The market capitulation over the last few weeks has been vicious. It has been swift and devastating to the wealth of millions.

Of course, many people will say it was unforeseen and they simply didn’t see it coming. And most people didn’t see it coming. But I know someone who did.

Credit where credit is due, as the eternal optimist I didn’t often agree with Vern Gowdie’s take that a crash was imminent. That is until a crash hit, and Vern proved to be 100% right.

OK, granted the actual spark that lit this stack of hay alight, the SARS-CoV-2 virus, no one really saw coming. But the crash that was waiting in the wings…yep, Vern has been all over it.

That’s why you’ll find ongoing commentary of this steaming economic mess from Vern all week here in Money Morning. You can find his essay below.

Also, I think it’s vital that everyone listen to an interview Vern did with our former publisher, Dan Denning. It’s a little bleak, but Vern’s been right about all this every step of the way. That’s why I think you might want to hear what he says is coming next. You can get the interview here.

Achtung!

As Vern notes, there’s fundamental economic change afoot. How this all shakes out is going to have immediate impact on global industry, but it’s also going to drastically change the future that we thought was coming.

Let me explain…

I had to take my dog to the vet today. The crumb-sniffer had ingested something he shouldn’t have. Don’t know what, but it caused him to vomit, shake, and be worryingly out of sorts.

The vet gave him a thorough check over and the good news is he’ll be OK. He might be small, but he’s resilient. Just hoping he’s not got ‘the rona’, which she didn’t test for…

Anyway, in taking Alonso to the vet I of course had to jump in the car with him and drive him there.

I wasn’t pulled over to explain where I was going. But clearly I was one of very few on the ghost town roads right now.

Quite simply, there’s never been a better time to drive the open roads. Only downside is none of us are really allowed to, other than essential trips like groceries and taking a sick dog to the vet.

But the absence of traffic got me thinking. I tried to look beyond the immediate superficial beauty of an empty road and understand what the ramifications of this are.

And sadly, it’s pretty dire for one particular industry, and one particular country — Germany.

When there are no cars on the road you immediately begin to think about the car industry. Right now, certainly in my area, all the car showrooms are closed. Mercedes, BMW, Audi, Volvo, Mazda — all shut. And the service centres are on skeleton crews as well.

This means no new car sales. Not a reduction, not a slowdown, none at all. And one of the most common ways that car dealers sell new cars is through Personal Contract Purchase agreements (PCP).

The way it works is that you typically pay a small deposit (or none at all) at the start of the contract, then ongoing monthly amounts contributing typically towards the depreciation of the car over the term of the contract.

Then at the end you have a choice, pay a pre-arranged balloon payment, or hand the car back. Most people hand it back and take out a new PCP deal for a new car. This ‘churn’ is how most car showrooms get new car sales. It’s also how carmakers supply the second-hand market as they get to sell the car again once it’s back in their inventory.

Hence there are huge amounts of car finance out there through carmakers and their finance arms. Now in an economic shutdown like this, a lot of these loan agreements come under stress. When unemployment skyrockets and defaults start to become a serious problem for people, you have to look at what debts they default on first.

First to go will almost always be car finance. That’s because the car itself is the collateral behind the loan. A default on a PCP will mean the car is repossessed and the borrower’s credit rating tarnished.

But in the broader scheme of things, that’s most likely the first outgoing people will be prepared to sacrifice. Hence we expect that with rising unemployment and constraints on people’s incomes, we’ll see a spike in defaults in the car finance industry.

This could see a flood of bad debts carried on the balance sheets of both banks and shadow banks the car companies run. It could also see an influx of second-hand cars to the market in a market where no one’s buying cars. That could see car values plummet and residual values of PCP agreements that are in force also plummet.

And with a lot of car companies offering guaranteed final value (GFV) on these deals, there’s a very good likelihood that the real value of these cars ends up being far lower than these GFV amounts.

This all ends up being carried by carmakers.

The car companies are scrambling to cover this offer hardship assistance to people who can’t afford to repay. But this only prolongs the inevitable. And the question comes, how and when do they unwind these provisions?

This problem eventually winds its way back to some of the biggest carmakers in the world. Namely, Volkswagen, BMW, Mercedes-Benz — all of which are the bedrock of German industry.

Add to the pain of a potential car finance debt bubble bursting, these German giants were focused on China delivering the bulk of their growth. And now most of them are either operating on massively reduced production lines or completely shutting down operations.

How does this play out in the domestic Aussie market?

Well it’s clear that the coronavirus crisis has hit most automotive related stocks.

PWR Holdings Ltd [ASX:PWH], AMA Group Ltd [ASX:AMA], and Autosports Group Ltd [ASX:ASG] are three small-cap automotive related stocks that have been smashed.

Our view is that while some of these stocks look attractive right now compared to pre-coronavirus crisis numbers, the story isn’t over here.

We see more spirals down for the likes of Volkswagen Group, BMW, and Mercedes (Daimler)? If the ticking car finance debt bomb is about to explode, if the second-hand market is set to flood, if PCP and PCP-style finance agreements are about to turn to junk, then is any short-term bounce here a false flag?

We think so. We think that right now, automotive related stocks are up there with airlines as the ones to stay away from. That’s not saying these are all necessarily bad companies. In fact, at the right time there may some opportunity for a few of these to be bounce-back belters.

But you also need to consider the car industry may suffer from this for years. It’s quite possible that fallout from this crisis means reduced car ownership. A reduction in new car finance arrangements. A drop in global car sales and a flood of inventory to the second-hand market.

A buyer’s paradise, but a car investor’s nightmare.

Furthermore, it may accelerate the adoption of new transport technologies and automated/autonomous systems. These may lead to increases in subscription ownership models, pay-as-you-go ownership, and further improvements in the sharing of ownership.

None of these play out particularly well for carmakers, car accessories sellers, and aftermarket parts suppliers. That is unless they can adapt and realise what could be a whole new social order.

These are the kinds of considerations you need to think about before jumping into car stocks, no matter how cheap they might seem. And our view is, at least for now, let this house of cards collapse before you get too white hot about what comes out the other side.

Regards,

Sam Volkering,

Editor, Money Morning

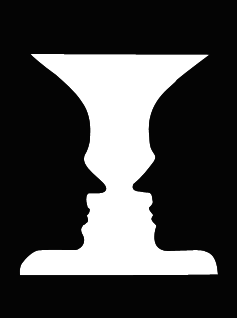

How Do You See Me?

Vern Gowdie, Editor, The Gowdie Letter

What do you see?

|

|

|

Source: Hubpages.com |

The vase? The two faces?

Life is rarely one-dimensional. There are always different aspects to consider.

For example, popular thinking has it that ALL this stimulus will be inflationary. Trillions here.

16% of GDP there. But what’s been lost in the argument/discussion is this detail.

The ‘newly minted’ dollars will not be enough to replace the lost earnings AND borrowing power of all those previously employed.

And (this is another big AND), if people — in sufficient numbers — somewhat rebuff the whole ‘debt-financed live beyond my means’ economic model, then global GDP numbers will shrink.

Yes, there’s more money being created than ever before. However, there’s a whole lot more being destroyed.

Central banks are always going to be behind the curve. They won’t know the extent of the damage until AFTER the (lagging) data is released. Then they’ll go (even more) ballistic. But will it be enough?

After a sustained period of deflation, will they try to get in front of this and do way too much? Do we then get inflation?

Questions to which, as yet, we have no definitive answers. However, anyone who thinks things are going back to normal when self-isolation ends, may want to think again.

This is whole new world stuff. The damage to (government, corporate and personal) earnings, resulting from this new normal, is what markets are currently grappling with.

How much? How long? How deep? How painful?

In due course, the altered economic model will be fully priced into asset markets. That won’t happen overnight.

Which is why investors should brace for further heart-in-mouth plunges.

If you have skin in this game — be it in superannuation, shares, property, money in the bank — you need to be conscious of the various aspects at play.

The good times are over, we have now moved into the make or break phase…and it requires you to see things differently.

This is not a time to panic. It’s a time for ACTION. Click here to download your free report now.

I am neither bullish or bearish

The popular view — from the reams of feedback I’ve received over the years — is bearish, permabear, or chicken little…and they’re the polite ones.

Life is simpler if we label someone and place them in a pigeon hole.

However, that labelling came from a one-dimensional view, my investment approach during the ‘up phase’ of the cycle.

My investment philosophy is winning by not losing.

And by losing, I mean those capital-destroying losses that can take years or decades to recover from or worse, you never recover.

I am neither bullish nor bearish…just cautious.

Right about now I can hear the protests going up…

‘Surely, advocating putting all your money in cash is bearish?’

Those holding that view are looking through the wrong end of the telescope. In bullish (and getting more bullish) markets, your level of ‘bearish’ should rise. Sell into a rising market.

And conversely, in bearish (and getting more bearish) markets, your level of ‘bullish’ should rise. Buy into a falling market.

I struggle with why that’s so difficult for people to comprehend? It’s the time-honoured way to create lasting wealth.

Unfortunately, most people get it the wrong way round. The reason for my cash position was pretty straightforward…markets were feverishly bullish. That whole TINA narrative was reflective of that.

The ‘everything bubble’ — the biggest asset bubble in history — was ALWAYS destined to meet a pin.

And when it did, the sheer size of the bubble, meant it had/has the potential to be Great Depression-like ugly.

Why on Earth would you want your capital exposed to that? Makes no sense to me.

Timing the arrival of ‘the pin’ is a mug’s game. So you wait, safe in the knowledge your capital is intact and government guaranteed.

Those who looked through the big end of the telescope now have absolutely no idea just how much capital they have at risk.

Will it be 30% or 50%, or 65%, or nearly 90% like the Great Depression? The more this market falls, the more bearish those once bullish investors will get. The only guarantee you get with that approach, is the guaranteeing of losses.

By comparison, that government guarantee looks pretty good. So far, the All Ordinaries is down about 30%. Is that the end of it or is it just the first round? What do you think?

This initial blow the froth off the top correction has taken the All Ords back to a level first breached in 2006, 14 years ago.

‘Shares for the long term’?

|

|

|

Source: Commsec |

But let’s bring the focus in a little tighter.

The All Ords most recent move above the 5,000-point level was in 2014. It took less than six weeks to wipe out six years of gains. That’s how quickly paper profits can be shredded and what if this market hasn’t finished yet?

How far back might the Aussie market go?

4,000 points…a level first breached in 2005?

3,000 points…a level first breached in 2000?

2,000 points…a level first breached in 1994?

These unknowns are why I opted for the known…100% of my capital not being exposed to capital-destroying losses that could take decades to recover from.

Is this a bearish stance or at 60 years of age, was this just me being prudent?

When markets are in the bearish zone — where I consider they offer far more reward than risk, then it’ll be time to turn bullish.

But not yet. We’re a long way from the bearish zone. Why?

Various valuation metrics I follow have us nowhere near the bottom.

And, social mood is still too high. There are far too many people who remain bullish. Reports of people rushing to establish online trading accounts is, to me, an indication of where the mob’s thinking is at present.

When it comes to markets, you really do need to practice self-isolation. Stay as far away from the mob as possible.

The mob — those looking at a one-dimensional world — invariably gets it wrong.

The time to buy will be when no one wants to buy. When online brokers are reporting a high level of inactive or closed accounts. The sound of market silence is what you want to hear.

Until then, I’ll wait and, as a bonus, banks have increased the term deposit rates. For now, 100% of my money is earning almost 2%.

That ‘known’ is far more appealing than the unknown level of capital loss AND dividend cuts that awaits share investors.

When looking at the various dimensions of investing, the one thing that’s most overlooked and the most difficult to value is peace of mind.

Unfortunately, it’s not until you lose it that you discover its real worth.

Winning by not losing is much more than a one-dimensional view of the world.

How do you see your situation now?

Regards,

Vern Gowdie,

Editor, The Gowdie Letter