that’s scarce and in demand tends to go up in value over time.

Art, commodities, baseball cards, and property are several good examples. I mean in Perth, there’s only so much land you can build on next to the beach.

But there’s another more subtle point to this that isn’t always obvious as an investor.

And that’s the fact that working out what’s going to be valuable in the future isn’t as easy.

Something doesn’t become valuable just because it is scarce. You need to think about future demand too.

I mean, a Van Gogh painting is immensely valuable now, but in his lifetime, he could barely sell one.

Similarly, Perth in the 1950s hadn’t seen a major mining boom since the late 1800s.

The accepted thinking at the time was that Australia lacked sufficient reserves of iron ore for domestic production, hence there would be no viable mining industry.

Didn’t that turn out to be wrong!

Several mining booms over the next few decades and into the 21st century brought people and property demand to Perth in droves.

But it’s little wonder my grandad saw Perth as something of a hick town back then.

He couldn’t imagine that those beachside shacks were a once-in-a-lifetime bargain staring him in the face.

Which brings me to my point…

A digital land grab

There’s one asset that is going to become the scarcest asset in the world very soon. April 2024 to be exact.

I’m talking about Bitcoin [BTC].

In April 2024, the flow of new produced halves to just 3.125 BTC new bitcoin produced every 10 minutes or so.

This makes it scarcer in terms of ‘flow’ — that is new supply relative to existing supply — than gold.

‘Bitcoin?!’ that’s not worth anything I hear some of you sceptics think!

Well, not only is that wrong — one bitcoin sells for US$30,000 as I type, and the network has a market cap bigger than the top three global banks combined — but if you’d been paying attention last week, you would have seen a huge about turn from some very interesting players.

You see, last week, BlackRock, the world’s largest money manager, announced plans for a bitcoin spot ETF.

Given all the regulatory dramas in crypto of late, this was a bolt from the blue. And the price reacted savagely higher.

No wonder…

An approved bitcoin ETF in the US would open up bitcoin to reams of institutional capital.

This news was quickly followed by a slew of announcements from other major banks. As I told my Crypto Capital subscribers last week:

‘Contrary to the “crypto is dead” headlines, we’ve seen the exact opposite play out.

‘In the past few days, multiple big name finance institutions such as Fidelity, Charles Schwab, Citadel, and Deutsche Bank have all announced crypto related products.’

Even Fed Chairman Jerome Powell came out and said:

‘Bitcoin and crypto appears to have staying power as an asset class…’

Do you realise what’s happening here?

Every bank and financial player that told you crypto was a con, is quietly — and now not so quietly — looking to carve out a position for themselves in this space.

I mean, Larry Fink, head of BlackRock, once called the idea of a bitcoin ETF an ‘index of fraud’.

And now, today, they’ve applied for just such an index.

You couldn’t make this about turn up.

The truth is, they see what’s coming, and they now want in.

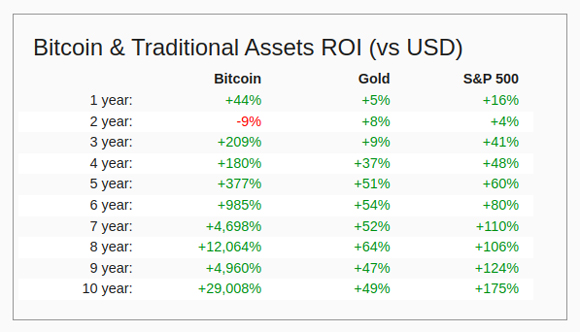

Despite all the negativity you’ve heard about bitcoin over the years from the mainstream media and their mates in big finance, this chart shows the reality of the situation:

|

|

| Source: Messari |

It’s funny, but I’ve been in bitcoin since late 2013 and most of the time I’ve been mocked for it, especially from fellow finance professionals.

But I can take their jibes pretty easily, given I’ve backed the best-performing asset of the last decade and have helped thousands of others too.

The facts don’t lie…

Bitcoin has vastly outperformed both stocks and gold over every time frame except the last two years.

That’ll likely turn positive soon too.

But the amazing thing that people still don’t seem to grasp, is that the upside on the table is still so immense.

The total market value of bitcoin right now is just 0.1% — yep, 0.1%! — of total global asset wealth.

For context, US stocks make up around 8% and gold around 2.4%. Property and bonds make up a huge chunk too.

This means, if bitcoin rose 10 times from here, it’d still only make up 1% of total global assets.

My view is that it’ll take over gold in terms of a store of value asset before 2030, so that’s 24 times from here.

Of course, I could be wrong…

But to my mind, NOT having a small allocation of between 1–5% of your overall portfolio in bitcoin is a far bigger risk.

The way I see it, you’re standing on the edge of a digital ocean right now. You’re looking at all these ‘shacks’ called crypto, not thinking much of them.

I mean, everyone knows they’re worthless, don’t they?

But in my opinion, you should think again.

Because what you’re really looking at are premium assets that, for a limited time only, are available at a bargain basement price.

Let me be blunt…

In my opinion, that window of opportunity to buy a ‘premium bitcoin stake’ is closing fast.

Good investing,

|

Ryan Dinse,

Editor, Money Morning