Hot enough for ya?

I’m in Melbourne today, but I’m not talking about the darn weather.

I’m talking about commodities.

And yes, they can get hotter.

This week, I’m going to take you on a journey that leads to a remarkable conclusion about where markets could go in 2026.

And what you can do about it.

But first.

Let’s start with this odd collision of technology and geology to give you a taste of what I’ll be sharing with you over the next three days…

They’re Fingerprinting Rocks Now

What if I told you authorities are now testing the molecular DNA of rocks?

To catch mineral smugglers.

This is the bizarre new reality of Australia’s mining industry in 2026.

The Darwin Dialogue held in April 2024 established a framework for international discussions on securing the mineral supply chain. And governments are deploying Big Data and cutting-edge tech to ensure that happens.

And new tech is being developed to ensure that happens.

Here’s how it works.

Every mineral deposit on earth has a unique chemical signature. Think of it like a fingerprint.

By analysing trace elements and isotopic ratios, authorities can now verify exactly where a shipment of say, rare earth concentrate, came from.

Did it really come from a legitimate Australian mine? Or is it conflict material from Myanmar being laundered through our processing facilities?

The tech can tell.

Why does this matter to you as an investor?

Because Australia is one of the few places on earth where critical minerals can genuinely claim to be “clean.” No child labour. No funding for armed militias. No environmental catastrophe hidden in the jungle.

That makes Australian minerals (hopefully) worth a premium.

Which is precisely why criminals want to exploit it.

According to the FY26 Risk Radar released by the Australian Mining Review, illegal mining syndicates are a major threat.

Strange, right? We usually picture blood minerals coming from remote African or South American jungles.

But the soaring prices of lithium, rare earths, and cobalt have changed the calculus. Informal and illegal operations across Southeast Asia are now trying to launder their minerals through Australian processing hubs.

They want that ESG-certified stamp of approval. They want the price premium that comes with it.

The Crackdown Is Real

So what are governments doing about it?

More than you’d expect. And it’s creating both chaos and opportunity across the global mining landscape.

The geochemical fingerprinting technology is already deployed. Australian authorities are building comprehensive databases of mineral signatures from known deposits. When a shipment arrives claiming to be from a particular mine, they can verify it on the spot.

This isn’t theoretical. Border security agencies are running tests on suspicious shipments right now.

The technology is so precise that it can distinguish between minerals from different zones within the same mine.

But the bigger action is happening on the supply side.

Governments worldwide are hammering operations that can’t verify their provenance or ensure operations are safe.

Indonesia has been revoking nickel mine permits and shutting down questionable operators.

Brazil’s labour ministry is taking a harder line on safety and environmental compliance at lithium operations.

The message is blunt. If you can’t prove your minerals are clean, you’re locked out of Western supply chains.

This regulatory squeeze is having real consequences.

Projects are getting delayed. Operations are being shuttered. Supply is tightening at the exact moment demand is exploding.

And that’s where things get interesting for your portfolio.

Three Stories That Tell You Everything

Let me show you how this plays out in practice.

Three recent events capture exactly how geopolitical and regulatory pressures are reshaping commodity markets right now.

First, the Sigma Lithium mess in Brazil.

Earlier this month, it was revealed that Brazil’s Labor Ministry had shut down three waste piles at Sigma’s flagship Grota do Cirilo mine.

The official reason? Major safety risks.

This was Brazil’s top lithium producer, with annual production capacity of around 270,000 tonnes of concentrate. It’s been idle since October 2025.

When the news came out shares hard and fast.

It shows how quickly regulatory scrutiny can kneecap supply from even established producers.

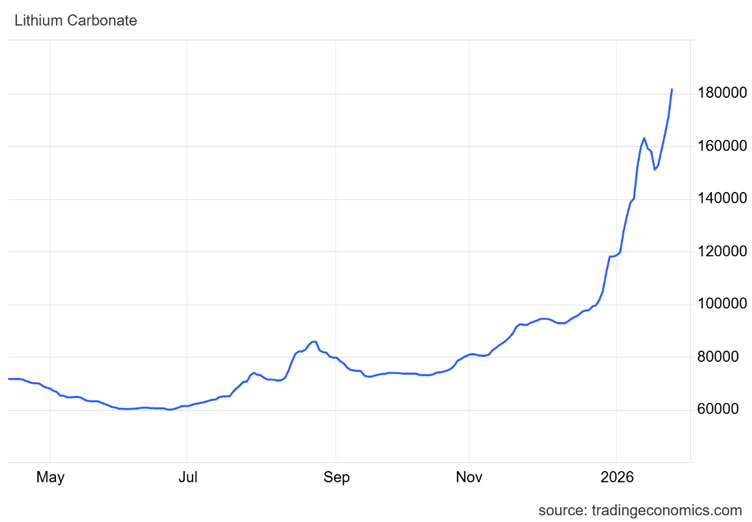

Meanwhile, this is what is happening to the lithium price this year, by the way. Going absolutely berserk after a long time in the doldrums:

Source: Trading Commodities

Second, the tin story.

This one ties directly to one of my existing recommendations in Australian Small Cap Investigator: Metals X [ASX:MLX], currently sitting at a market cap of roughly $1.1 billion.

Note: this is not financial advice or a recommendation — MLX is well beyond the price it was recommended at, and this is only an example.

The shutdown of illegal tin mining operations in Southeast Asia, particularly Myanmar and Indonesia, have been wreaking havoc on supply.

MLX runs the Renison mine close to home in Tasmania, which produces ~3-4% of the world’s tin.

The market finally recognised the value of reliable, conflict-free tin supply.

And this is what the MLX chart over the last year looks like:

Source: Market Index

Note: Again, this is not financial advice or a recommendation.

Third, the Indonesia nickel crackdown.

In June 2025, Indonesia revoked licenses for four nickel mining companies.

Indonesia is now actively cutting nickel output across the country to support prices after years of oversupply crashed the global market.

The market seems to be pricing in persistent rumours which suggest additional permits could be revoked if companies fail to meet environmental and administrative obligations.

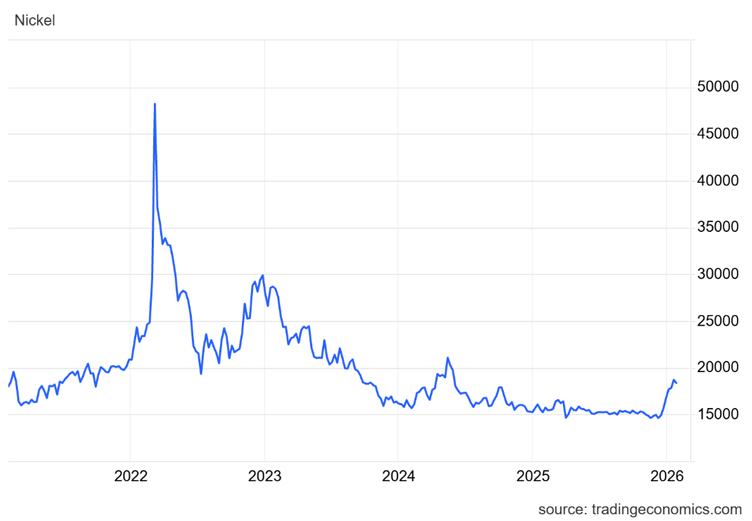

This is what just happened to the long-term nickel price, note the sharp up trend, bottom right:

Source: Trading Commodities

This matters because I just recommended a nickel stock to members of Australian Small Cap Investigator.

The thesis is straightforward. As questionable operators get shut down and supply tightens, the premium on clean, compliant nickel production expands.

All three stories share a common thread. As the global commodity race intensifies, authorities are getting dead serious about supply chain integrity.

That’s causing disruptions, shutdowns, and supply constraints. And every disruption hands you an advantage if you can spot the potential beneficiaries if the supply shock hits.

You’re Already Sitting in the Right Spot

Here’s the thing about being an ASX investor in 2026.

You’re sitting in the right place at the right time.

Australia holds an extraordinarily strong position as the commodity race heats up.

World-class deposits of virtually every critical mineral the world needs. Stable government. Strong rule of law. Transparent regulatory frameworks. Existing infrastructure. Deep mining expertise.

Our local stock market is packed with commodity plays of every shape and size. Projects at various stages of the mining lifecycle. Domestic and international exposure.

The diversity of opportunity is staggering.

As supply chains fracture along geopolitical fault lines, Australian-listed miners with projects in safe jurisdictions are becoming the obvious choice for institutions. They want a secure supply without reputational or regulatory landmines.

The capital is mobilising. The demand is real. The supply constraints are tightening. And you just might be sitting in the middle of the biggest commodity opportunity in a generation.

Part One of Three

This article kicks off a three-part series this week exploring the most important investment themes for 2026.

Today, we covered commodities. Why supply chain disruptions and illegal mining concerns are creating new opportunities for Australian investors.

Tomorrow we turn to AI. The forgotten investment theme everyone assumes is over. It’s actually entering its most interesting phase.

Then on Wednesday, I’ve got a deep dive on how these two themes interact in mysterious and profitable ways most investors haven’t even considered yet. The convergence is coming faster than you think.

Ready to Get Ahead of the Crowd?

Click here to learn more about BIG DIG, a major investment thesis from our in-house geology and mining investment guru, James Cooper.

It reveals exactly how investors can position themselves profit from everything I discussed today.

Regards,

Lachlann Tierney,

Australian Small-Cap Investigator and Fat Tail Micro-Caps

Comments