2021 will go down in the history books as ‘The Year of Delusion’.

Anything that could be floated higher by a deranged central bank stimulus policy, did so.

Value, literally and figuratively, meant nothing.

The worthless became priceless.

If it was going up, it would continue to go up.

No amount of reason could persuade the FOMO brigade to exercise logic and act with restraint.

For those with long memories of bubbles past, 2021 was a long year.

Finally, as the year ended, some sanity began to prevail.

The hottest of the speculation hotbeds — cryptos and NASDAQ — thankfully and belatedly, topped out in early November.

2022 is when the cost of this period of excess and recklessness starts to be counted.

The collapse of this massive financial markets Ponzi scheme is still in its infancy.

Early victims, predictably and regrettably, are coming from the collapse of various crypto scams.

What was once considered priceless has reverted to its true value…nothing.

The collapse of various crypto pyramid schemes (and mark my words, there’s more to come) has turned into a lawyer’s picnic.

Bankruptcy filings.

Lawsuits countered by more lawsuits.

Liars accusing other liars of lying.

If you’re a spectator, and NOT a trapped speculator, it’s all great theatre.

However, for the millions who, knowingly or unwittingly, walked, ran, or high dived into this web of deception, it’s a sad and sorry situation.

The judge presiding over the Chapter 11 bankruptcy of Voyager Digital asked affected persons to write a ‘victim impact statement’…pleading their case.

Here’s an edited extract from one of the publicly available letters (emphasis added):

‘My family worked for over 24 years to build a family business together that was all our blood, sweat, tears and that took us away from our families for years. We worked hard and long for those twenty-four years. In December of 2020, we sold our family business…I took about ½ of my proceeds from the sale of our company and put it into Voyager on their crypto application…

‘I have four children aged 16 years, 12 years, 11 years and 8 years old currently. That money was an investment into their futures to pay for their college. I put over $350,000 into USD coin because of the promises of “safety and security,” from Voyager and 9% interest and “FDIC insured,” USD coin. I also put over $700,000 more in Bitcoin and Ethereum that are now decimated…’

24 years to build family wealth and 18 months to destroy it…heartbreaking.

Versions of this story are told in EVERY boom and bust.

The sudden loss of wealth can have devastating consequences…investment in children’s futures jeopardised, homes foreclosed on, loss of self-worth, mental illness, and even suicide.

In the dull and boring times, the psychological impact of markets is of little interest.

Emotions remain rangebound.

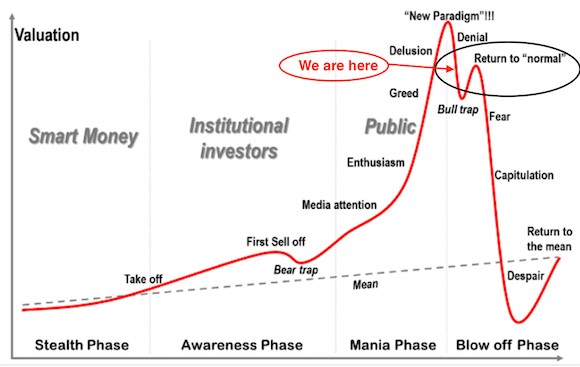

However, in the before and after of a bubble, emotions breakout…running to euphoric highs and plunging into despair.

On the cusp of collapse

In recent issues of The Gowdie Letter and The Gowdie Advisory, I’ve written at length about the behavioural patterns of bubbles and busts:

|

|

|

Source: Dr Jean-Paul Rodrigue |

This template of emotional responses is based on the study of human nature dating back to Tulip Mania in the 1630s.

Unless 500 years of primal impulses have somehow been miraculously erased from our DNA by Fed policy, we’re teetering on the cusp of a collapse in confidence…leading to fear and despair.

As the UNreal markets return to the REAL economy, real people are going to suffer real losses and real pain.

Here’s a dose of reality from Bloomberg on 26 August 2022 (emphasis added):

‘Greg Jensen, co-chief investment officer of Bridgewater Associates, expects that equities are facing a significant drop to align them with the real economy.’

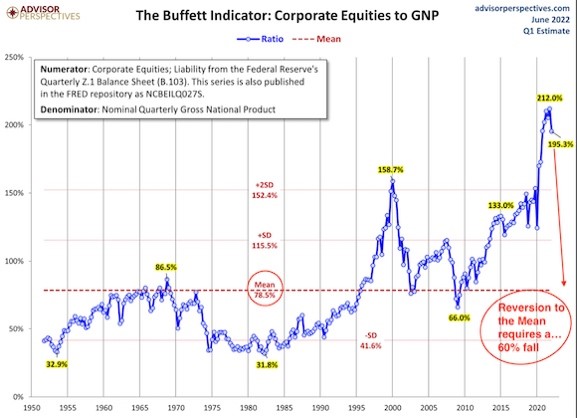

How far out of whack is the US market with the underlying economy?

The Buffett Indicator (US share market value as a percentage of GDP) indicates a ‘Return to the Mean’ collapse in the order of 60% is required for the realignment:

|

|

|

Source: Advisor Perspectives |

Remember, this is the potential loss on the broader US indices.

Individual holdings, especially those in the once-considered ‘priceless but worthless’ realm, are going to be smashed…and I include cryptos in this category.

Massive losses are coming.

Fear. Panic. Despair.

The opposite emotions associated with a boom are going to conspire to drive prices much lower.

If booms bring forth irrational buying, it stands to reason a bust will herald in a period of irrational selling. Again, this mob mentality isn’t new…it too dates back to Tulip Mania.

More letters. More pleadings. More heartbreaking stories. More shattered dreams.

To avoid being one of those who spend their days trapped with thoughts of regret, it’s crucial to understand…

The REAL meaning of wealth

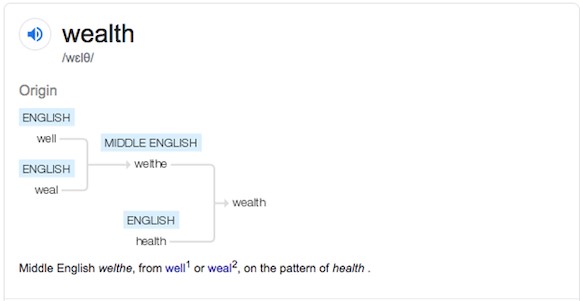

Etymology is the study of the origin of words.

Wealth is a word that’s morphed into a meaning that’s at odds with its origin.

The Merriam-Webster definition of ‘Wealth’ is:

‘Abundance of valuable material possessions or resources.’

This is the widely accepted meaning we use in our everyday discourse.

However, the origin of ‘wealth’ has nothing to do with material possessions:

|

|

|

Source: Google |

Wealth is the result of combining ‘well’ and ‘health’.

The real wealth in a family is measured by the health and wellbeing (physically and mentally) of its members.

Please take the time to understand the emotional cycle associated with wealth creation and destruction.

If we focus our actions on the original meaning of ‘wealth’, then the modern-day version of ‘wealth’ should take care of itself.

Regards,

|

Vern Gowdie,

Editor, The Daily Reckoning Australia