Brisbane-based TechnologyOne [ASX:TNE] failed to hold onto its early morning gains today despite solid FY23 results. The share price slipped by -1.77% to trade at $16.12 per share as bearish moves across the sector dragged the company down.

The enterprise resource planning (ERP) software company has seen its 14th consecutive year of record profit, revenues, and SaaS fees, marking another notch in its trajectory.

Despite these losses today, the company has seen a solid year of growth, with shares up 30.5%, outperforming the tech sector by 14%.

It’s been a relatively quiet year for the software giant, with small gains throughout the business. TNE impressively handled a severe cyber breach in May this year, pushing its stock price up rather than down, something rarely seen.

Let’s dig into its financial results and see what’s next for the company.

Source: TradingView

TechnologyOne FY23 Results

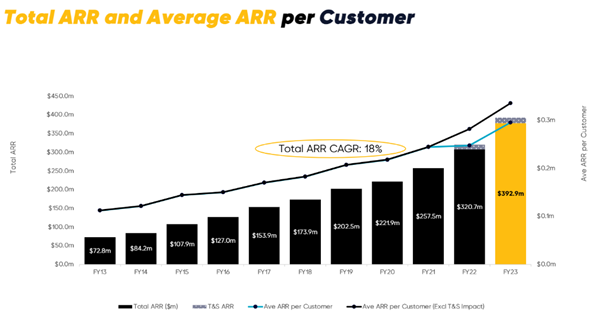

After today’s results, the company says it’s on track to beat its goal of $500 million in annual recurring revenue (ARR) by 2025.

For the financial year ending 30 September 2023, the company’s ARR was $393 million, putting it on track to reach its target a year earlier.

The company reported a net profit after tax of $102.9 million, up by 16%, surpassing its guidance of 10–15% growth for the year.

The better-than-expected results meant the company would pay a special dividend of 3 cents a share on top of the final dividend, bringing the full-year payout to 19.52 cents a share, up by 15%.

Source: TNE

The company has also channelled these high revenues into a higher research and development (R&D) budget, totalling $112.0 million, a 21% increase from the previous year.

TechnologyOne’s CEO, Ed Chung, thinks this is a major pathway to growth, saying today:

‘With strong results and a confidence in our sales pipeline, we made additional investments in all our pillars for growth to enable us to continue to double in size every five years beyond $500 million ARR. In R&D we increased investment by 21% to accelerate the development of our ground-breaking Digital Experience Platform (DxP).’

Net revenue retention (NRR) was another area where TechnologyOne excelled, achieving a rate of 119%, well above its long-term target of 115%.

This indicates that existing customers are retaining their business with TNE and expanding their use of its services.

Another notable shift for the company was the completion of its five-year plan to shift from an on-premise legacy licence business to a SaaS company. By making the shift, the company has steadily reduced its licence fees from $75 million per year to zero.

With all this, TNE finished the financial year with substantial cash and investment holdings of $233 million and no debt.

So what are the company’s plans moving forward?

Outlook for TechnologyOne

With a strong balance sheet and outlook, the company has added to its strategic goals with new ‘pillars of growth’.

These aim to double TNE every five years, something that will require some finesse to accomplish. Much of that growth will stem from identifying potential takeover targets to accelerate progress.

The company disclosed within the report that it had spent $2 million in due diligence costs for a potential UK takeover target but decided not to proceed.

The company has been known to be cautious in the UK market. After battling to be profitable over there for years, it will want to tread carefully.

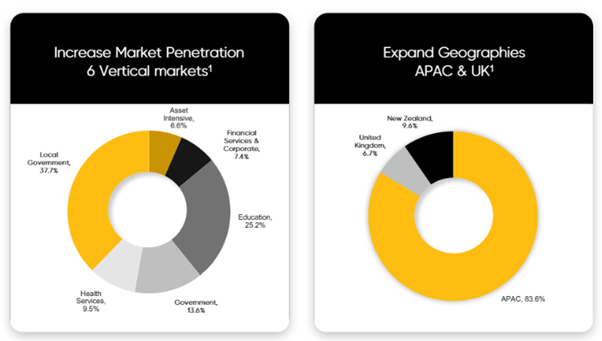

But this expansion is critical for the company’s long-term strategy, as it diversifies its revenue streams and reduces dependency on the domestic market.

You can see below how centred the company is within the APAC market, something they have tried to change:

Source: TNE FY23 Report

However, moving outside our waters involves bumping against some bigger fish such as Oracle, SAP, and Microsoft.

Wherever the company decides to jump to next, it should be worth keeping an eye on. The company stands in a healthy position that should afford it plenty of flexibility to hit its growth targets and is one to watch.

Another tech miracle?

If you’re looking for other tech stories to invest behind, look no further than the incredible moves of Bitcoin [BTC].

The asset class many had claimed dead has now pulled a return of 142.4% for the past 12 months. That makes it the best-performing asset class this year.

Compare that to the ASX 200s -1%, and you can see why more people are taking notice.

Our exponential investor and tech specialist, Ryan Dinse, has been a long-time cryptocurrency investor and isn’t surprised at all.

In fact, he mapped out these movements. What is next on his timeline?

Bitcoin to US$1 million. Sound ridiculous? Too good to be true?

Watch his video here to see how the market looks coming out of this crypto winter and where it’s headed next.

Regards,

Charlie Ormond

For Fat Tail Daily