Today I’m going to look back on a report we released in late February, as markets tumbled.

And I’m also going to look ahead to how you can invest in the second half of the year.

The report was called ‘The Coronavirus Portfolio’ and it came at a time of immense uncertainty.

I remember those last two weeks of February vividly…

There was the first sign of markets wobbling on Friday, 21 February.

In the office we were watching the news reports coming out of China closely, but still optimistic things could be contained.

Then Monday happened and the slide began.

I had a couple ideas floating around my head about how people could invest should things go belly up, but over the course of that week things accelerated.

By Tuesday, amidst a sea of red numbers, our publisher James Woodburn started doing the rounds.

I said I had an idea called ‘The Coronavirus Portfolio’ and he told me to get it out as quickly as possible.

With a rough draft already prepared, we put the report out by the next day.

The ideas in the report were brewing for a couple weeks, but the market slide made its publication an imperative.

Here’s a look at the five investments, that at the time, we suggested readers of the report should consider.

Four Innovative Aussie Stocks That Could Shoot Up after Lockdown

Two ‘macro-buffer’ assets and three stocks — four winners

The report was centred around five potential ‘winners’ as markets crumbled (based on hypothetical buy and sell points).

Four of these proved to be significant winners. All of this is hypothetical of course, but when we put out reports, research, or recommendations — we put a lot of thought into them.

Here are the two assets which I referred to as ‘macro-buffers’:

- Gold (winner)

- Bitcoin (winner)

And three stocks:

- Zoono Group Ltd [ASX:ZNO] (big winner)

- Food Revolution Group Ltd [ASX:FOD] (loser)

- Genetic Signatures Ltd [ASX:GSS] (big winner)

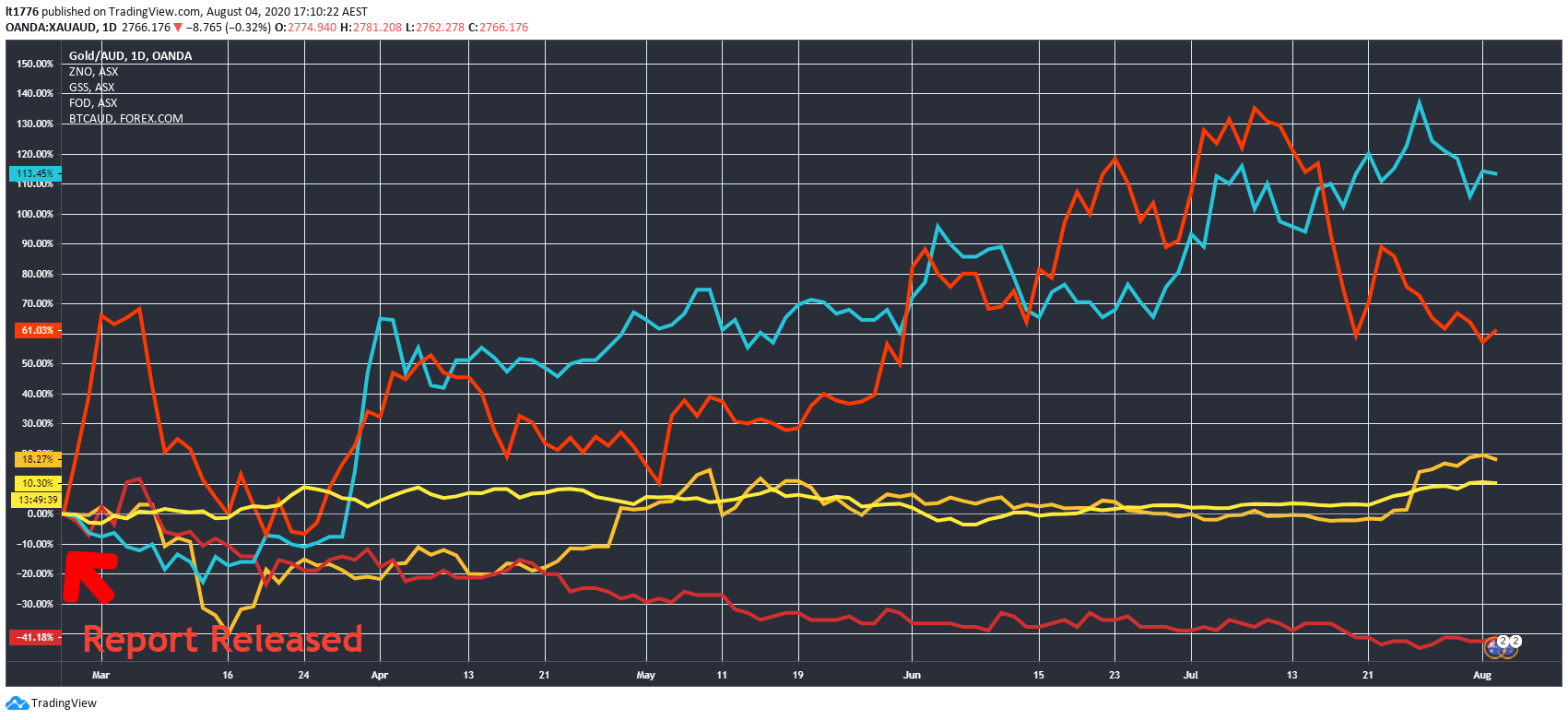

Here’s how they performed from the date of the report’s release:

|

|

| Source: tradingview.com |

Assuming an equal weighting in all five investments, turns out ‘The Coronavirus Portfolio’ could have returned 30.32% in less than six months.

Annualised this comes to more than 60%.

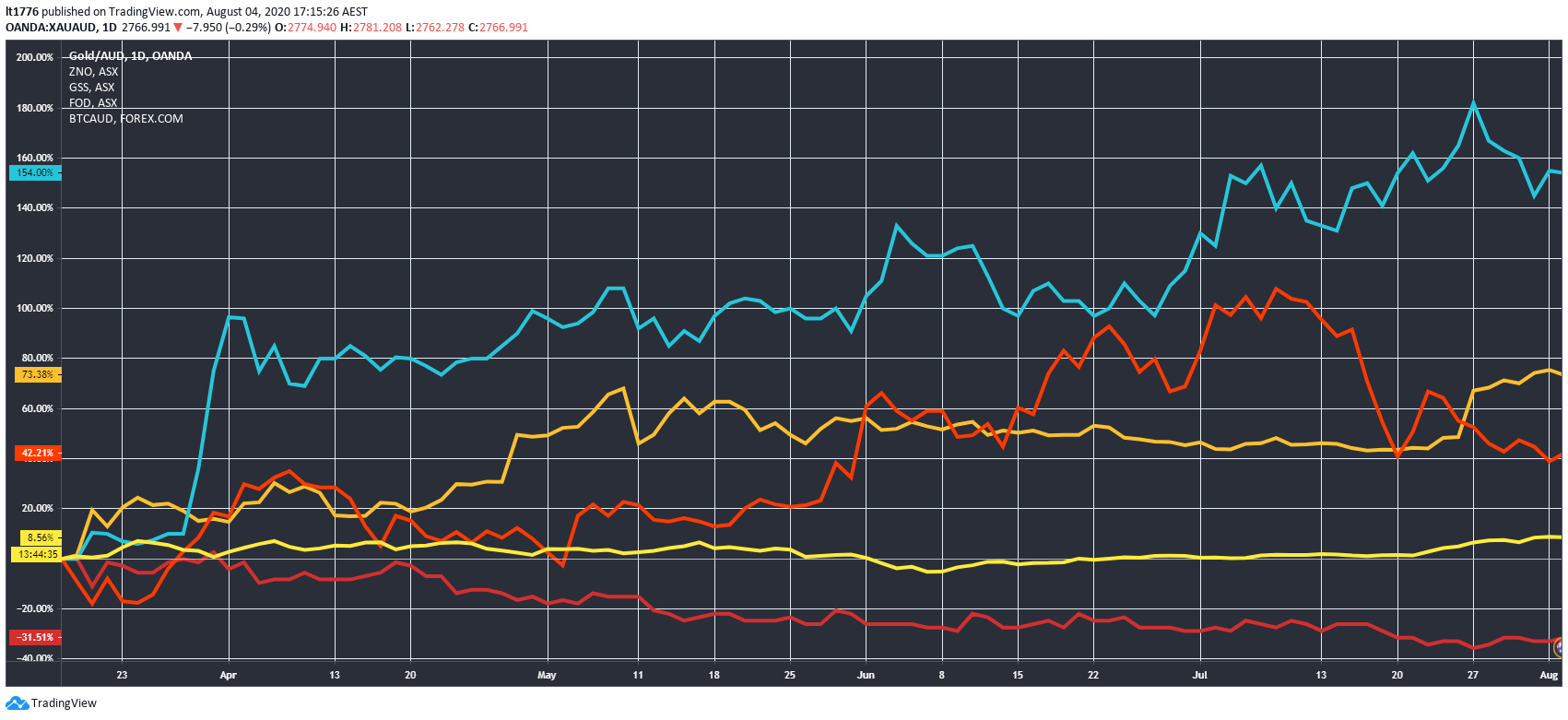

From the March market low, the returns are better:

|

|

| Source: tradingview.com |

The returns from the March market low come to 49.32% and annualised more than 100%.

The Coronavirus Portfolio was more a mock mini portfolio than anything else.

And there is a general view that a portfolio holding 12–18 stocks is the right amount for diversification.

But this was a very targeted kind of portfolio, designed to help readers weather a very strange market environment.

FOD and ZNO were hand sanitiser producers, GSS was a personal coronavirus testing kit company, and gold and Bitcoin [BTC] were put in to balance the portfolio — a hedge.

It’s worth revisiting what I said about these last two things in the report:

‘There is one thing that history teaches us.

‘That is, the Federal Reserve, the ECB, the PBOC, and the RBA will try and step in to avert the crisis.

[…]

‘A coronavirus-led downturn may prove to be the trigger for central banks to engage in yet more rate cuts.

‘But more importantly, what happens if the whole global supply chain, much of which runs through China, chokes up?

[…]

‘It is possible that the inflation could box in central banks — leaving them little room to manoeuvre.

‘It’s hard to see central banks raising interest rates in a downturn…

‘Will we see a further “melt-up” rally once the virus passes and the stimulus/Quantitative Easing (QE) kicks in?

‘Whichever outcome it is, what’s currently unfolding plays into the hands of the two biggest bets on distrust in the financial system.

‘And it comes down to two different ways of remedying this distrust.’

In hindsight, it looks largely on point.

The virus hasn’t passed but we did see a rally on the back of massive stimulus and QE.

And gold and bitcoin are holding up quite well as the distrust of fiat grows.

But what if you’d stuck with an ASX 200 ETF during February and March?

How did the portfolio compare with ASX 200 ETFs?

An ASX 200 ETF like the SPDR S&P ASX 200 Fund [ASX:STW] in the same periods would have resulted in a 10.27% loss, or a 29.6% increase if you’d managed to pick the precise bottom.

So, the market is catching up to ‘The Coronavirus Portfolio’ from the March lows.

Which is why I’d like to discuss how to invest in the second half of the year.

You see, at the point where the market was about a third of the way through its total fall, Ryan and I made some quick adjustments to our Exponential Stock Investor portfolio.

Ryan said to me, ‘If you are going to panic, panic early.’

We didn’t exactly panic, but we did do a speedy assessment of the risks to our portfolio.

We recommended a sell on some stocks we were up on, culled a few stocks that were most exposed, and held onto a few ‘binary outcome’ stocks.

It’s looking like the right decision now.

Going forward, we’ve made some exciting recommendations based on the mega-trends emerging from the pandemic — a collision point like no other.

Including this particular approach to making a vaccine.

It’s called synthetic biology, and we think it’s the next big thing in the investment world.

You may hear from us in the next few days about the Exponential Stock Investor service and we’d encourage you to learn more about it.

Regards,

|

Lachlann Tierney,

For Money Morning

PS: Four Well-Positioned Small-Cap Stocks: These innovative Aussie companies are well placed to capitalise on post-lockdown megatrends. Click here to learn more.

Comments