On Thursday, ASX graphite producer Syrah Resources [ASX:SYR] released its June Quarter results.

Then on Friday, Syrah followed up with a memorandum of understanding between it and giant automaker Ford and SK On.

Ford has embarked on a deal-making spree to shore up critical metals for its EV push, announcing recent deals with the likes of Rio Tinto [ASX:RIO] and Liontown Resources [ASX:LTR].

And on Friday, Ford also entered a binding lithium offtake agreement with lithium developer Ioneer for lithium carbonate at INR’s Nevada lithium-boron project.

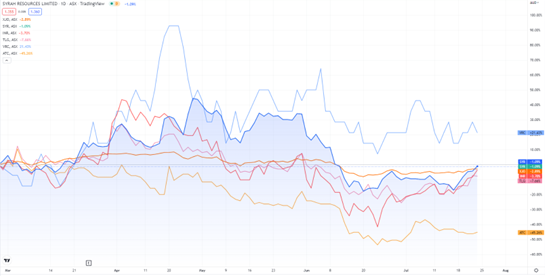

SYR shares have struggled recently, down 25% year-to-date:

www.TradingView.com

Syrah’s MOU With Ford

The company announced it has entered a non-binding memorandum of understanding with Ford Motor Company and SK On Ltd for an offtake of natural graphite active anode material (AAM) this morning.

The three companies have entered the MoU to ‘evaluate a strategic arrangement’, including the supply of natural graphite to BlueOval — Ford’s joint venture with SK On — via SYR’s vertically integrated AAM facility in Louisiana.

BlueOval aims to supply lithium-ion batteries for Ford’s EVs.

Syrah said that under the MoU, Ford and SK On will test and qualify Syrah’s active anode material and aim to finalise a binding offtake agreement by the end of the year.

If a binding deal is reached, an offtake commencement date is expected to be no later than 2028.

Developments at Syrah’s Vidalia graphite project continue with construction planned for completion by next year.

‘Syrah is developing Vidalia as a vertically integrated natural graphite AAM supply alternative for USA battery supply chains with construction of a 11.25ktpa AAM facility expected to be completed in the June 2023 quarter and start of production targeted in the September 2023 quarter.’

Ways to play the great EV battery race

The EV market is set to reach unprecedented highs by 2030, with 26.8-million-units expected in sales by then.

Governments have been making moves to increase their nations production to boot, funding programs which support battery metal mineral production for their respective economies.

Joe Biden is publicly campaigning battery metal production ramp-ups in the US, offering loans to assist companies in making production headway.

The EU has set targets to scrap higher-emission vehicle sales by 2035, and Australia has been tailing China, determined to shake the country’s monopoly on the market.

But our energy expert Selva Freigedo says that lithium-ion battery mineral supplies face an impending ‘crunch’.

She has found three metals at the forefront as global shortages could be set to push prices even higher.

Find out more about ‘Three Ways to Play the Great EV Battery Race’ here.