‘Living in Western PA, I see this just like the Marcellus Shale land grab to extract huge amounts of natural gas…

‘20 years ago, oil and gas companies got land leases as fast as they could… They didn’t know when and how they would develop those resources…

‘They just knew that if they were going to win, they needed to get as much land as possible. It’s like buying Manhattan real estate…

‘You don’t know what’s going to be built on top of it…

‘You only know you want a piece of the most valuable property in the world. Saylor is doing the same thing with bitcoin.

‘He may not fully know what will get built on top of it (his Bitcoin Treasury Company is only the beginning), he only knows that having the most scarce digital property ever is the key to long-term wealth creation.’

Rick Newton

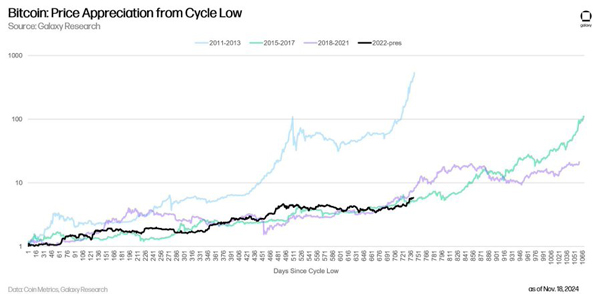

Check out this chart:

| |

| Source: Galaxy Research |

The different lines show the comparative price behaviour of Bitcoin (on a log scale) through various cycles.

The thick black line is the current cycle from 2022 to the present.

If you compare this cycle to the previous two bull markets (2015-2017 and 2018-2021), you can see we’ve only recently started outperforming the 2015-2017 cycle (green line).

And we’re still well under where we were in the 2018-2021 bull run (purple line).

And when Bitcoin goes on an exponential bull run, buyer greed can go into overdrive.

But then there’s the more important point…

This is no ordinary Bitcoin cycle.

For the first time ever, we have real institutional money coming in via the new Bitcoin spot ETFs.

For the first time ever, we also have a pro-Bitcoin US President in charge too…well, we will when Trump’s takes office on 20 January 2025.

And when I explain why Trump’s election is such a big deal you might start to agree with me and realise that this time is very different from previous cycles.

With all that in mind, let’s dig in…

This time is different

OK, I know many a sagely market veteran will tell you those are the four most dangerous words in the investing lexicon.

But scepticism isn’t a strategy, especially when it comes to Bitcoin.

As Swan’s Head of Private Wealth put it:

| |

| Source: x.com |

Put another way, the difference between an insane bubble and the path of rapid adoption is indistinguishable from the outside.

I’m betting on the latter.

Why?

Well, let’s look at some of the latest developments from last week:

- Strong rumours that Trump’s media business is buying crypto exchange Bakkt for US$100 million.

- Micro Strategy just raised a further US$1.75 billion in convertible notes at an interest rate of 0% to buy MORE BITCOIN!

- Bitcoin options launched on the world’s premier commodity exchange (the CBOE). This is expected to help bring in a lot more institutional money as they now have sophisticated tools to hedge their exposures in line with their investment mandates.

- Michael Saylor is presenting to the Microsoft board on 10 December on why they should invest in Bitcoin. Microsoft has US$78 billion in cash right now. If shareholders vote to approve this agenda item, we could see a mad rush of corporate adoption from the big tech companies.

- Tether’s banker Howard Lutnick, who has gone on record saying he is a Bitcoiner with ‘hundreds of millions of Bitcoin’ has been named as Trump’s Secretary of Commerce.

- Trump reportedly considering crypto lawyer Teresa Gullen to replace Gary Gensler as head regulator at the SEC.

- There are also rumours that Trump will create a specialist White House czar crypto role – a first ever.

- Listed company Rumble – a US$1.6 billion online video platform company – adopting Bitcoin on their company treasury. Several other smaller companies have also reported adding Bitcoin as a treasury asset. The race for corporate Bitcoin adoption is heating up.

All this has happened in just the past couple of weeks.

And it makes me firmly believe that Trump’s pro-crypto agenda wasn’t just campaign talk. He’s putting the people in charge to make it happen.

He’s even investing in it himself!

And that’s making big investors much more comfortable upping their crypto exposure.

As CIO of Bitcoin ETF Bitwise tweeted, this was the missing link for mainstream adoption in the US:

| |

| Source: X.com |

Of course, the big news item that could propel Bitcoin to unprecedented highs is if Trump endorses Republican Senator Cynthia Lummis’s Bill to create a Bitcoin Strategic Reserve.

I think it could be a strong possibility of happening.

I mean, the US has a strategic CHEESE reserve; you think they won’t set one up for Bitcoin?!?!?!

| |

| Source: X.com |

So many bullish tailwinds are developing that it’s hard not to be excited right now!

But remember: even Bitcoin bull markets frequently have short, vicious pullbacks.

To ride the wave properly, you need to know the big picture…

The path is set

Like it or not, in my opinion, Bitcoin is on a relentless journey to become the global reserve asset.

There’s only so much to go around; if it succeeds, we could go a lot higher from here.

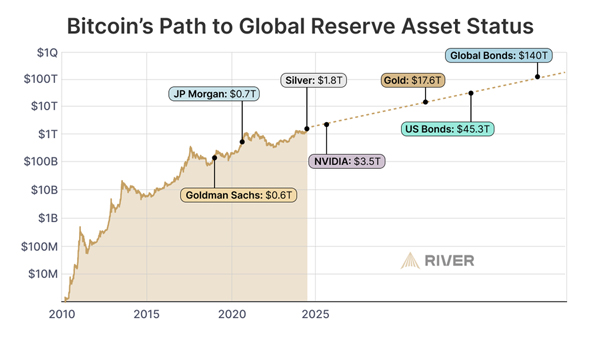

As this chart shows:

| |

| Source: River |

The next targets are locked and loaded.

Gold next, and then the US$140 trillion bond industry. It’s all up for the taking.

Speaking of bonds…

Big Insurance is coming

This week, I came across some interesting research from two US academics and a government economist.

They showed how Bitcoin acts as a hedge against the risks of sovereign debt default.

You can read the paper here.

This paper is getting attention right now in mainstream circles, given the credentials of the authors.

I explored this same idea four years ago after interviewing former Canadian bond trader Greg Foss.

Foss was a big Bitcoin advocate in 2020 and was one of the first to see Bitcoin as a ‘credit default swap’ – a hedge against governments defaulting on their debts.

Foss has recently re-adjusted his Bitcoin valuation model, giving Bitcoin a current valuation of US$300,000+.

It’s not as heady a valuation as Michael Saylor’s US$13 million by 2045 prediction! But it’s based on just one aspect – the idea of Bitcoin as a hedge against fiat debasement risk.

The idea of Bitcoin as a hedge against the fiat system — which was once considered pretty niche — is gaining increasing traction.

And these days, even big insurance companies are starting to look for exposure to Bitcoin any way they can get it within their investment mandates.

| |

| Source: Rob Hamilton |

It’s funny…

Everyone in mainstream land still thinks Bitcoin is ‘risky’ (and it is volatile) but now here’s the world’s master’s at assessing risk – the big insurers – investing in it!

Anyway, this is a super interesting trend to watch, and I think we could see more bond offerings, including Bitcoin coming in 2025.

In my opinion, this bull has a lot longer to run.

The once-in-a-generation digital land grab is on!

Speak soon…

Regards,

|

Ryan Dinse,

Editor, Crypto Capital and Alpha Tech Trader

Comments