We’re back!

2025 promises to be a wild year for markets, and Trump will undoubtedly take us along that path.

Now, it’s not my intention to fill your inbox with more Trump coverage.

In fact, commodities offer one market area, allowing investors to escape at least some of this year’s inevitable frenzied Trump focus.

But we can’t escape it entirely!

One key reason could be this…

The emergence of America’s 51st state

Trump’s known for pulling off big deals.

Buying well-known golf courses in Scotland to grabbing swathes of prime real estate in Manhattan.

But what about an entire country?

Well, if Trump gets his way, the massive island nation of Greenland could become the 51st state of America!

On the surface, that’s an almost unbelievable development.

After all, this autonomous territory sits under the Kingdom of Demark, a longtime American ally and one of NATO’s founding members.

Yet, according to Trump, he’s prepared to use military force to grab hold of Greenland.

While this could be familiar Trump blaster, the plan does appear to have a profound motive.

You see, Greenland sits in a highly geologically active region, endowing it with abundant resources.

But thanks to glacial melting over the last couple of decades, accessing Greenland’s potential bounty is set to become much easier.

Bedrock that once lay several hundred meters below the ice is now exposed.

That means a new mineral frontier has opened up.

I have little doubt this lies at the heart of Trump’s plan to capture Greenland.

Geologists can now peer directly into the outcropping rock and examine the mineral potential over this enormous landmass.

Given the rapidly melting ice, moving machinery, like drill rigs, for exploration is now much more straightforward. So, too, is getting those minerals out of the ground.

Russia is already discussing the potential of unlocking massive new mineral fields across its vast Siberian arctic territories as ice sheets subside.

And it seems America wants in on this action, too.

But why would the US, a leader in advanced technology, finance, and banking, suddenly be interested in something as basic as raw materials?

Commodities: The front-line battleground

in trade wars

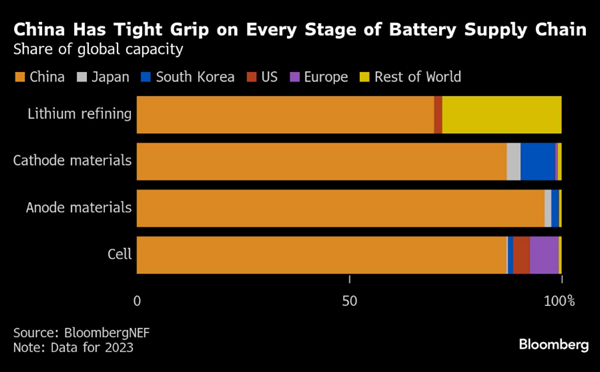

As you may know, China holds a firm grip on critical mineral supply.

This is the thorn in the US hegemony’s side, holding it back from dictating the terms of global trade.

If the country pursues trade tariffs and other measures too aggressively, it risks a blockade of critically important resources dominated by Chinese supply.

One example is the battery supply chain.

As you can see below, China (orange) is a force to be reckoned with in this growth sector:

| |

| Source: Bloomberg |

But mineral dominance also spills over into technology and defence.

This is why Trump wants access to new mineral frontiers…

Trade wars and the battle to secure mineral supply chains are becoming a key focus for national security.

That’s why the US Department of Defense has been investing billions in mining projects in the US, Canada, and Australia.

And that’s why Greenland could become a key focus for American interests in 2025.

Already, Trump is putting boots on the ground, with his son, Donald Trump Jr, visiting the nation right now.

The Alaskan Playbook

As crazy as that seems, this wouldn’t be the first time the US has gained control of a massive northern frontier.

Back in 1867, under President Andrew Johnson, America purchased Alaska from Russia.

At the time, Johnson copped a swarm of criticism for his decision to buy this frozen, inhospitable landmass.

Sceptics dubbed the deal ‘Sewards Folly’, a polite way of saying useless land.

We now know that’s not the case at all.

Alaska has rich oil fields and some of the world’s largest copper and gold deposits.

And just like Alaska, Greenland is also endowed with mineral wealth.

To date, relatively little exploration has taken place over this emerging frontier.

However, the geological survey of Denmark has detected strong potential for zinc, lead, gold, iron ore, heavy and light rare earth elements, copper and oil.

These important resources might allow America to unwind its reliance on China…eventually.

2025: Expect more conflict centred

on commodities

But perhaps the key point here…

Announcements like this speak to the real concern about global mineral supply.

And that’s a dramatic shift from 5-10 years ago… Where investment in new mine developments and exploration sank to historic lows.

Commodities have been taken for granted for years, especially in the West.

But we could see a dramatic shift in 2025.

The building blocks of modern civilisation and the fuel that drives every aspect of human civilisation…investment in resources needs to play catch-up in a big way.

Without a stable supply, chaos erupts. And the West has already been caught short.

Don’t be surprised to see Greenland emerge as a significant focus in America’s strategy to secure stable mineral supply.

The fallout from these events will have major consequences…

The least of which will be the surging interest in mining stocks.

So, pay close attention.

I believe 2025 will mark an important transition where commodities regain their status as the most important asset to own.

Stay tuned for more!

Regards,

|

James Cooper,

Editor, Mining: Phase One and Diggers and Drillers

Comments