In today’s Money Morning…the new German coalition has confirmed it is planning to legalise cannabis…a growing conundrum…homegrown opportunities…and more…

Machen sie sich bereit für eine grüne goldgrube!

That’s German for ‘Get ready for a green bonanza!’…

Because overnight the new German coalition has confirmed it is planning to legalise cannabis. Not just for medicinal purposes — which is already available — but for widespread recreational use.

A move that will make them the first EU nation to embrace this polarising plant.

And with the wider European market for cannabis expected to reach €3.2 billion by 2025, Germany is in the driver’s seat to pave the way for much more to come. Particularly as the current ‘legal’ market for cannabis in Europe is estimated to be worth just €403 million.

Suffice to say, that’s a lot of growth in a very short amount of time.

But I wouldn’t doubt the potential for this forecast to be met. After all, we’ve seen just how far Canada has come with its own domestic pot market. Doubling sales last year to the tune of CA$2.6 billion, with an expectation that this figure will grow by a further 60% by the end of 2021 as well.

Germany is now in a position to try to emulate this success.

But the big question right now is where will Germany source its cannabis?

A growing conundrum

As one German pot entrepreneur, Florian Holzapfel, tells Reuters, Germany doesn’t exactly have a great foundation to become a good grower:

‘Holzapfel, however, said it would hard for Germany to become a big producer nation given high overheads and inclement weather.’

Indeed, as has been loosely reported over recent years, Germany has relied on importing cannabis from the Netherlands, Austria, and Canada to supply its medicinal use. But this is slowly changing as authorities have begun to allow imports from more nations recently. Including the likes of Spain, Portugal, and Israel.

As you’d expect, though, this level of demand and supply is merely a fraction of what legalised recreational use will require. Which is why, despite some efforts to establish a local growing industry, it seems likely that Germany will become even more reliant on importing its pot.

For established markets like those in North America, that could be a huge win.

Because until we begin to see more widespread adoption and investment in Europe, Canada and the US could dominate cannabis production, providing the necessary supply to satisfy European demand.

That is the hypothetical but logical argument anyway.

It certainly took Canada quite some time to sort out its teething issues with the newly legalised industry. It suffered massive shortages in its inaugural year after legalisation.

For investors, though, that pain may now be their gain.

A scenario that could very well lead to a transatlantic pot stock boom for both Europe and North America. The kind of megatrend that plenty of cannabis believers have been talking about for years now…

Which begs the question, what about Australia?

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

Homegrown opportunities

When it comes to our local pot stock narrative, things have gone relatively quiet of late.

The massive boom that occurred in a number of small-caps in late 2017 and early 2018 is now long behind us. Leaving many of the established brands and businesses now in an awkward position.

It seems the reality of fostering a long-term industry has scared away a lot of the speculation. At least for the time being.

But that certainly doesn’t mean Aussie pot stocks are dead either…

I’d even argue that many of them are potential bargain buys — especially the ones that are vying to become major producers and exporters.

It is simply a matter of whether they’ll have enough time and money to establish themselves. The factor that will likely make or break this tiny but exciting sector.

And while I’ve said a lot of the speculation has left, that doesn’t mean all investment has dried up.

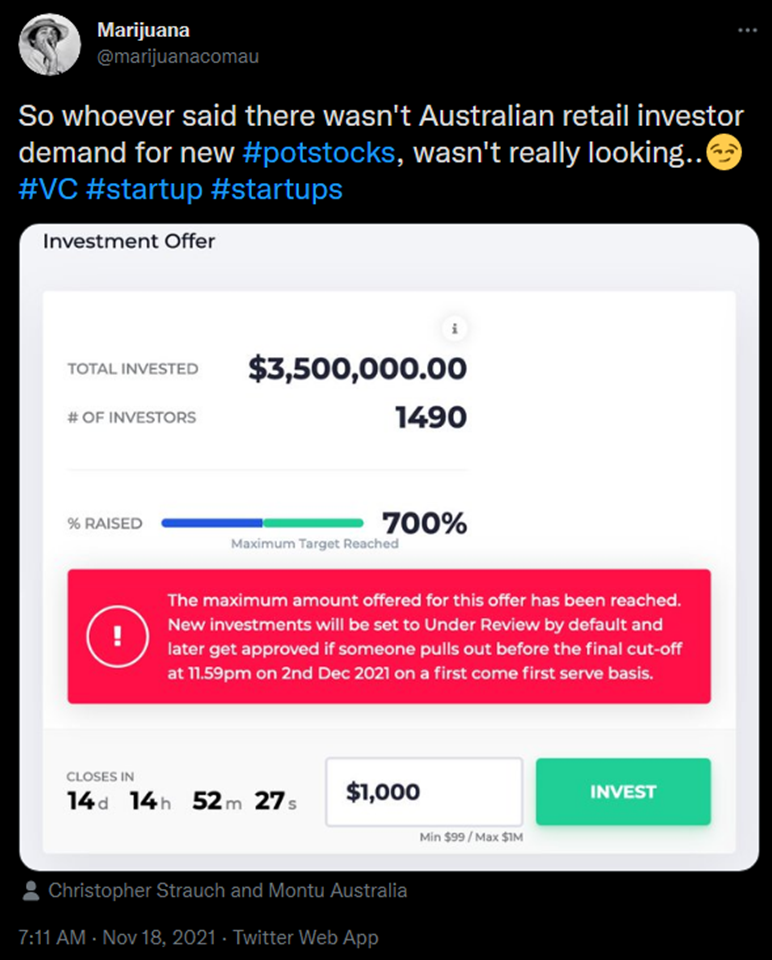

Montu, one of the more recent entrants into the Aussie cannabis space, has proved that demand is still out there. Spruiking their somewhat unique business model — an entire cannabis ecosystem — to investors via crowdfunding platform Birchal.

And as this recent tweet notes, they haven’t struggled at all to find capital:

|

|

|

Source: Twitter |

As you can see, despite only opening this offer on 16 November, Montu reached its maximum offer well ahead of the close. Showcasing just how hungry some local investors still are for good pot stocks.

A sign, perhaps, that there is plenty of potential yet from this budding industry.

Who knows, maybe once Europe starts to truly embrace cannabis, it will be a new tipping point. One that could ignite a huge boom for pot stocks all around the world.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

PS: Ryan is also the Editor of Australian Small-Cap Investigator, a stock tipping newsletter that hunts down promising small-cap stocks. For information on how to subscribe and see what Ryan’s telling subscribers right now, click here.