For over three decades, Amazon built an empire on one simple rule: never let customers leave our ecosystem.

Every feature, from Prime to one-click buying, was designed to keep shoppers trapped inside Amazon’s walls. It worked so well that Jeff Bezos called it ‘his moat.’

But last month, Amazon did something that should make every investor stop and think.

Amazon just sacrificed its most sacred business principle. You should be asking why.

This story follows on from my piece Google Search Isn’t Dead, It Just Smells Funny. Here we are imagining what’s next in the digital realm of commerce.

When Giants Break Their Own Rules

Amazon’s new ‘Buy for Me’ button is coming out of a testing phase in the US.

Behind it is an AI agent that helps customers buy products from Amazon’s competitors.

| |

| Source: Amazon |

Think about how radical this move really is.

Amazon has spent 31 years building a ‘fortress’ — a meticulously constructed walled garden designed to keep shoppers and retailers within its ecosystem.

I’d argue that this has come at a cost for you and me. Amazon leverages its dominant e-commerce position to operate a quasi-monopoly.

Economist Yanis Varoufakis described these platforms as the ‘land’ in a new digital feudalism. It’s hard to disagree when Amazon engages in such aggressive rent-seeking.

A good example is its high third-party seller fees . Now, there’s clearly value in what Amazon offers sellers, principally the scale of customers.

But fees have ballooned past this value, surging 32% in the past five years. These fees now account for a quarter of Amazon’s total revenues, reaching US$156 billion in FY24.

But now they’re turning this on its head.

They’re shifting from a model of external sellers on their platform to now deliberately sending customers — and revenue — to direct competitors (for a cut).

The only rational explanation? Amazon’s leadership believes something bigger is coming. Something that threatens their entire business model if they don’t act first.

That something is Agentic AI shopping.

The Death of Decision-Making

Here’s what Amazon’s executives understand that most investors don’t: we’re entering the age of delegation.

Thanks to AI advancements, we’re moving into the Agentic Era.

What does that mean?

AI that’s proactive and independent — personal Assistants for all.

What are the impacts?

Delegated research. Delegated decision-making. Delegated shopping. Delegated everything.

These changes will be felt everywhere, but let’s stick with e-commerce for now.

According to Microsoft, 33% of e-commerce enterprises will include agentic AI by 2028. Today, less than 0.5% do.

Around 70% of consumers said they would use AI agents to purchase flights, and 65% would use them to book hotels and resorts.

Instead of consumers browsing, comparing, and buying, AI agents will handle the entire process autonomously.

Soon, you’ll ask your AI agent to ‘get me running shoes under $200 with good arch support.’

It will research options across dozens of websites, check reviews, verify sizing, and complete the purchase — all without you touching a keyboard.

Not ready to trust AI with big purchases? You’ll still rely on it for research and recommendations — likely within AI-driven interfaces.

Some have called it ‘the death of the checkout page’. Digital advertisers are already sounding the alarm

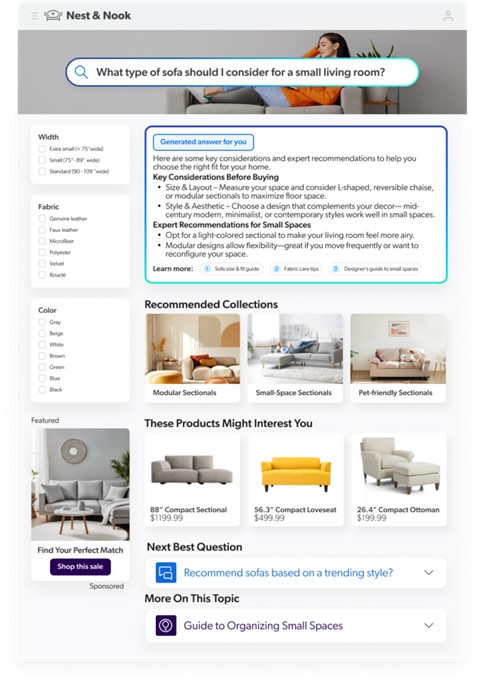

Here’s an early example: search boxes replaced with intent boxes.

| |

| Source: Coveo |

What consumers want is changing. People’s time has never been more valuable, and they expect things to be frictionless.

I believe AI will enable this on a whole new scale.

But when AI agents handle purchasing decisions, the companies that win aren’t necessarily the ones with the best products or prices.

They’re the ones that best integrate with AI systems.

Here’s a stock for you to consider before this trend blindsides the world.

One ASX Stock for this Trend

For the ASX, I think the money to be made is in the background systems that would make agentic shopping possible.

When an AI agent buys a product from a website in Japan and needs it delivered to Melbourne by Friday, what happens behind the scenes?

Someone must coordinate customs clearance, freight forwarding, warehousing, and final delivery across multiple countries and systems.

That someone is WiseTech Global [ASX:WTC].

WiseTech’s platform supports 17,000 clients across 174 countries and processes over 55% of global manufactured trade flows.

WiseTech has amassed an unparalleled data moat through its flagship product, CargoWise. This gives it unique visibility into global trade.

Something AI can leverage. Data = power.

On top of that, CargoWise isn’t just a basic tool — It’s like having Microsoft Office, but for global logistics.

You can manage freight forwarding, customs, compliance, warehousing, and transport management all within one program.

Its competitors tick some of these boxes, but none within a singular program. Something that massively favours a future AI user.

Its recent e2open acquisition further strengthens its platform’s automation chops.

As agentic shopping explodes globally, WiseTech becomes the invisible infrastructure enabling AI agents to seamlessly fulfil complex, cross-border purchases.

The company won’t just ride the wave — they’ll build the pipes that make it possible. And sooner than you expect.

Amazon’s willingness to sacrifice its sacred business model tells us just how seriously it takes this threat.

I believe that spells opportunity.

One More Thing…

Speaking of companies rewriting the rules of entire industries, there’s another AI story unfolding in an unexpected place.

While we watch retail transform, one AI company is quietly revolutionising mining operations and could be ahead of a massive trend as Trump considers ‘one major move no one is seeing coming.’

Regards,

|

Charlie Ormond,

Editor, Alpha Tech Trader and Altucher’s Early-Stage Crypto Investor

Comments