In today’s Money Morning…no ifs, buts, or maybes about it…separating the trash from the treasure…the art of stock picking…and more…

Are you familiar with the term ‘stock picker’?

I wouldn’t be surprised if you weren’t, to be honest.

Stock pickers have become something of a dying breed. A remnant of a bygone era that many have considered dead and buried.

And I wouldn’t blame anyone for thinking that way.

The last time we truly had a stock picker’s market was back around 2009. Back at the height of the Global Financial Crisis.

In the 11 years since, being a stock picker has become somewhat obsolete.

Why? Because we saw one of the greatest and longest bull markets in history. A period that has been dominated by passive investing strategies and relatively easy returns.

All you needed to do was park your money in an index-tracking ETF and you probably would have done great. Sure, some would have done better than others, but for the most part it was easy to be an investor.

There was no need to pick individual stocks when the whole market was going up.

But then 2020 rolled around. Bringing with it a black swan event that has thrown a mighty wrench in everyone’s plans.

COVID-19 didn’t just put an end to the bull market — it turned it on its head.

And because of it; for the first time in over a decade, it is now a stock picker’s market…

No ifs, buts, or maybes about it

First and foremost, let me just say that this isn’t my opinion. Nor is it my way of trying to bend the truth.

Categorically speaking, we’re in the midst of a stock picker’s market. No one can deny that fact.

Just look at this data from the US:

|

|

|

Source: Morgan Stanley |

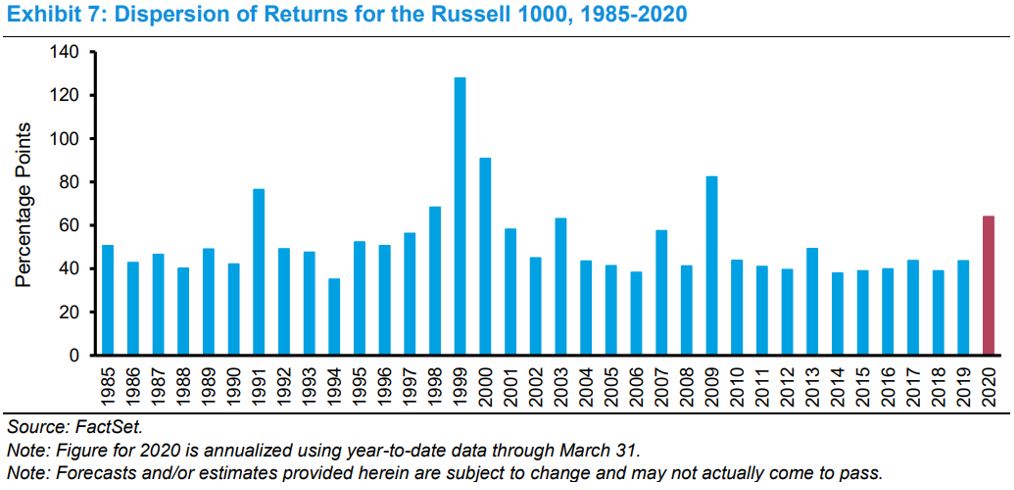

This graph is comparing the ‘dispersion’ of returns from the Russell 1000 Index. A collection of 1,000 stocks that range from large- to mid-cap in size.

As you can see, 2020 (the red bar) sticks out like a sore thumb. The first year since 2009 to show a breakout in dispersion.

Plus, keep in mind that this data only goes to 31 March. Meaning that it hasn’t even considered all the mayhem since then.

So, what the hell is dispersion?

Well, in simplified terms, it is a measure of the range of returns from a group of stocks.

When dispersion is low — as it has been for the majority of the past decade — stocks tend to generate similar returns. In this case, they’ve all been going up for the most part. Which is why passive investing has become so accessible and popular.

It’s hard not to make money in a strong bull market.

But, when dispersion is high — like it is right now — then returns can vary wildly from stock to stock.

Let me show you…

Separating the trash from the treasure

When it comes to the ASX, this ‘dispersion’ is on full display.

Take a look at these six stocks over the past year, for example:

|

|

|

Source: Google Finance |

As you can see, the cumulative returns are almost mirror images of one another. With the three on the left delivering staggering gains of 857.45%, 325%, and 623.24% respectively. While the stocks on the right have fallen by 75.38%, 82.98%, and 72.46% respectively.

It is about as stark a difference as you’ll ever see in a stock market. And there are hundreds of other examples just like these to choose from.

Highlighting, once again, the extreme dispersion we are seeing in stock returns right now.

For investors, this has been the defining factor of 2020. A year that has brought severe ups and downs for all involved.

And while that will certainly be a headache for some, for stock pickers it is an opportunity. The first opportunity in years to flex their muscles.

The art of stock picking

You see, stock picking is an artform.

A skill that can be learned and mastered.

Don’t get me wrong, no stock picker has ever had a 100% success rate. That just isn’t feasible when it comes to investing.

But, a great stock picker can set themselves apart from the rest. Especially when the market conditions favour them — just like they are right now.

That’s why right now, for the first time in over a decade, we’re seeing the return of the stock picker. A phenomenon that will ensure those who can find the best stocks will also get the best returns.

It is something that I believe any dedicated investor can’t afford to ignore right now.

Because if you have the drive and the passion, you could net yourself some seriously amazing returns. Just like the examples I’ve provided above.

I’ll have plenty more to share on this subject in the coming days and weeks.

So, keep an eye out; because when it comes to stock picking, the time to get involved is now.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.