Joint venture partners Strike Energy [ASX:STX] and Talon Energy [ASX:TPD] released their first production update for the new Walyering Gas Field in the Perth Basin of WA.

Gas first flowed from the greenfield site on 25 September 2023, to the Parmelia Gas Pipeline with a five-year offtake deal struck with energy giant Santos [ASX:STO] to provide 36.5 PJ of condensate.

The government has closely watched the Basin project, which endorsed the development under the Perth Basin gas acceleration strategy.

It’s been 10 years since the last operator commissioned a new greenfield domestic gas development in WA, and the path to production has been one mired by significant cost and timeline overruns.

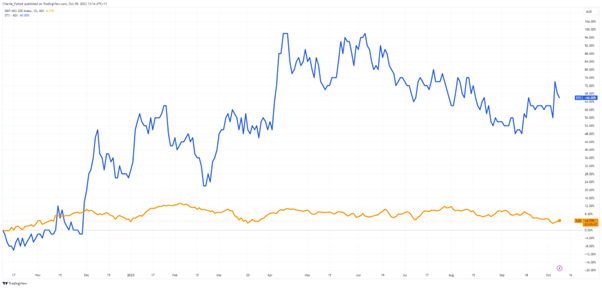

Shares in the companies are down 1.19% today, trading at 41.50 cents a share, but have soared in the past 12 months, gaining 62.75%, the fifth-best performance in the Energy Sector this year.

Source: TradingView

Strike a deal

The Walyering field has begun ramping production after proving its stability in producing approximately 20 terajoules (TJ) of gas daily. This was within the initial production guidance, averaging around 200 barrels of condensate per day.

During September, approximately 52 TJ of commissioning gas was successfully sold, paving the way for firm gas sales.

The gas field, boasting 2P Reserves of 56 petajoules (PT) equivalent, is proving to be a treasure trove for both Strike and Talon.

The joint venture plans to increase production to its nameplate capacity of 33 TJ/day over the coming quarter.

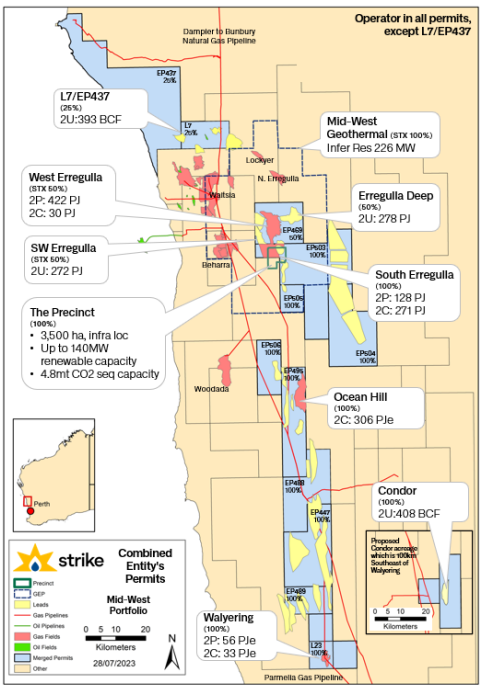

Under the joint venture, Strike holds 55% and is operating the site, while Talon owns the remaining 45%. The companies share other joint ventures within WA and hold approximately 1,022 PJ of conventional gas 2P reserves and 2C resources combined.

The two companies are currently in the midst of a merger deal, which hit the headlines in mid-July as the deal appeared to sour.

On 25 July, Stike pulled its take-it-or-leave-it offer at the Talon board, which stalled for time in the hopes of a better deal.

After shareholders turned on Talon’s board members with a fiery ultimatum for not taking the talks seriously, both parties returned to the negotiating table in less than two days.

As recently as 28 August, Stike offered what it described as the ‘best and final offer’, which appears to be 5 cents per share sweeter.

With the merger now inked, Strike CEO and Managing Director Stuart Nicholls says the pathway to accelerate the fields is simplified, commenting:

‘This is an earnings accretive transaction for Strick that will simplify Strike’s operations and provide a platform to remove the costs in operating and managing its existing joint venture with Talon. The combined group will have the capacity to generate initial annualised cashflows in excess of A$82 million from the Walyering gas field alone. The additional free cashflow generation will support an acceleration of Strike’s Government endorsed Perth Basin development strategy.’

The development of Walyering has not been without controversy, facing immense backlash from environmental groups and missing key development goals, which ran up costs.

The final cost of the development was $30 million gross, with $16.5 million net to Strike. The company blamed the pushed construction time, higher labour costs and additional manpower costs on the price tag.

In all, costs were double what was forecasted, and the completion time was triple what was planned.

Outlook for Strike

While overruns are typical for junior developers, these put pressure on the joint venture to resolve quickly to regain profitability and pay off its large debts from the development.

Strike went so far as to provide a ‘letter of comfort’ to Talon to increase an existing financing facility due to the project’s increased final cost.

Thankfully, they anticipate recovering their share of the construction cost from gas and condensate sales within a mere two quarters. This rapid payback underscores the high returns on investment that this venture promises.

The company also holds extensive permits within WA and has agreed with Talon to drill the Walyering-7 well in the first quarter of next year.

Source: Strike Energy

The potential for Strike to move into a strong growth period should excite investors. WA gas supplies are forecast for solid demand as a critical buffer in the government’s Net Zero strategy to move away from more carbon-intensive energy production.

This short-term demand spike was highlighted by a September report that forecasted the domestic gas market would remain tight until 2027 when new supply would come online.

The report went on to say:

‘Gas demand will remain robust through to 2033, with new gas plants needed to support the planned coal retirements and the expansion of renewables in the power sector alongside an almost doubling of industrial demand for gas.’

This spells an undervaluing of Strike’s current assets and should see it’s the Walyering field bearing fruit at the perfect time.

Progress at odds with sense

There is a catch, as there often is in politics.

This progress appears to be at odds with the WA Domestic Gas Policy, where the state is expecting to spend vast sums of money to walk back much of this progress.

The Centre for Decommissioning Australia (CODA) estimates that over the next 50 years, approximately $56.9 billion will need to be spent to decommission Australia’s offshore oil and gas infrastructure.

According to Australian Petroleum Production & Exploration Association (APPEA) director Caroline Cherry, this work and regulatory hurdles in the sector mean that ‘critical investment has been put at risk at a time when the state needs more gas supply to meet growing demand.’

Our Editorial Director Greg Canavan has been doing a deep dive into the costs and realities of the Net Zero movement.

If you want a different perspective on where we are headed and stocks that could benefit from the potential U-turn.

Click here to find out.

Regards,

Charlie Ormond

For Fat Tail Commodities

Comments