In today’s Money Morning…who should you listen to?…these sectors are running hard…big returns on offer…and more…

Every day in the markets, we are bombarded by endless streams of information. Sifting through it all and making sense of it can be an insurmountable task.

Is it even valuable for you to spend four minutes reading this article? What do you have to gain from it? If you are on the hunt for valuable investment ideas, how can you know if they are valuable on the day you receive them?

As time passes and you read 50 other articles, will you even remember the various ideas you read today if you didn’t act on them?

It’s only in the fullness of time that you can stand back and assess whether someone’s investment ideas are worth listening to. And even then, no one gets everything right.

How can you possibly work out who to listen to?

If I were to tell you that small-caps are the area of the market you need to focus your attention on for big opportunities, why would you believe a word I say?

They’re too risky, aren’t they? It’s a crapshoot. They are way too volatile. No one knows what the future holds, so everyone is guessing whether they are a professional or not.

Is that how you see things in small-cap land?

I want to make the case that you need to allocate more time to investigating small-caps by looking backwards rather than forwards, so you can see just what’s on offer if you’re paying attention.

These sectors are running hard

I wrote an article in Money Morning on 26 November last year called ‘These Sectors Are Running Hard’, where I outlined a bunch of stocks that I thought you should keep your eyes on.

I want to list each stock mentioned and the returns they generated in the last 8.5 months so you can get a sense of what you could have reaped if you had read that free article and invested some dosh.

Not every stock went up. But I think that makes the exercise worthwhile because it is a real-world example of statements made and actual outcomes.

For this exercise to work, I reckon it is worthwhile for you to read the actual article above because it will give you a fuller sense of what was said.

In the interest of full disclosure, I will also give you a quick outline of how I traded the stocks that were also in the Retirement Trader portfolio, which is a trading service that I run. Words are only worth so much. It’s how you actually trade and invest that matters.

So each stock mentioned and their returns in less than nine months since the article are:

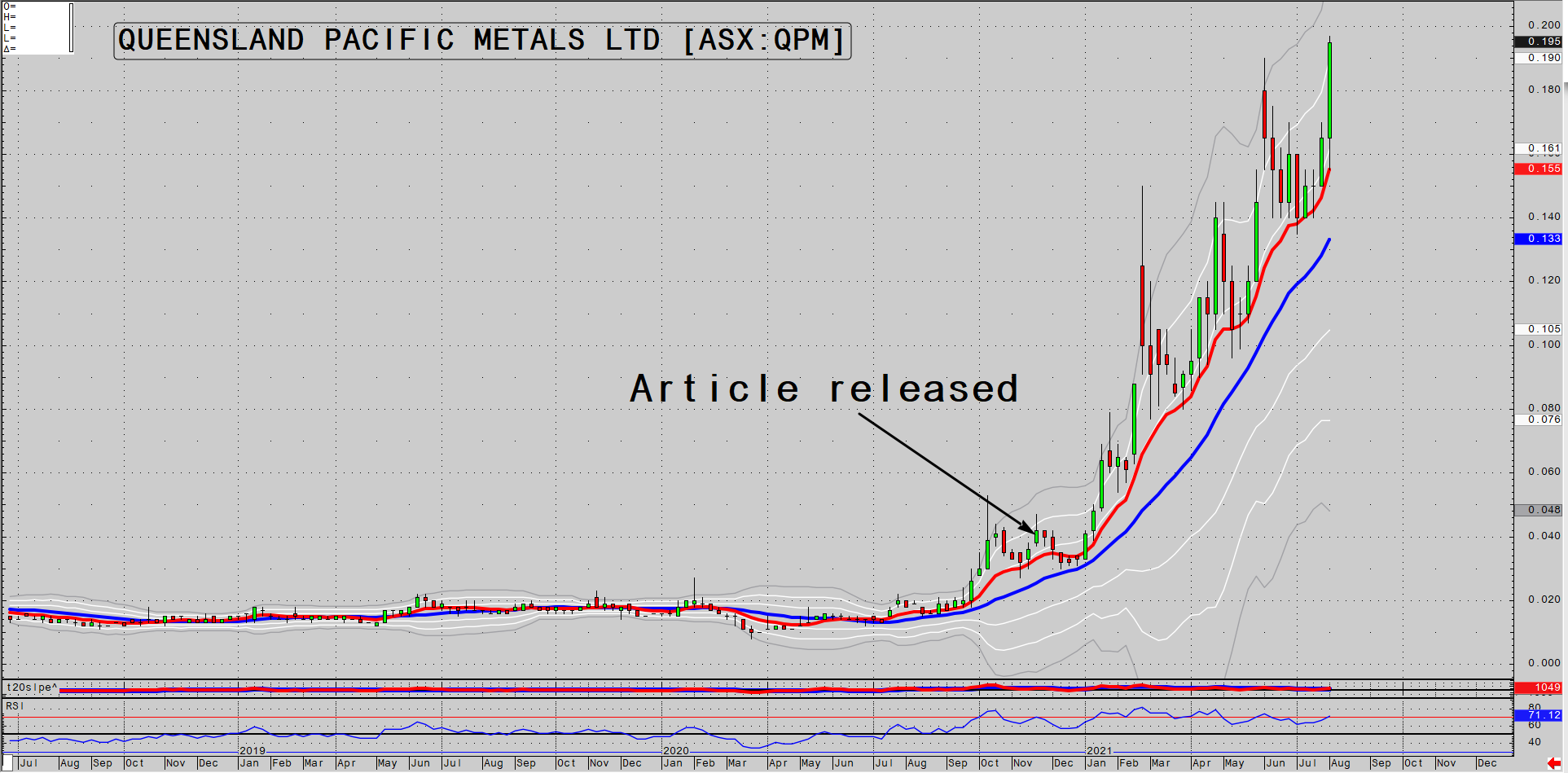

- Pure Minerals Ltd [ASX:PM1] now called Queensland Pacific Metals Ltd [ASX:QPM] up 353%

- FYI Resources Ltd [ASX:FYI] up 180%

- Zelira Therapeutics Ltd [ASX:ZLD] down 42%

- Botanix Pharmaceuticals Ltd [ASX:BOT] down 40%

- Lynas Corporation Ltd [ASX:LYC] up 105%

- Pensana Metals Ltd [ASX:PM8] moved listing to London after a massive rally

- Hastings Technology Ltd [ASX:HAS] up 41%

- Greenland Minerals Ltd [ASX:GGG] down 61%

- Arafura Resources Ltd [ASX:ARU] up 24%

- Orocobre Ltd [ASX:ORE] up 111%

- Galaxy Resources Ltd [ASX:GXY] up 148%

- Pilbara Minerals Ltd [ASX:PLS] up 186%

- Panoramic Resources Ltd [ASX:PAN] up 26%

- Blackstone Minerals Ltd [ASX:BSX] up 18%

- Andromeda Metals Ltd [ASX:ADN] down 46% (I said it was too expensive)

- Minotaur Exploration Ltd [ASX:MEP] down 46% (MEP connected to ADN price)

Zelira Therapeutics rallied 85% from 7.6 cents to 14 cents after the article was written, but then turned and collapsed after a few terrible reports. It was in the Retirement Trader portfolio, but we took part profits on the way up and then got stopped out of the position for no loss on the way down.

Lynas Corporation and Orocobre are also in the Retirement Trader portfolio and remain members of it. We bought Lynas for $2.15 and the price is currently $7.58 (253% above entry price). We bought Orocobre for $2.83 and the price is currently $8.48 (200% above entry price).

Big returns on offer

As a quick case study in what small-caps can do for your wealth, I reckon it is compelling. Yes, there were a few that went down, but when you consider the returns above were generated in less than nine months, it has to make you sit up and take notice if you aren’t currently investing in the space.

It has to be noted that I made it clear in the article that I thought ADN was overvalued. MEP’s share price is connected to ADN’s, as you can see by their similar movement with both falling by 46% since the article was written.

Greenland Minerals dropped 61% since the article was written due to an election result in Greenland that has thrown their immense rare earth project into disarray. Bad news does happen in small-caps and has to be factored into your initial investment position sizing.

I put Queensland Pacific Metals (up 353%) and FYI Resources (up 180%) at the top of the list because I made specific comments at the end of the article that they were two stocks to consider.

This is what I said about QPM in the article:

‘Their Townsville Energy Chemicals Hub (‘TECH’) Project will process high-grade nickel-cobalt laterite ore imported from New Caledonia to produce battery chemicals for the emerging electric vehicle sector.

‘I reckon they are one to watch.‘

QPM explodes higher

|

|

| Source: CQG Integrated Client |

My comments on FYI Resources were:

‘FYI Resources Ltd [ASX:FYI] is another HPA hopeful that has been running pretty hard lately but their market cap is still very reasonable at $60 million. They are in a trading halt today to raise $5 million at 20 cents. Once the raising is done and dusted I reckon that is one worth putting in the bottom drawer.’

FYI flies

|

|

| Source: CQG Integrated Client |

It can be incredibly confusing navigating the small-cap sector. There is so much going on and it can be overwhelming making decisions with stock prices flying all over the place.

But that’s where we come in. Our job is scouring the markets every day looking for opportunities for you to prosper. But for this to work for you, you must pay attention and be prepared to act.

I hope I have given you food for thought and I will be adding to the conversation over the next week as I describe what I think are the key themes you need to focus on over the next decade.

If the above returns were generated in less than nine months, imagine what could happen if you ride some of the massive investment themes that are changing our world so drastically.

Regards,

|

Murray Dawes,

For Money Weekend

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here