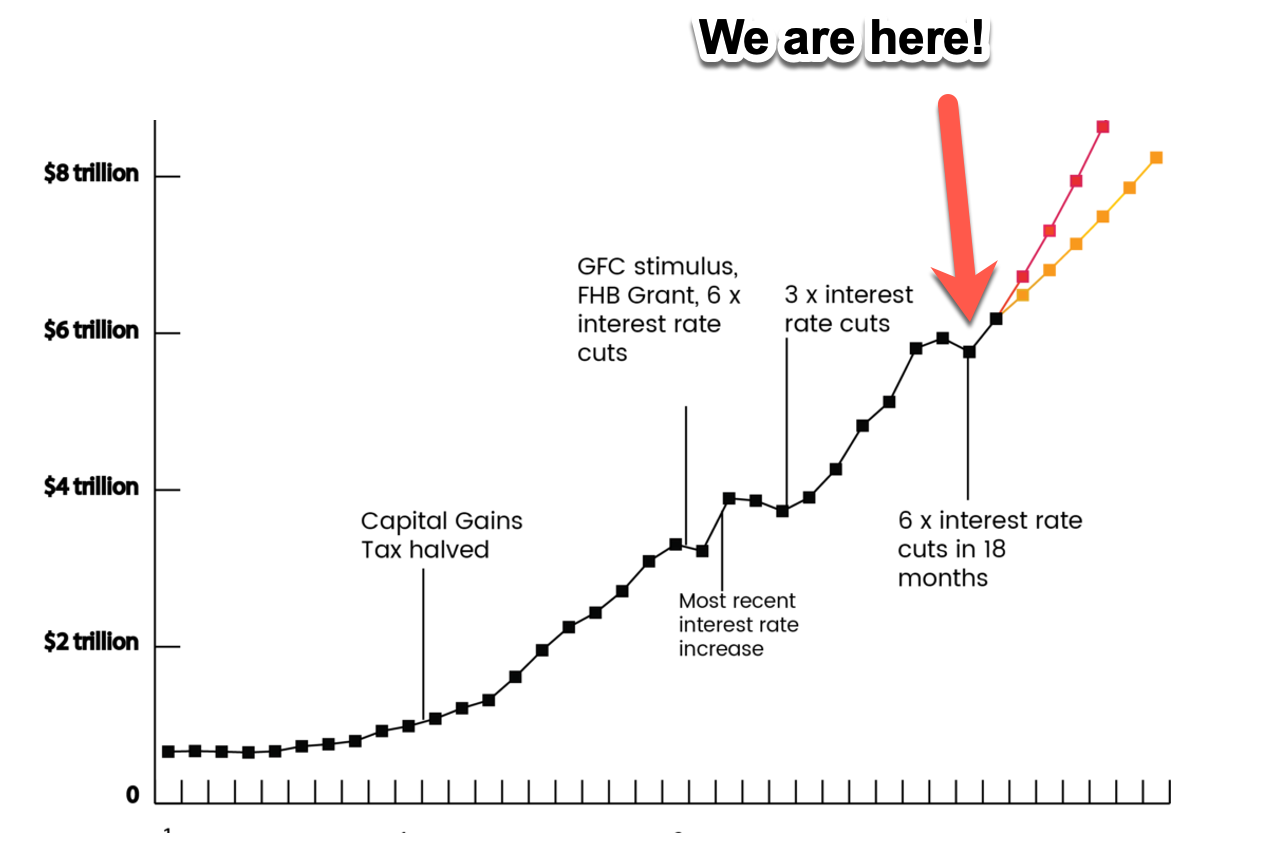

Take a look at this graph:

|

|

| Source: Prosper Australia |

It’s a forecast we put together at Prosper Australia a few months ago in April.

The figures are based on past land price growth rates extrapolated from the national accounts (ABS 5204061).

The last decade’s increase in national land values averaged 4.9% per annum.

Forecasting forward, that suggested Australia’s total land values would increase from $6.2 trillion to $8.2 trillion by the time we reach the peak of this current real estate cycle in 2026.

It might sound bullish — but we’re not even through 2021 — and it’s clear we’re going to blow these figures out of the water in 2026.

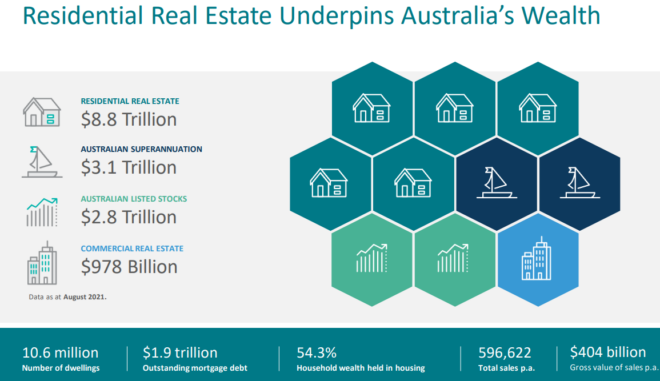

The CoreLogic August housing chart pack came out last week.

It shows that the total value of Australia’s housing stock is now worth $8.8 trillion:

|

|

| Source: CoreLogic |

That’s more than Australia’s total superannuation wealth ($3.1 trillion), listed stocks ($2.8 trillion), and commercial real estate ($978 billion) combined.

The total value of residential real estate in Sydney now exceeds $2.53 trillion.

Melbourne’s $1.74 trillion.

When Brisbane, Adelaide, Perth, Canberra, Hobart, and Darwin’s market values are added together, they total $1.694 trillion.

- Sydney $2.53 trillion

- Melbourne $1.74 trillion

- Brisbane $626.7 billion

- Adelaide $307.5 billion

- Perth $528.8 billion

- Hobart $62.3 billion

- Darwin $25.9 billion

- Canberra $143 billion

‘I’m pretty sure in the next couple of months that’ll probably tick over the $9 trillion mark, it’s moving that quickly,’ said Tim Lawless, CoreLogic’s head of research.

Notably adding:

‘[T]his huge dwelling value disparity is almost unique to Australia.’

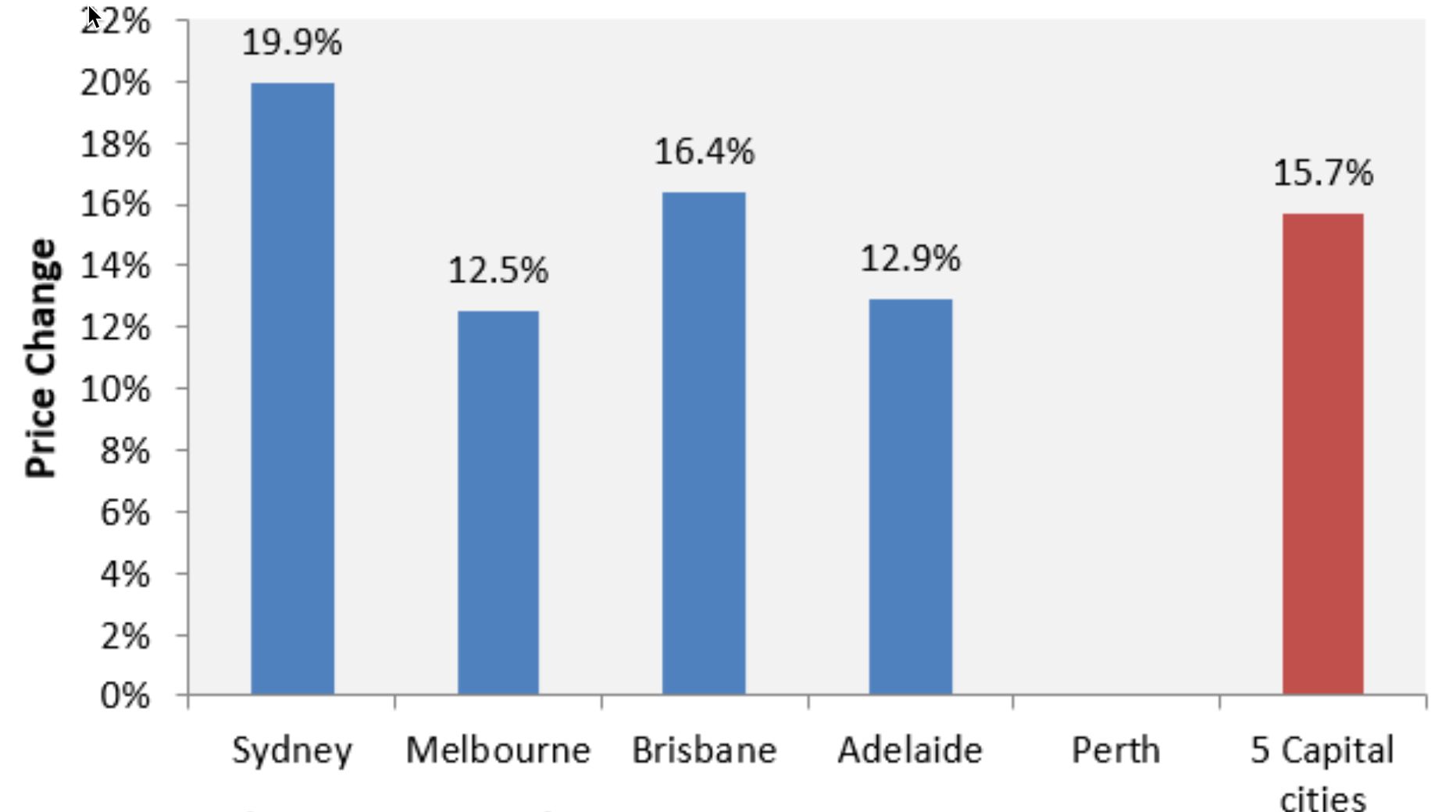

The latest stats show how fast the market has moved in just the last 12 months alone:

|

|

| Source: CoreLogic/Macrobusiness (Note: Perth’s data has been removed from the stats due to investigations into abnormalities.) |

Up almost 20% in Sydney. Clearly, lockdowns are having no impact on slowing the trend.

If anything, the reverse is happening.

Panic buying has taken force.

A scramble to get into the market principally by home buyers, wasting months of their time missing out on deals in locations they will never be able to afford.

A few recent news snippets paint the picture. From news.com.au:

‘If we saved everything above the absolute necessity, we would still be saving for three years for the amount we need to have a deposit and it’s still not enough as houses have gone up $100,000 in the last six months on the Coast for three to four bedroom house.’

And ABC News:

‘“We have seen hundreds of houses and made offers on 15, but our success rate is zero, zip, we have not got one.”

‘“We put three offers on three houses in one weekend and systematically got rejected from all three,” Ms Whiting said.’

It’s not an easy market to navigate, that’s for sure.

Well, not for home buyers with little flexibility.

It’s a great market for investors, however.

There are numerous locations that still have prices for less than $500K.

Areas where the rents are covering interest payments on the loan.

These are areas attracting rapid population growth from an influx of Delta refugees fleeing lockdowns.

Prices may be high compared to last year — but they’re going to be a lot higher in the years ahead.

This trend isn’t going to turn anytime soon.

Land has taken the gains of the massive stimulus that has been pumped into the economy.

Much of it poured into infrastructure spending.

Buyer grants, stamp duty cuts, record low lending rates, and blockchain technology assisting fractionalised purchase agreements are all playing into it.

You don’t want to waste the phenomenal opportunities that this current cycle is gifting.

Best wishes,

|

Catherine Cashmore,

Editor, The Daily Reckoning Australia

PS: Australian real estate expert, Catherine Cashmore, reveals why she thinks we could see the biggest property boom of our lifetimes — over the next five years. Click here to learn more.