In today’s Money Morning…the inflated ‘new normal’…between a rock and a hard place…what it all means for investors…and more…

Yesterday I talked about the glaring issue of the Fed’s reverse repo program.

An overnight money market that topped out at US$991.939 billion at the end of June. A troublingly large sum of cash that is being used as a means to clean up the Fed’s own QE mess.

So, if you haven’t already read part one, then I suggest you do so.

Because I finished by talking about what happened the last time this reverse repo market was surging in activity. Back when the Fed was trying to unwind its QE program following the ‘08 crash.

And fortunately for the Fed, and the US economy, it all panned out pretty smoothly.

Which is why I’m certain Jerome Powell is expecting a similar result this time around…

But, as we’ve recently seen, higher than anticipated inflation has thrown a spanner in the works. With the US CPI figures hitting levels not seen in over a decade. Metrics that Powell and his cronies insist are merely transitory in nature.

I wouldn’t be so sure of that, though, if I were him.

The inflated ‘new normal’

See, whether you buy into the inflation argument or not, it is hard to argue against the supply chain bottlenecks — issues brought on by the pandemic that are causing a range of goods and services to fail to meet demand.

What is, in my view, the biggest catalyst for the US’s recent inflationary spike.

Again, though, whether this is a ‘transitory’ problem as the Fed suggests, is the real question. Because as we’d all like to think, as the world continues to get vaccinated these issues should subside.

But a global vaccine rollout is no small feat. Which is why I wouldn’t be surprised if it takes far longer than some expect.

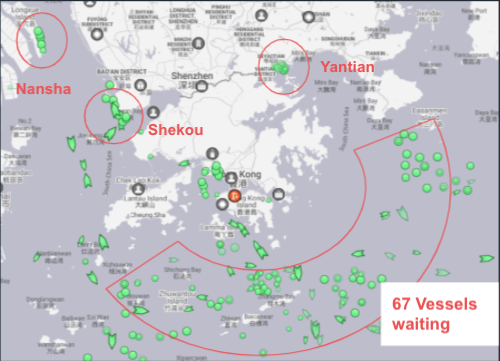

Which is why we’re still going to see mini outbreaks. Like the one that recently hit China’s Yantian port — one of the busiest trading ports in the world.

Which led to this:

|

|

|

Source: Supply Chain Dive/Flexport |

This port’s outbreak has caused an estimated delay of up to 5% of global freight capacity. Which is likely to have a far bigger impact on trade than the Suez Canal blockage earlier this year…

That hardly seems ‘transitory’ from my perspective.

But I’m getting somewhat off topic.

Because what really matters is how these bottlenecks, and the inflationary pressures they produce, impact the Fed’s plans. Drastically limiting their options, and potentially sealing their monetary policy fate.

Stay up to date with the latest investment trends and opportunities. Click here to learn more.

Between a rock and a hard place

The big problem facing the Fed is that all this cash in their reverse repo program is a ticking time bomb. Money that was provided by the QE policies but has failed to translate into productive economic growth.

More importantly, though, it is money (almost a trillion dollars’ worth, remember) that is hungry for yield.

So, if these supply chain issues continue to coax inflation higher, it could cause a knock-on effect. After all, if inflation does get out of hand the Fed will be forced to raise interest rates sooner than expected. Something that was already raised as a possibility by the dot plots in the Fed’s most recent minutes.

A nice and simple solution to rein in any stubborn inflation, right?

Well, normally it would work like that. But the problem is that all this cash in the reverse repo market, which has been growing bigger by the day, would now have a reason to return back to bank balance sheets. Because if rates are raised, these banks can get a better return from the higher interest.

As a result, though, that would flood the market with an extra trillion US dollars. A scenario that would only add more inflationary pressure, not less.

So, by that logic, you can see that the Fed is potentially cornering itself. Put in a position where it may be unable to raise rates due to all this extra cash that would flood the economy if they did.

And that, dear reader, is the trillion-dollar elephant in the room.

The one scenario that I’m sure the Fed is well aware of and is desperate to avoid. Which is why there is all this talk about transitory inflation, and assurance that QE isn’t coming to an end.

Only time will tell if Powell can pull the rabbit out of the hat though.

Because it is going to take some serious economic wizardry (or subterfuge) to escape this predicament.

What it all means for investors

Now, with all that being said, it is the ramifications for markets that we care about most. And as you may have already guessed, this scenario doesn’t bode well for stocks.

I’m not going to suggest that it will crash global stock markets, but the inflation narrative is a threat. One that would place pressure on certain sectors and specific companies.

But depending on the severity of the Fed’s consequences, it could also present buying opportunities. Particularly within the small- and micro-cap space where companies are more likely to be mispriced compared to large-caps.

More importantly, though, it will appeal to assets that aren’t entirely dependent on the value of the US dollar. With both gold and cryptocurrencies, the two most prominent that come to my mind. Two very different asset classes that serve as a somewhat similar hedge against inflationary pressure.

You may, however, scoff at this suggestion.

After all, both the gold and crypto markets have fallen significantly in recent weeks. But that is precisely the point in my view.

Right now is the perfect time to start diversifying into these sectors if you haven’t already. Particularly as my colleague, Brian Chu, believes we may be on the cusp of a major bull market for gold. A trend that could turn Australia into the focal point for this coveted precious metal.

Plus, it means you don’t necessarily need to invest in physical gold itself, either. With Brian suggesting that gold mining stocks could be the best source of gains. Which is precisely why he has put together a list of his favourite five, which you can read all about here.

Or, if you’re looking for a more modern means to diversify away from central banking interference, then crypto might be for you. An emerging asset class that presents not only an opportunity for extreme gains but also the chance to be a part of an entirely new monetary system.

The kind of once-in-a-lifetime innovation that you won’t want to miss out on.

Either way, the point is to stay aware of the headwinds that are coming. Because whether it happens in a matter of weeks, months, or years — the Fed is guiding the US economy down a precarious road.

One that is exemplified by this extreme trillion-dollar reverse repo rate.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

PS: Ryan is also the Editor of Australian Small-Cap Investigator, a stock tipping newsletter that hunts down promising small-cap stocks. For information on how to subscribe and see what Ryan’s telling subscribers right now, click here.