Here’s 4 things I want to share with you today…

(1) We keep hearing that the US markets are “expensive” or “overvalued”.

But they keep holding around all time highs too.

If we pick through some recent stories, it’s not hard to see why, either.

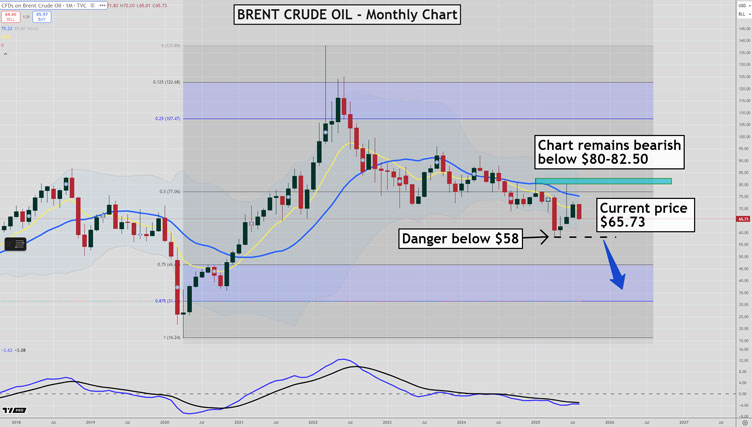

First of all…look at this chart from Charlie Bilello. US corporate earnings are up 11% this year…

| |

| Source: X |

Compare that to the general Aussie market, where earnings have gone nowhere for three years.

That reminds me.

I remember sitting down with my colleague Greg Canavan in March when we chatted over the tariff question at the time (the video is still available to Fat Tail paid subscribers).

I recall saying that the tariff issue would be a repeat of Trump’s first Presidency. It would flare up and spook everyone for a bit, then we’d all move on.

That’s pretty much what’s happened since.

There’s simply too much money roaring through the big tech stocks for the market to dive around trade issues (yet, anyway).

Plus, Trump has extended the reprieve on China tariffs for another 90 days.

What else can we see?

(2) Trump’s “Big Beautiful Bill” is going to juice corporate America’s free cash flow.

Check this out from the Wall Street Journal…

“In short, changes like allowing upfront depreciation of assets and immediate expensing of research-and-development expenses will bring swift windfalls to American corporations but also lasting tailwinds. This in turn has provided incremental fuel to stock markets, a counterweight to risks from tariffs and other policy uncertainty.”

We’re talking serious coin here.

One estimate puts it close to US$150 billion that’s staying with the companies and not going to the US Treasury.

That’s not all…

(3) Both the above combined mean US companies can use this money to buyback stock…and that’s what they’re doing.

See this also from the Wall Street Journal…

“American companies are repurchasing their shares at a record pace, boosting their balance sheets and fueling the U.S. stock rally.

U.S. companies have announced $983.6 billion worth of stock buybacks so far this year, the best start to a year on record, according to Birinyi Associates data going back to 1982. They are projected to purchase more than $1.1 trillion worth overall in 2025, which would mark an all-time high.”

And as a final kicker…

(4) Now we have the Fed highly likely to cut interest rates, according to Reuters…

“The likelihood of a Federal Reserve rate cut in September is now seen near 100% after new data showed U.S. inflation increased at a moderate pace in July and “Treasury Secretary Scott Bessent said he thought an aggressive half-point cut was possible given recent weak employment numbers.”

Those are four powerful tailwinds, and explain why US stocks have surged out of the April low.

The question now: is it all priced in?

I’d suggest yes. So I’m not certain how much more the US can keep powering up.

That said, there’s no reason to get unduly bearish either. And that’s fine.

A solid, steady market is enough to keep the Aussie market in good shape too.

Perhaps one area of concern for the USA is how dependent it is on the technology sector.

Some even argue that the US is in a “redneck recession”…where Wall Street and Silicon Valley are fine and dandy but much of the country is getting left behind.

See this from the Telegraph…

““Manufacturing is in recession. Construction is in a deep recession. Transportation and distribution is in recession. Wholesaling is in recession. Retail is holding on by its thumbs, it’s very close,” says Mark Zandi, chief economist at Moody’s Analytics.

It all comes back to the same thing. US tech is now going all in on artificial intelligence.

It’s the only game in town.

AI is the future of the markets, in more ways than one. Where AI goes, nobody knows. But we’re going to find out.

Best Wishes,

Callum Newman,

Australian Small-Cap Investigator and Small-Cap Systems

***

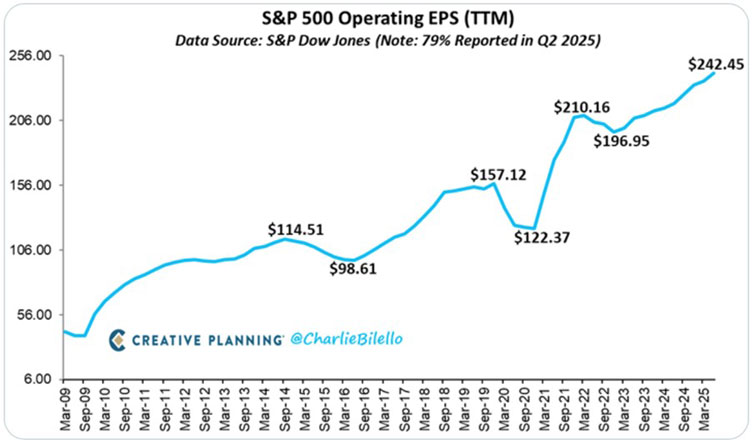

Murray’s Chart of the Day –

Oil

Source: Tradingview

[Click to open in a new window]

I haven’t bothered to give you any updates on oil for the last few months because it has been stuck in no-man’s land.

After the recent spike above US$80 in Brent crude oil, the sellers stepped back in and the price collapsed below $70 and has sat around that level since June.

We either need to see a monthly close above US$75.43 to confirm a monthly buy pivot, or a jump above US$80-82.50 to change the current bearish outlook.

We have now seen 5 retests of the 20-month moving average that have failed. In other words, the long-term downtrend is well and truly entrenched.

A failure below the low of the whole downtrend near US$58 would spell trouble with little support below that level until US$46.50.

With the possibility of as cease fire in the Russia/Ukraine war on the cards, there may be a solid catalyst evolving that could see oil prices drop sharply.

I remain bullish for the prospects of oil long-term so see any coming collapse in the oil price as a buying opportunity.

Regards,

Murray Dawes,

Retirement Trader and International Stock Trader

Comments