You’ve just invented a time machine.

For some odd reason, you decide to travel back in time by about 800,000 years.

Why?

I don’t know. Maybe you want to be mates with some prehistoric fauna…?!

Anyway, you decide to go to the East Pilbara region in WA — also a weird choice, because there’s not a lot to do there, even nowadays.

Now if you did all of that, exactly as I said, you’d be standing at the epicentre of the magnetic North Pole.

It’s strange to think about, right?

Hot, barren, sunburnt Pilbara. The North Pole.

But that’s not a story, or even a thought experiment. It’s 100% scientific fact.

How’s that possible?

Well, you may have heard of a little thing called the Earth’s magnetic field.

If not, here’s the gist:

Basically, in 1600 a bloke from England wrote ‘De Magnete’, which proposed that the Earth was just a big, pretty-looking magnet that we all happen to be living on.

He was right.

A ‘magnetosphere’ does surround us, called the ‘magnetic field’.

It acts like a shield to supersonic solar winds from space, deflecting over 98% of charged particles from the sun and galactic cosmic rays.

And probably saving us from a lot of sunburn.

Your compass, which relies on Earth’s magnetic field, tells us which way is north and which way is south.

And this is probably the only time we ever really think about Earth being like a magnet.

Interestingly, this magnetic field changes over time too. Today, the poles are moving at a steady 65 km per year.

But occasionally they flip — just like that!

The last time was 780,000 years ago (which explains why the Pilbara was once Santa Claus’ hometown).

Worryingly, some predictions say we’re due for another flip inside the next two decades. I’ll spare you this potential doomsday scenario today. 2020 has been bad enough…

Check out these four innovative Aussie small-cap stocks before lockdown ends. Download your free report now.

My main point though, is that magnets are pretty important.

Who knew?

That’s why today I want to talk about a different type of magnet; one a bit closer to home.

It’s riding a wave of innovation in a number of key sectors, most notably energy. And if you find the right investment in this booming industry, it could turn out to be a magnet for you — a money magnet!

Some key charts are telling me you should pay very close attention right now.

Let me explain why…

This rare earth looks pretty attractive

Neodymium and Praseodymium, collectively known as NdPr, are rare earth metals with specific permanent magnetic qualities.

These qualities make them a crucial material in new forms of zero emission energy.

So, I’m talking wind turbines, electric cars, and all sorts of renewable energy generation and storage.

Some estimations have demand for NdPr doubling by 2025. And we don’t have anywhere near that level of supply yet.

Another factor to consider…

Most NdPr today — like most rare earths — is produced in China.

With the current US–China tensions I spoke about yesterday, this fact worries a lot of companies innovating in those growing industries. Especially as many rare earths are needed in key strategic areas like defence and energy.

A note from rare earth miner Medallion earlier this year put it like this:

‘Certain critical raw materials are a cornerstone for America’s high-tech industries. Rare earth elements alongside lithium, graphite and cobalt are essential for defense applications, renewable energy generation and storage, and electric mobility.

‘REEs enable high-strength permanent magnets—the technology of choice for electric and hybrid vehicles, larger wind turbines, robotics, and countless other applications.

‘At present, global access to REE magnets is dominated by Chinese interests, due to strong influence of Chinese state-owned companies in REE mining, processing, and magnet manufacturing industries.’

As I said, this industry is on a lot of people’s radars right now. So, is the timing right for you to take a position?

This chart suggests it could be…

This crossover hasn’t happened in over three years

If you follow me on Twitter (@Konfidinse), you’ll have seen me post this chart last week.

|

|

|

Source: Twitter — @Konfidinse |

This is a chart of the Van Eck Rare Earths/Strategic Metals ETF [REMX].

As you can see the price of this ETF has been in a steep decline since 2017.

But since early this year it has bounced back strongly. So strongly that the 30-day and 90-day moving averages (MA) have just crossed the 200-day moving average.

This is a key technical indicator that says the bulls are returning to this space. This crossover hasn’t happened since late 2016.

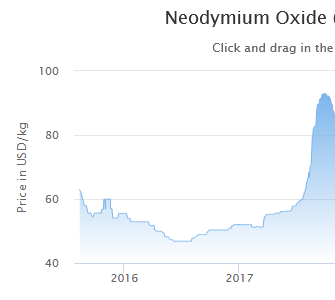

When that happened, back then, the price of NdPr did this:

|

|

|

Source: Kitco |

Interesting…

If you want to delve in further

Magnets, who’d have thought they were so interesting/worrying?

But potentially lucrative too!

With a bit of luck, we’ll avoid the doomsday scenario of the magnetic field flipping, and instead find good value in certain key ASX-listed rare earths miners getting set to produce such materials.

There are a few stocks you can look into here that have a defined JORC rare earths resources (meaning they’re not just pie in the sky claims).

Though remember, this is the riskier end of the investing world…

Good investing,

|

Ryan Dinse,

Editor, Money Morning

PS: Rare earths is just one space hotting up right now. There are actually a few ‘mini sector booms’ on the Australian stock market. These can be areas ripe for stunning growth in a short amount of time. Check out our analyst Lachlann Tierney’s thoughts on where to look, particularly in small-caps here.