In today’s Money Morning…this chart tells you that small-caps aren’t dead…how to navigate the small-cap world when value is starting to matter…Life at Zero…and more…

The answer is yes.

After the Morrison government effectively shouldered all the risk for loan guarantees, or at least 80% of it, there will undoubtedly be some ASX-listed small-cap beneficiaries.

And yesterday, Ryan Dinse argued that this was the beginning of a phase in Australian history where the government is, in essence, the economy.

I too, think the changes to the loan guarantee scheme are the tip of the iceberg when it comes to government meddling.

Now as misguided as this may be, the key is to position yourself to benefit from it.

Ideology should not stand in the way of your investments — something Ryan drilled into me since I started working with him about two years ago.

Four Innovative Aussie Small-Cap Stocks That Could Shoot Up

Which is why I think it’s relevant to catch up with how the various ASX indices are performing.

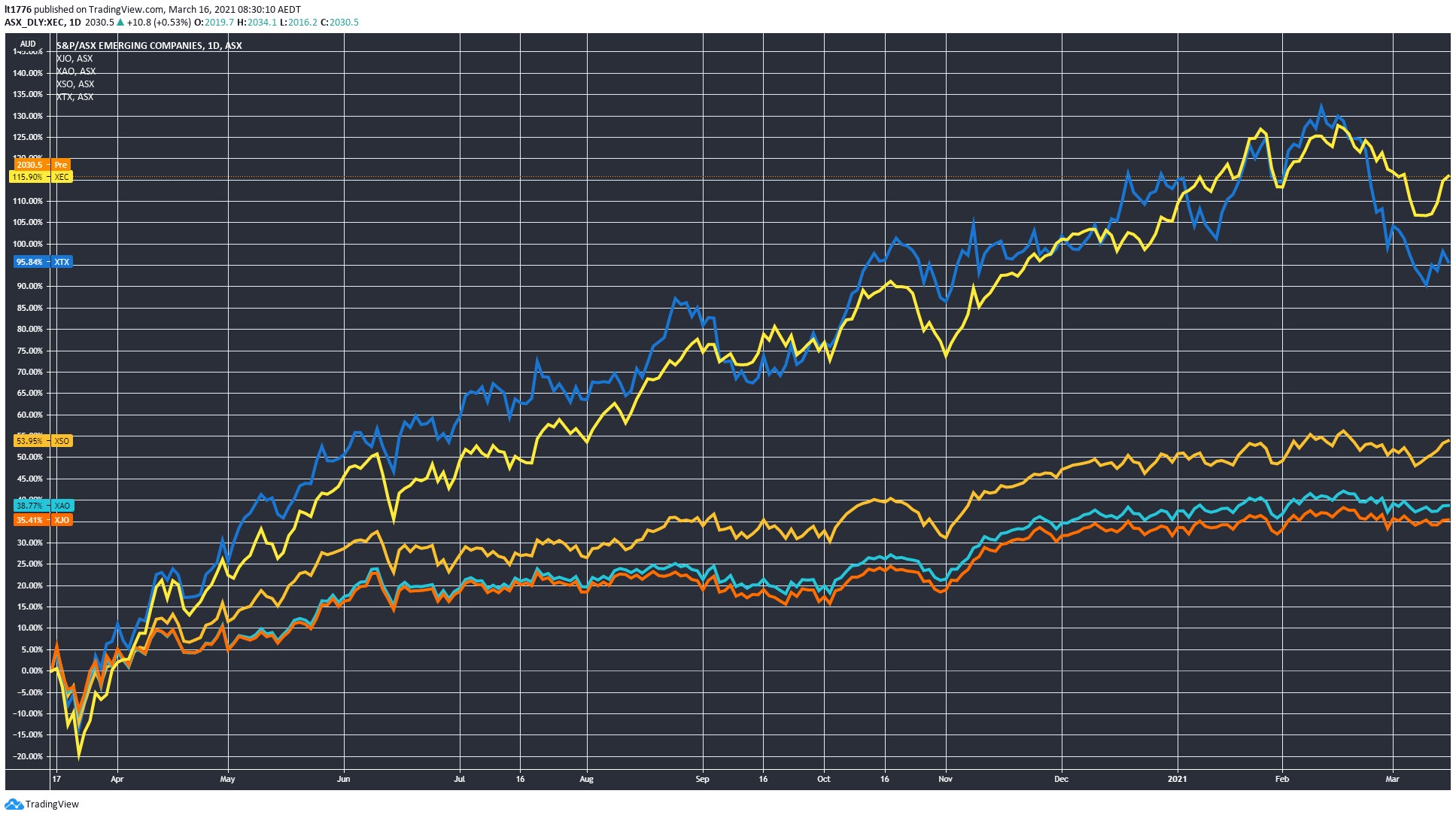

This chart tells you that small-caps aren’t dead

Check it out:

|

|

| Source: Tradingview.com |

You’ve got the S&P/ASX All Technology Index [XTX] (blue line) matched up against the S&P/ASX Emerging Companies Index [XEC] (yellow line), the S&P/ASX Small Ordinaries [XSO] (gold line), the S&P/ASX All Ordinaries [XAO] (teal), and the S&P/ASX 200 [XJO] (orange line).

Now let’s dig into this a bit.

There was a lot of chatter recently about how XTX sold off from the start of the year.

Oh no, the YTD returns are negative after a massive run-up, panic!

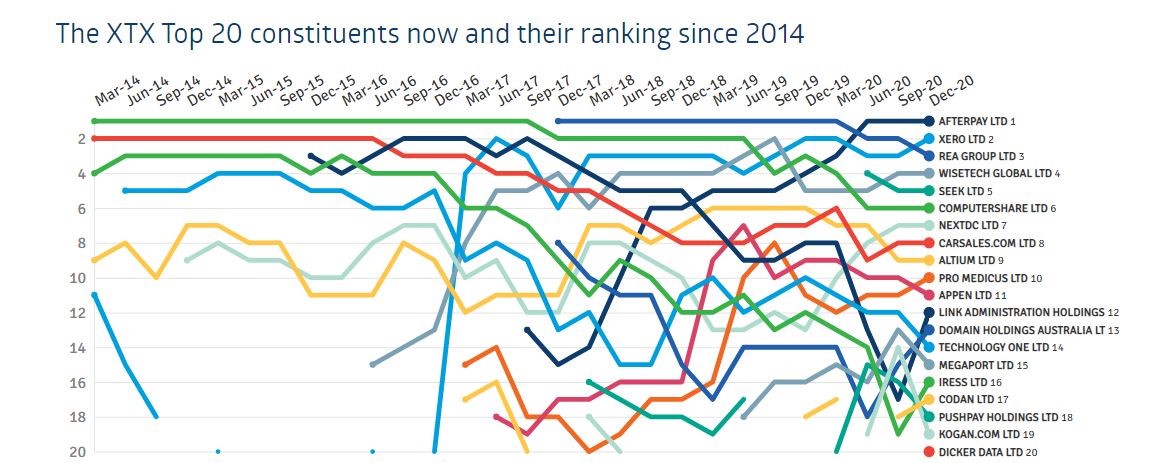

To be fair, this was always on the cards, particularly with rising bond yields and the fact that the companies you can see below are all quite large.

|

|

| Source: ASX |

I’d call this the Australian ‘Big Tech’ index, more so than ‘all technology’.

There are plenty of smaller ASX-listed technology companies out there that are still doing quite well.

I just needed to check my watchlist over the last couple days of trading to confirm this, as it’s pretty much all green for now.

What about XEC though, and why is it outperforming XTX?

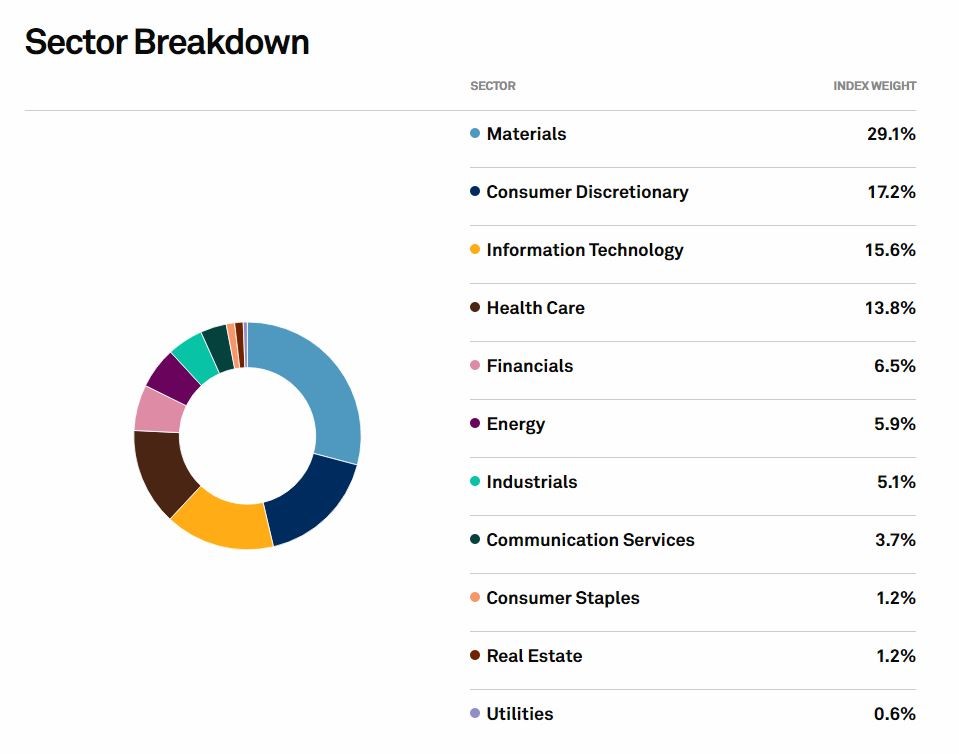

Have a look at the constituents of XEC below:

|

|

| Source: S&P Global |

As you can see, it’s heavily weighted towards materials.

We know that commodities are an increasing focus for investors, as things like lithium, copper, and nickel (despite its recent pullback) run hard.

Meanwhile XAO and XSO are outstripping the big dogs in XJO still.

For now, that means for me that the ‘value pivot’ may need to wait a bit.

If we see XJO start to outstrip those two, the change in market dynamics will be confirmed and I will be wrong.

But for now, I think I’m right to say that small-caps are definitely still on the menu.

How to navigate the small-cap world when value is starting to matter

Over the last couple of weeks, we’ve championed Greg Canavan’s service which is based on the thesis that low rates are here to stay, and that value should shine in the coming two years.

This was the ‘Life at Zero’ event.

But today, I want to highlight a smart way to operate if small-caps are more your thing.

Our friend and colleague, Callum Newman (Cal), has a unique methodology to his trading service.

In our editorial meeting yesterday, he gave us the complete rundown.

In a nutshell, here it is:

- Identify companies with positive news flow and indications of a future positive announcement in the small-cap space, ie: a catalyst for share price growth (Cal reads announcements voraciously)

- Understand the sector dynamics and how this plays into a company’s fundamentals and outlook over a longer time frame

- With #2 in hand, this gives Cal the confidence to hold the company (within reason and with a sensible stop-loss) despite what the market does in the immediate future

- Sell into positive news for (hopefully) a quickfire win

I think it’s a sound and unique methodology. Now, it doesn’t always pay off as Cal will attest.

But what it does do, is give you the opportunity to position effectively ahead of anticipated catalysts that the market is either too lazy to pick up, or ignorant of.

That’s the edge that Cal’s research and trading system can give you.

So, if you think, like I do, that small-caps still have a significant amount of steam in them — then this service may interest you.

You can learn all about Cal’s special event, and get a trade idea for free, right here.

Highly recommended.

Finally, I’ve got that exciting news for you.

We’re launching the Money Morning Podcast tomorrow.

You can listen to our first episode then, where I talk to a star of the crypto world in Australia.

It’s a fun chat, and you’ll definitely learn a thing or two about the world of monetary policy and bitcoin in the process.

I look forward to sharing a crypto-themed, podcast-enhanced Money Morning with you tomorrow.

Regards,

|

Lachlann Tierney,

For Money Morning

Lachlann is also the Editorial Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.

Comments