As if awakening from a long, pleasing dream…and rubbing the sleep from their eyes…at last, America’s mainstream newshounds are beginning to notice that debt is not such a good thing. The Fed keeps its key lending rates too low for too long. They say it is to boost the economy. Instead, it has the opposite effect; it slows down growth and makes people poorer. Fortune:

‘Americans are so indebted that it’s holding back the economy

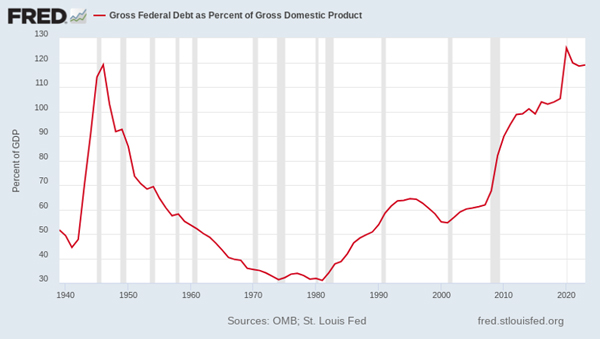

‘While government debt has been dominating the news, there is far more private debt than public debt in the economy–and it represents the greater economic challenge. As of year-end 2022, public debt totaled 123% of GDP, while private sector debt totaled 165%.

‘The level of private debt–student debt, mortgage debt, small business debt, and more–has more than doubled as a percentage of GDP since 1980. It stifles economic growth because it burdens individuals and businesses. In fact, debt has been consistently growing faster than GDP, which means that the burden on the private sector is almost always increasing.

‘Debt can be employed productively. In fact, an economy can’t function without debt. Yet debt is a paradox: its overuse can bring harm–and even disaster.’

So far, so good… the more debt you have, the less of your current income you can spend or invest.

But then, the poor journalist gets into the deep end of the pool… and sinks. ‘How come debt got so big,’ he must have asked himself. And he comes up with a cockamamie answer:

‘Debt grows because it takes new debt to grow the economy. If you want to build a new house or buy a new car, you can either spend proportionately less on something else, which means the overall GDP won’t grow, or you can borrow the money. Reducing spending to save in order to make the purchase reduces GDP during the period in which you save. If your employer increases your pay and therefore gives you more to spend, you can use that to grow the economy–but those earnings essentially are predicated on someone else’s debt growth.’

Oh my…will someone please throw this fellow a life preserver! He believes that economies only grow thanks to borrowed money. If that were so, debt would grow bigger and bigger, until the feds had to ‘do something’.

‘Increased debt, especially private sector debt, is fundamental to economic growth–but it mounts up over time. In the absence of a drastic reconfiguration of economic life, debt growth is essentially perpetual. Total debt–private debt and government debt added together–has grown from 142% of GDP in 1950 to a mind boggling 294% today. The inexorable march of debt may well be the most important economic factor in our lifetime. It underscores the need for new approaches in addressing this unbridled debt.’

New approaches?

In an honest economy, people borrow… but they also pay back what they borrowed. Debt and output are linked together, like two oxen pulling a plow. One never gets too far ahead of the other. In the US, the level of total debt to GDP was fairly low and fairly constant for the first thirty years after WWII.

That’s what you would expect. Debt rises with output. More people borrow more money… and more people pay it back.

Also, during those 30 years, the economy grew twice as fast as today – with no increase in the debt/GDP ratio.

| |

| Source: OMB, St Louis Fed |

As people earned more money (higher GDP), they had more money to save… leading to more money to borrow. Credit (debt) came from savings. And savings came from output. People had to earn more money (GDP) and save it, before other people could borrow it.

The money system was changed in 1971, providing the US with a ‘credit money’ that didn’t have to be earned, mined or saved. And then, the Fed in its wisdom decided that it would boost GDP by lending this new, fake money at artificially low interest rates. And since these faux savings were being lent at faux and falling interest rates, borrowers didn’t have to pay back…they just refinanced and borrowed more.

The whole system is a fraud. Lending fake money at fake rates increases the debt level. In effect, people don’t pay off their debts…they extend them into the future. Then, when the future comes they’re still paying for past expenses, leaving them less money available to spend or invest.

None of this seems to have occurred to Fortune. Rather than fix the system properly… by insisting on honest money and honest interest rates, the magazine proposes to use duct tape and baling twine.

Student debt would be erased by simply forgiving it… requiring instead that debtors do ‘community service.’ In other words, taxpayers would take the loss.

The plan for mortgage debt involves restructuring loans. The program’s particulars were unclear… but the gist of them is to lighten the load on the borrowers at the expense of the lenders.

Fortune goes on to suggest changes to bankruptcy and federal tax laws, which may or may not be helpful. But the basic problem is that if the borrowers don’t pay their loans back, someone else will have to take the loss — either the lender (default)…the taxpayer (bailouts)…or the general public (inflation).

In every case, losses don’t vanish; they just get moved around…from the people who deserve them, to the people who don’t.

Regards,

|

Bill Bonner,

For Fat Tail Daily