What goes up…must come down.

That’s the law of gravity.

Some argue that gravity applies to asset prices too.

To some extent, I agree. We’ve seen it happen with the boom-bust cycle. Stocks, properties, commodities, and cryptocurrencies bubble and then burst.

But what is different with asset classes are that they usually, over time, come back higher.

There’s one asset that I want to highlight for you today.

You guessed it, it’s gold.

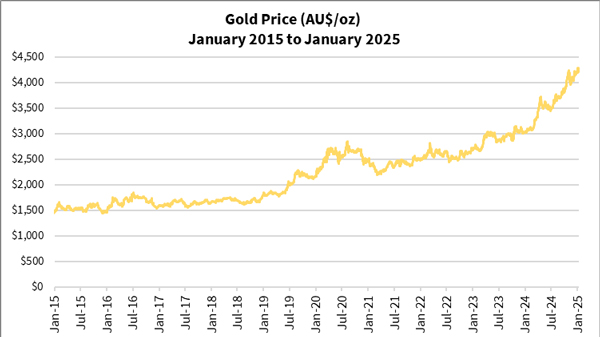

Last week, it closed at a new high in Australian dollar terms, $4,377 an ounce. You can see in the figure below how strongly it rallied over the past decade:

| |

| Source: Refinitiv Eikon |

Gold almost doubled in price five years ago (AU$2,251) and almost tripled in the past ten years (AU$1,492).

You might be asking whether this means gold has become too expensive to buy and whether a correction is coming.

Let me explain today why this is the wrong question to ask…

While some things never stop changing, some remain the same.

Generations have come and gone, and nations and kingdoms have flourished and disappeared. Technology and knowledge have advanced over time.

Yet some things never change – economic mismanagement, misallocated resources, corruption in high places and the rising cost of living.

What is the solution to these issues from the powers that be?

Paper them over by creating more currency and manipulating the interest rate.

The idea that money (fake ones) can solve all problems appears to prevail, despite mounting evidence showing these problems metastasise into unmanageable proportions.

We’re seeing it in Australia. For example, the National Disability Insurance Scheme (NDIS) has enjoyed immense government spending, only to become more inefficient and weighed down by administration costs.

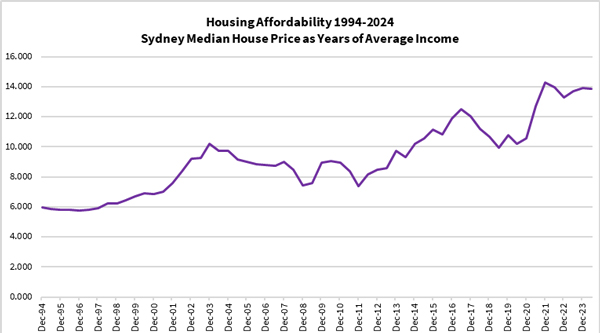

Or the property market. The government has vowed to make housing more affordable. It’s gone the other way.

Look at how many years of average income needed for a Sydney worker to buy a median house:

| |

| Source: Refinitiv Eikon, ABS |

Suspected corruption and misallocated resources aside, we should examine how we measure prices. That’s the source of the misunderstanding. Solving that will help you reconcile the illogicality of our financial system.

Wrong measure, wrong conclusions

There’s a reason why rulers (used for measuring, not those in charge) are made of rigid materials – plastic, wood or metal.

You won’t see an elastic ruler. Imagine trying to measure 10 centimetres using that! You could stretch the ruler further out one moment and let it go in another. It won’t be consistent.

Yet this is what you do if you use dollars, pounds, pesos, yuans, etc. to measure value. These currencies change relative to each other and against themselves over time.

I’m sure you heard from your grandparents about how a loaf of bread costs 20 cents in the 1970s. Yet today you pay $4 at the supermarket!

A suburban house once cost a few thousand dollars in the 1950s, while today, they may cost more than $1 million.

Is bread better today than 50 years ago? Maybe. But I doubt it.

Neither is a house today necessarily better. You may feel more comfortable in a newly built home that offers more convenience. But the material and build quality are definitely inferior. Think how easily cracks appear in the structure these days!

My point is that using currencies to measure value gives an illusion, rather than a true image, of the economy and the financial system. It blurs judgment and decision-making.

Set things straight: Adopt your

own ‘gold standard’

You may or may not have heard of ‘The Gold Standard’. It reflected the monetary system in the 19th and part of the 20th century. To standardise the value of each country’s currencies, they compared it against gold.

This system worked until after World War 1, when Germany started creating vast amounts of Reichsmarks to repay the debt to the countries that defeated them. Gradually, countries strayed off this standard. Spending beyond their means was too tempting, and papering over mistakes was a politically expedient option.

Once we went off this system and measured prices using currencies, things started going downhill.

My point here isn’t to delve too deep into ‘The Gold Standard’. Rather I want you to consider adopting that mindset in your life.

This means thinking in terms of gold, rather than dollars. It’ll make you wiser and wealthier.

What do I mean by that?

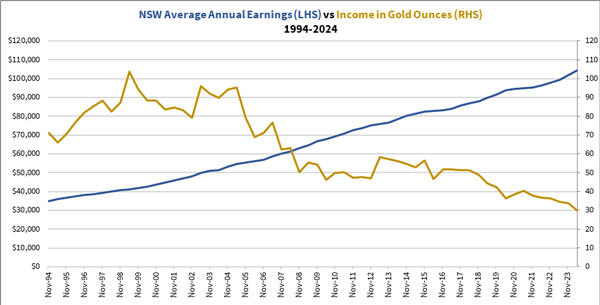

Well, let me show you how the average income in Sydney has changed in the last 30 years, in dollar and gold-equivalent terms:

| |

| Source: ABS, Refinitiv Eikon |

While the average employee received more dollars over time, the gold-equivalent income decreased steadily. You work harder to make less.

Perhaps this holds the key to explaining the rise in dual-income households, an explosion in the use of debt and a growing wealth gap.

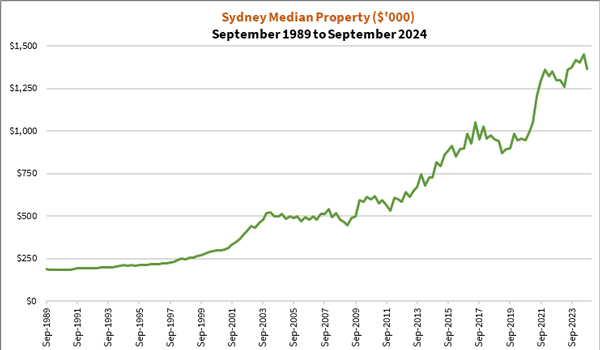

How about the median property price in Sydney? Let’s have a look at it in dollar terms:

| |

| Source: ABS |

This figure explains why so many people are anxious to jump onto the property market, by any means necessary. They fear missing out on the runaway prices.

Not so fast!

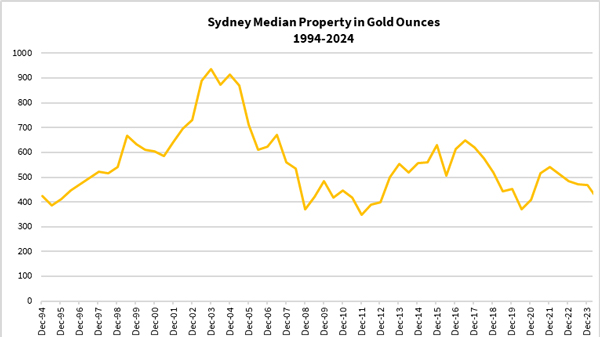

Have a look at how many ounces of gold is needed to buy that house:

| |

| Source: Refinitiv Eikon, ABS |

What those figures show is gold retaining its purchasing power and giving one of the world’s most expensive real estate markets a run for its money, pun intended.

Can you see how gold silently and effortlessly beat the term deposit savings accounts? Yes, setting aside your savings into gold instead of a bank account would’ve let you keep up with property prices.

Moreover, prices are going up not because there’s a bubble in these assets. More often than not, it’s a reflection of the currencies losing value when central banks keep creating them.

I hope this puts things into perspective.

Beyond preserving purchasing power,

build your wealth

With these insights, I hope you’ll appreciate why now is the time to think gold to preserve your purchasing power and aim to build your wealth.

Getting started with precious metals is easier than you think. You can start by buying gold coins, bars or units of exchange-traded funds. For those willing to stomach more risk, there is an opportunity for potentially higher returns by buying stocks in gold mining companies.

In case you want to learn more about this, I’ve prepared a game plan for you.

Find out about that in my investment newsletter service, The Australian Gold Report.

Let 2025 be the year when precious metals assets change the course of your life, for the better!

God bless,

|

Brian Chu,

Editor, Gold Stock Pro and The Australian Gold Report

Comments