The Brisbane-based retail holding company recorded stronger than expected results for the full-year of 2019/20.

At the time of writing the Super Retail Group Ltd [ASX:SUL] share price is trading at $8.76, up 8.01% on the previous day’s trade.

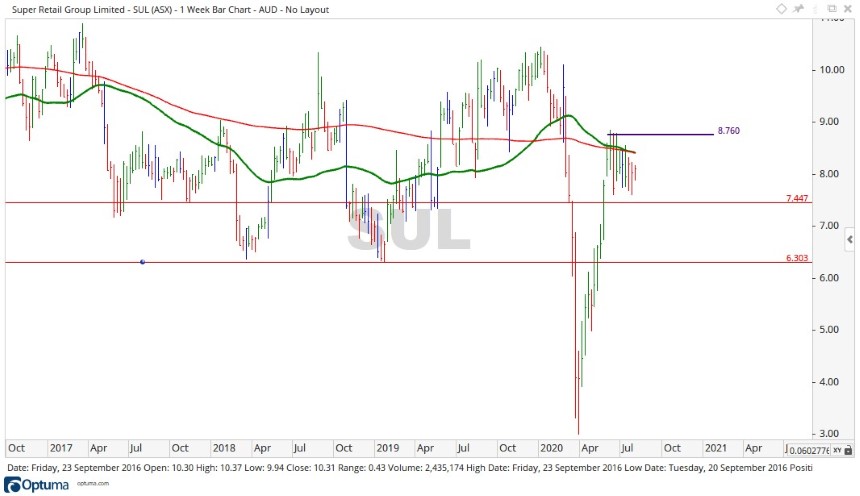

Source: Optuma

What’s happening at Super Retail?

Operating four popular brands that include Supercheap Auto, BFC, Macpac, and Rebel, the company hold a diverse group covering many sectors of the retail world.

Like everyone in this current climate Super Retail was not able to escape the impact of COVID-19.

Some positives did come out of it though.

At the start of the pandemic in Australia most states had rigid rules in place on what you could and could not do.

As they eased in certain states such as Queensland, Western Australia, and South Australia, the spending conditions improved, with the brands held by Super Retail group benefiting from the reopening as people started to get out and about again.

The reopening of some of the states pushed the yearly results into positive ground:

- Total revenue of approximately $2.82 billion (2018/19: $2.71 billion)

- Pro forma Segment EBITDA of between $327 and $328 million (2018/19: $315 million)

- Pro forma Segment EBIT of between $235 and $236 million (2018/19: $228 million)

With Super Retail Group CEO and Managing Director Anthony Heraghty mentioning:

‘Given the volatile trading environment, we are very pleased with these results. The Group’s omni-retail channel business strategy has enabled our businesses to adapt quickly to changing consumer behaviour during COVID-19.’

Where to from here for Super Retail Group?

Right now, Victoria is in bad shape in relation to COVID-19. The state is in lockdown, harsher restrictions loom, and the virus runs rampant.

New South Wales is teetering on the edge of a lockdown and things in Queensland appear dicey

This could all impact the earning capability of Super Retail Group severely.

Source: Optuma

Looking at the chart, by using a 50-day moving average (green line) against a 200-day moving average (red line) we can see they are about to cross over.

With the 50-day falling below the 200-day. This is a bearish signal known as the ‘death cross’.

This may be a sign of a sell-off soon.

With the price trading at $8.76 at the time of writing, there still is not a bullish sign as the price is yet to break the previous high made in June of $8.85.

This level needs to be broken to consider the stock bullish.

If the death cross proves effective and price falls away, then levels of $7.44 and $6.30 may provide future support to a decline.

Regards,

Carl Wittkopp,

For Money Morning

PS: Four well-positioned small-cap stocks: These innovative Aussie companies are well-placed to capitalise on post-lockdown megatrends. Click here to learn more.