In today’s Money Morning…a power grab is underway…how to fight back…how bitcoin can help…and more…

Last Monday, I talked about how big the opportunity in Bitcoin [BTC] still was.

And why there could be an influx of ‘big money’ coming in soon.

Well, since I wrote that, the ‘Uptober’ surge has begun.

Check out the chart:

|

|

|

Source: Coinigy |

Bitcoin is now a $1 trillion asset class and new all-time highs are very much in sight.

Believe me, some people are making a lot of money in crypto right now.

But what originally drew me to bitcoin in 2013, beyond the opportunity to make money, was the very concept of Bitcoin itself.

You see, it has certain properties which makes it unique amongst assets.

And as I’ll talk about shortly, perhaps these properties are now more important than ever before.

Let me explain…

A power grab is underway

It really feels that there’s a covert war on the individual playing out right now.

Consider a few recent headlines…

‘Yellen defends IRS rule requiring banks to report all transactions over $600’

The New York Post

‘Scott Morrison slams social media as “coward’s palace” and foreshadows future crackdowns’

SBS News

‘Australia: Unprecedented surveillance bill rushed through parliament in 24 hours’

Tutanota.com

Do you see what’s happening?

Bit by bit, the apparatus of the State is seeking to gain total knowledge over everything you do.

What you buy, who you speak to, even what you think.

Even worse is the fact that they seem to be only too happy to do the complete opposite when it comes to their own dealings.

We’ve allegedly had Fed officials in the US practically day trading stocks based on insider access to policy decisions.

We’ve had our own chief lawmaker in Australia, Christian Porter, refuse to disclose who made an anonymous $1 million donation to his private legal defence fund.

Sure, in both these cases, a little bit of public pressure made the culprits step down in some way.

But don’t think ‘justice’ is being done.

Believe me, the punishment for us plebs, if we did anything half as bad as this, would be a lot greater.

Sadly, Australia is probably turning into one of the worst places in the world when it comes to running roughshod over the rights of the individual.

We have no ‘Bill of Rights’ like they do in the US.

And our politicians — on both the right and left — seem only too eager to push the envelope as far as we’ll let them.

Funnily enough, Greek philosopher Plato’s vision of democracy was very different.

In his original idea, the ruling class were barred from ever owning private assets.

The idea was to prevent corruption by those who make big decisions for society as a whole.

But in our version of democracy, Democrat Nancy Pelosi’s husband is making so much money on stocks, traders on TikTok are copying his trades!

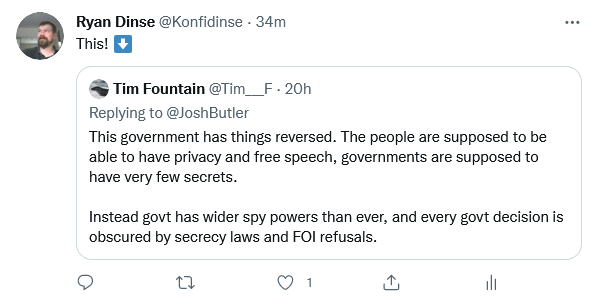

As a random person I came across on Twitter put it:

|

|

|

Source: Twitter |

And yet hope is not lost…

How to fight back

There are pockets of resistance.

For example, last week the ACT court of appeal made a ruling to lift a veil of secrecy in a long-running trial of a whistle-blower.

As The Guardian reports:

‘Former Witness K lawyer Bernard Collaery says a ruling that lifts secrecy over significant parts of his trial is a “victory for justice” and a testament to the legal profession, which has banded together to support him through his prosecution.

‘The ACT court of appeal on Wednesday overturned a ruling that would have hidden evidence during Collaery’s trial from the public, saying there was a “very real risk of damage to public confidence” if it could not be publicly disclosed.’

The idea of holding trials in secret — no matter the charges — are diametrically opposed to our very way of life.

So it was good that the legal profession helped defeat this, at least for now. We need them to keep stepping up.

But what else can you do?

Well, politically, you can vote for good independents who make this their main election platform.

In my opinion, the two-party system that’s dominated for so long is dying. And although it’s early days, there’s the chance for strong independents to be seriously considered by many people.

This trend is already starting to happen…

For example, in the US, former presidential nominee Andrew Yang recently quit the Democrat party last week to start up his own party.

He explained why:

‘“We can see that the current system is not working, that we’re losing a lot of common sense, that there should be a common-sense, middle-ground party,” Yang continued. “And that’s what the Forward Party is.’

His new party, incidentally, supports bitcoin!

But part of me fears that, as JRR Tolkien alluded to in the Lord of the Rings saga, no one can really be trusted with the ‘ring of power’, no matter their good intentions (unless anyone knows any good hobbits!).

But this is where bitcoin comes in…

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

How bitcoin can help

Now, of course, bitcoin can’t solve these issues by itself.

But it can help.

You see, the idea behind bitcoin is of a self-sovereign asset.

The rules of bitcoin can’t be gamed or changed. They’re in plain sight for everyone. Contrast this to Wall Street and it’s control over political power.

You can hold some value of bitcoin in a digital wallet, that only you can access.

You can use the Bitcoin network to send value to anyone, anywhere in the world, without having to rely on the banking system.

You can do this pseudonymously.

And in a world that’s fast becoming a police state, those basic properties almost feel revolutionary.

More and more ideas are being built on the Bitcoin technology stack.

For example, there are projects working on ways to send information using Bitcoin’s decentralised network.

You could find decentralised versions of Facebook and Twitter emerge.

That would make any new social media laws obsolete before they even began.

It’s a world where the individual retains some level of self-sovereignty in the face of growing State power.

And buying and holding some bitcoin in a wallet only you control is a tangible act of support for this alternative vision of reality.

In my opinion, unless you want an Orwellian future for your kids and grandkids, a world where power isn’t held to account but your every move is tracked, then this is the best chance we have to change course.

That’s the deeper impact of bitcoin and cryptocurrencies, beyond the immense financial opportunity at hand.

Good investing,

|

Ryan Dinse,

Editor, Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here