Suncorp Group Ltd’s [ASX:SUN] banking arm will launch a buy now, pay later service with VISA.

Despite the announcement, the SUN share price barely budged.

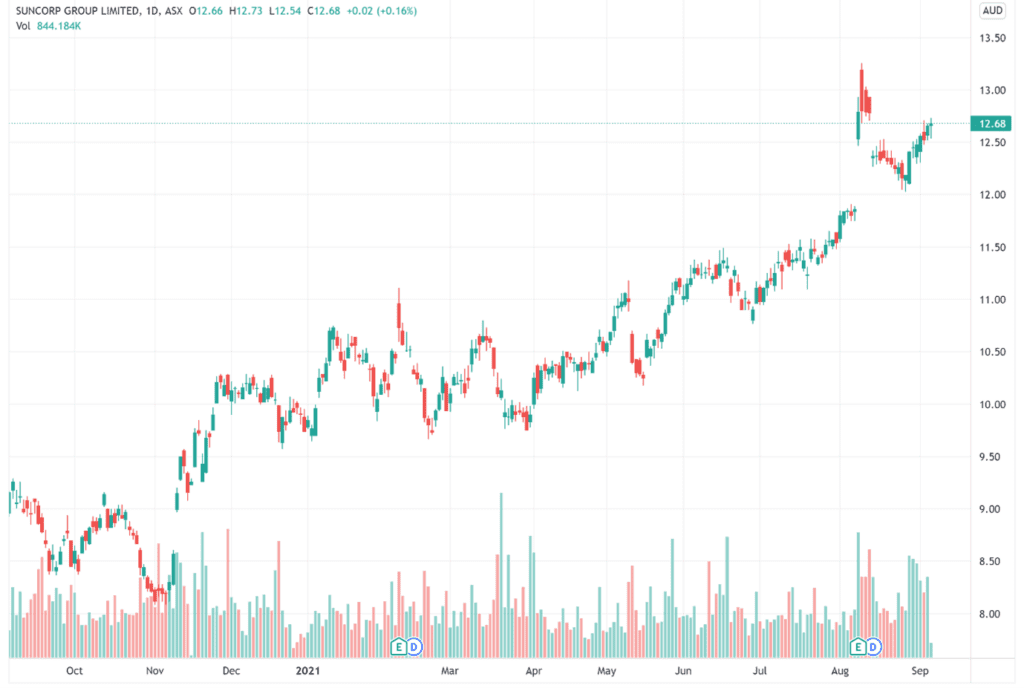

As you can see from the chart below, the Suncorp share price has shown relatively steady month-on-month growth.

Yet today, Suncorp shares are slow to change hands.

Perhaps the Aussie bank is a bit late to the BNPL party.

This is a rapidly emerging fintech sub-industry that has seen immense growth over the last five years. There are already several ASX winners in this space that Suncorp will need to compete against.

At first glance, Suncorp’s BNPL offering PayLater seems to work exactly like the other popular BNPL service providers such as Afterpay Ltd [ASX:APT].

With PayLater, customers can pay for purchases in four fortnightly interest-free instalments.

Let’s explore exactly how it works…

What sets Suncorp’s PayLater offering apart?

Suncorp has partnered with Visa on PayLater.

This is a strong foundation to start with.

PayLater will include both a physical and digital VISA debit card, which customers will be able to use in-store and online.

It’s a first for the Australian market and could encourage widespread use of its convenient BNPL facility.

Other Suncorp PayLater features on the company’s app include:

- No foreign exchange fees on international purchases

- No additional merchant fees

- A limit of $1,000 (once eligibility is determined by the bank)

- Flexibility to change your repayment day by up to six days

To make shopping flexible, customers will have two options: they can use a green colour-coded Suncorp VISA debit card to pay now from their Suncorp bank account…

Or they can use a yellow VISA debit card for the PayLater feature (which will split the cost of the purchase into four interest-free instalments).

After a two-day grace period for missed repayments, customers will be charged a late fee capped at $10 per purchase.

Customers will not be able to use PayLater for cash advances or gambling purposes.

Incumbents join the party

The ASX BNPL party is getting crowded.

Until this year, it was dedicated BNPL fintech start-ups crowding the space.

Now, the big banks and card companies are joining, too.

Having taken a wait-and-see approach, the industry incumbents are now likely satisfied that BNPL is here to stay.

And, given it’s here to stay, it’s better to roll out your own offering and capture some of the market share before the likes of Afterpay, Klarna, and Affirm gobble it all up.

Having flagged its own offering early this year, CommBank last month officially launched StepPay — an instalment option for CBA customers.

CBA also raised its stake in Swedish BNPL giant Klarna to 5.5%.

And online payments player PayPal just launched its own BNPL offering in Australia, aiming to enticing users away from APT and Z1P by charging no late fees.

What is interesting about Suncorp’s announcement is that its share price — like CBA’s —didn’t budge when the BNPL foray was announced.

Why is that?

Is the market unsure how to price the BNPL addition to Suncorp’s and CBA’s business? Or are investors indifferent to the prospects of the banks’ BNPL offerings?

Earlier in the year, we wrote that:

‘Investors likely to invest in blue chips like CBA may not care much about BNPL machinations and investors in BNPL providers may not be ready to jump ship just yet’ to big banks.

With BNPL now attracting wider strategic attention from traditional incumbents, it will be interesting to see how the market assesses their foray into BNPL over the next few months.

Another interesting thing is whether Suncorp’s BNPL foray primarily targets fintechs like APT and Zip Co Ltd [ASX:Z1P], or whether it’s aimed at the Big Four banks.

With banks wishing to attract more young users, Suncorp’s PayLater may be a way to make it a more attractive bank for prospective customers than the big banks with no BNPL option.

What’s next for the Suncorp share price?

Younger generations tend to prefer paying via BNPL instead of the credit cards their parents used.

Yet Suncorp CEO Clive van Horen seems to suggest PayLater will cast an even broader appeal, particularly considering today’s COVID-affected retail environment.

He commented:

‘This solution is also a win for Australian businesses, many of whom are doing it tough right now as we learn to live with COVID-19.

‘Our PayLater offering eliminates additional costs to those businesses who are currently paying millions of dollars in traditional BNPL fees.’

Although it’s early days for Suncorp’s PayLater, if the market can more fully grasp the potential opportunity at hand over the coming weeks, then we could see the share price begin to respond.

Suncorp could be a strong traditional blue chip stock to own right now, but it’s not necessarily the most innovative in a space that’s set for massive growth: fintech.

We usually find those qualities in other stocks…stocks the mainstream rarely report on. And if we’re right about their potential, they can yield massive gains…

So, if you’d rather read about the kinds of stocks I’m talking about, I suggest checking out a new free report by Exponential Stock Investor analysts Ryan Dinse and Lachlann Tierney.

It’s called ‘Three New Small-Cap Fintechs that Could Weaken the Banks’.

In this report, we reveal three of our favourite Aussie fintech stocks. They could potentially shoot up in price this year (and better yet — they’re only trading under $1!).

Get your free report here.

Regards,

Kiryll Prakapenka

PS: Along with your report, you’ll also get a free subscription to Money Morning, an e-letter that has been designed to deliver the most exciting investing opportunities straight to your inbox every day. Click here to get started.