In today’s Money Morning…a scam or the future of money?…centralised or decentralised?…humans are selfish by nature…and more…

Cryptocurrencies are one of the more divisive topics in the investing world. There’s plenty of people out there who think it’s a scam. And there’s many who think it’s the future of money.

There’re two issues that crypto needs to get right if it’s going to be the investment of the century. Understanding these two points is the key to making a killing in crypto.

I’ll get to them in a minute, but first, I wanted to touch on the two sides of this ideological war.

Our society functions well. We work together to build and share in prosperity. We have a strong core of shared beliefs and outlooks.

For this reason, it’s fascinating that there are issues that we can be so divided on. Money goes to the heart of how society functions. It’s very important.

Now, obviously, we’re going to disagree on things. That’s normal. But it seems to me that the crypto divide is fanatical. It’s religious level faith for some people. And I mean that for both sides.

I was thinking about what the core drivers are for both of those camps. There is a conservative-progressive dynamic in every discussion that involves change.

The role of conservatives is to protect and value the things that have served us well in the past. The role of progressives is to elevate new things that can work better.

This is exactly what is happening with the crypto debate.

The conservatives are saying we have a perfectly functioning financial system. It has underpinned growth and prosperity, and there is nothing wrong with it. It got us to where we are today.

The progressives are saying that there’s a better model out there. Many of them believe our current system is deeply flawed. Some resent government intervention.

That brings us to the first core point of this whole debate.

Control

Control is a central theme in the crypto debate. Should our financial system be centrally controlled by governments and central banks? Is that intervention a good thing?

The Great Depression occurred before our use of modern fiscal and monetary policy. The core tenants of our current approach are largely attributed to John Maynard Keynes, though they have taken a long time to mature.

Is it coincidence that we haven’t had a great depression since? I am talking about developed countries that utilise this system, of course.

Perhaps it’s partly because we’re all richer, and our proportion of discretionary spend is so high now. An economic recession now just means selling the investment unit on the Gold Coast or the second car. Whereas before, it was boiling our shoes because we didn’t have food to eat.

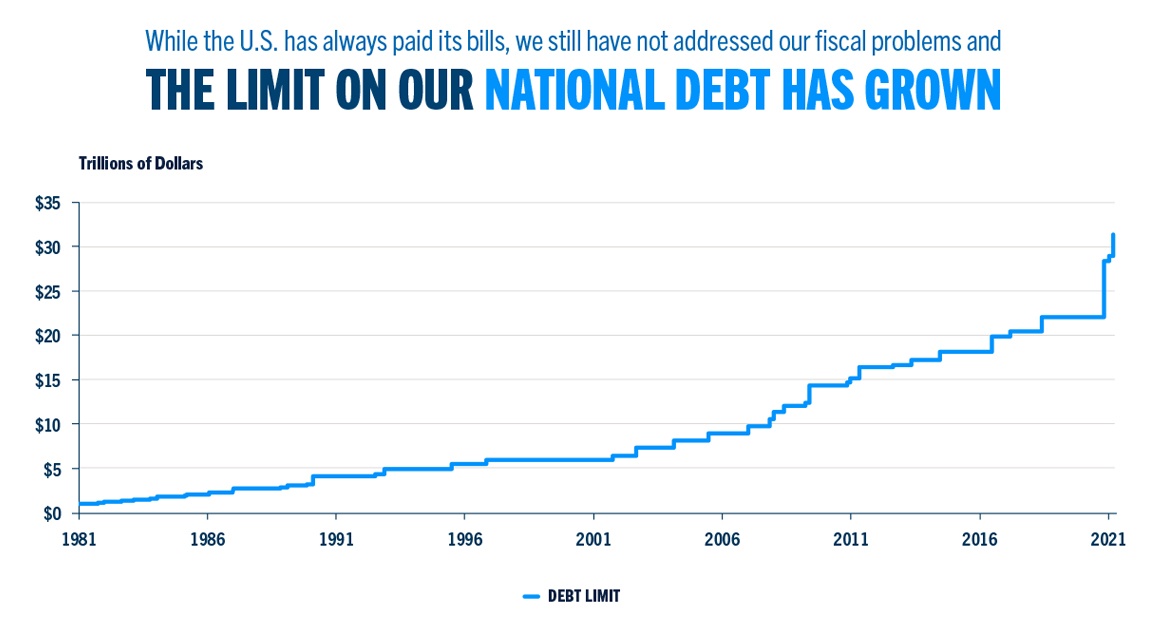

A common criticism of our current system is the levels of debt that some countries are taking on. The US has raised its debt ceiling 89 times in the last 63 years. They’re consistently spending more than they raise in taxes.

The following chart shows changes to the debt ceiling since 1981:

|

|

|

Source: Pgpf.org |

We have a human instinct that says owing money is bad. It’s in our genetics somewhere, I’m sure. Or drummed into us when we’re young.

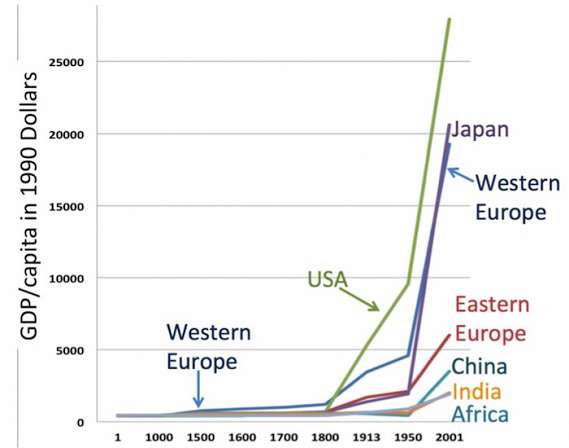

So is a decentralised financial system any better? It’s a purer form of capitalism, for one. Capitalism as a system is one of the greatest drivers of human advancement and prosperity that has ever occurred.

|

|

|

Source: Humansandnature.org |

Of course, it’s an easy target to hate on by the radical left. But its benefit is undeniable to any sane person. It’s easy to forget that capitalism in roughly its current form is relatively recent, and it has coincided with a surge in prosperity.

However, unrestrained capitalism is definitely NOT good. I know I’m going to lose some libertarians here but hear me out.

Trust

In 1968, Garrett Hardin wrote an article called ‘The Tragedy of the Commons’. he was expanding on an earlier essay by William Forster Lloyd in 1833.

The central idea is that resources that everyone can use will be depleted if there’re no limitations to their use. Basically, humans are selfish by nature.

When a coal power plant can burn their coal cheaper than the plant next door if they don’t worry about pollution, then that’s what they’ll do. They’ll pollute. If they don’t, someone else will to make a few extra dollars.

Now, don’t get me wrong, I’m not saying we’re all evil, and we’re all going to do this. Absolutely not. But some people will. Enough that it’ll be bad.

Think of Ponzi schemes. In unrestrained capitalism, you can start a Ponzi scheme where the whole intent is to take money from others and make yourself rich.

I would argue that there’s a heap of projects in the crypto space that are that exactly — Ponzi schemes. Certainly not all of them, though, but enough that it’s bad.

So the question for me becomes, how does crypto mature into a system that’s constrained in its capitalism? I don’t believe it can survive and become mainstream without these constraints.

Crypto is an interesting beast. It has great potential. The trick is going to be, how do we integrate it with trust and constraints into mainstream use? Not just speculation, but actual mainstream use.

I have been thinking about where that agent of trust could come from. It almost certainly has to come without government intervention. Or at most, vastly curtailed government intervention. After all, a big part of crypto appeal is government overreach.

Trust and control are two core problems that crypto needs to contend with in order to win the hearts and minds of the general public. It seems to me that trust is the most immediate hurdle.

While we aren’t all buying products using crypto every day already, that doesn’t mean there isn’t a heap of opportunity in the crypto markets. In fact, getting into anything before it goes mainstream is how you make the big dollars.

My colleague Ryan Dinse uncovers great crypto opportunities. He runs an excellent investment service with Greg Canavan called New Money Investor.

Ryan is one of the most interesting people to listen to when it comes to this stuff. In fact, if you didn’t catch it already, his piece yesterday in Money Morning gives an excellent counterargument to what I’ve already put forth here, and it’s well worth a read.

I find the whole interplay of crypto with traditional finance fascinating. It’s like a complicated dance. It’s interesting to see which projects can navigate these perils of trust and control and still bring value to our lives.

Until next week,

|

Izaac Ronay,

Editor, Money Morning

Izaac is also the editor at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Izaac’s telling subscribers right now, please click here.