Do you know why many investors fail while others succeed?

One of the most common mistakes is buying a stock off someone’s advice.

Should you stop reading now, given I write precious metals and mining stocks newsletters and offer stock recommendations?

Hang on a second. There’s more to it than that.

Failure doesn’t come simply from buying a stock tip. It’s what they do afterwards.

That is, do they monitor the company’s price movements from time to time? Do they research the company and learn about why they bought? Are they aware of what factors to consider when they plan to sell?

It’s one thing to listen to an expert (or follow the crowd). It’s another to take ownership of your decisions.

This is especially important when trading gold and other mining stocks.

Today, we’ll discuss the importance of knowing your limits and managing your emotions when investing in gold and precious metals mining stocks.

A lifelong journey of learning

Many of you who read my articles would know that my journey into gold and gold stocks began with a conversation with a primary school friend in 2013. He told me about how gold maintains purchasing power in our crooked financial system. He suggested I learn about gold and to consider buying it to protect my wealth.

You could say he gave me an investment tip (not advice), buy gold!

And that’s exactly what I did.

But I didn’t just buy gold. I wanted to see how to leverage off gold’s rise over time. That’s why I ventured into gold mining companies. At the time, I thought a rising price of gold would mean gold stocks would deliver even bigger gains.

I shifted my stock portfolio to predominantly gold stocks in July 2013, hoping to make a windfall on my decision.

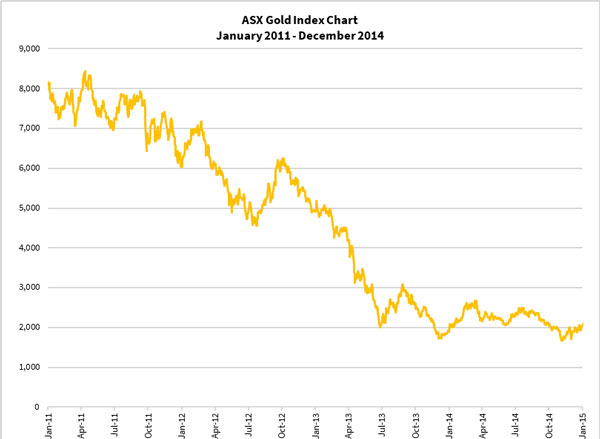

I was partly right about gold stocks multiplying gold’s moves, but dreadfully wrong at least for 18 months, as you can see below:

| |

| Source: Refinitiv Eikon |

This is how the ASX Gold Index [ASX:XGD] performed.

And if you thought that was bad…

My portfolio was down 63% from August 2013 to the end of the year and another 30% down during 2014.

Yes, this was a classic example of how monumental a failure can be just taking advice from someone else.

But that’s not the end of the story…

I wasn’t simply taking my friend’s word and acting on it, I read widely. I delved into hundreds of videos and articles to understand more about the financial system, the precious metals and commodities markets and how to evaluate gold mining companies.

My losses mounted because rather than cutting my positions when things didn’t go my way, I doubled down. It was a deliberate decision.

While balancing my full-time job as a lecturer, I developed a deeper understanding of the dynamics of trading gold and gold stocks.

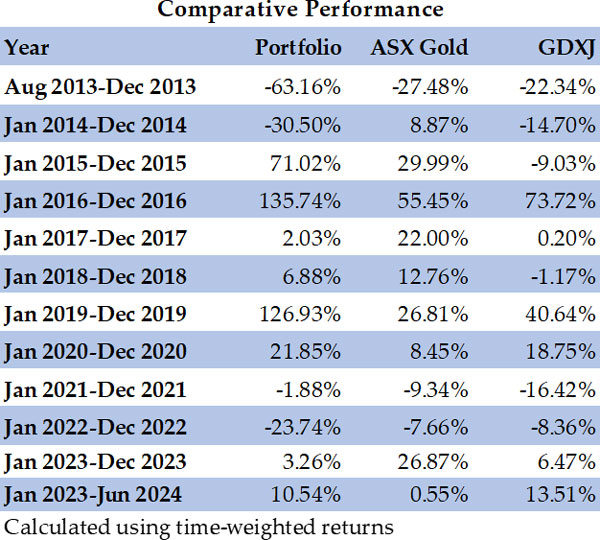

This gradually helped me develop my valuation framework and strategy, which netted me significant gains in 2015–16 and 2019–20.

| |

| Source: Australian Gold Fund |

As you can see, investing in gold stocks is a wild journey. In some years, I delivered exceptional returns while giving back some of my gains in others. Many would consider this journey as nerve-wracking. It’s not their cup of tea.

But with each gold price cycle, I developed new insights as I studied the decisions made and how the environment contributed to my outcomes. This helped build my intuition for future gold price cycles.

My goal is to learn how gold and gold stocks work. I inform my strategy with my insights and let that feed my successes.

For me, success is a by-product, not the objective.

Managing your emotions — The difference between success and failure

I don’t believe it’d surprise you if I told you that gold and gold stocks can still take me on an emotional rollercoaster nowadays.

Despite doing this for more than a decade and enjoying some success, daily price movements can still affect my mood. What’s different is that I’m better at managing my emotions, not letting them drive my trading decisions.

Your winning trades will undoubtedly lift your spirits and your net worth. However, I suggest putting everything in perspective. It’s important to review whether your success came from your analysis, timing, luck, or all of them combined. Work out your strengths and play to them. And never let your success make you feel invincible.

In both the 2015–16 and 2019–20 bull markets, I withdrew some profits, bought some gold bullion, and deposited some in my savings account. In hindsight, I should’ve moved a bit more out of those stocks, given what happened after, especially 2021–23. With the benefit of hindsight, experience and refined market indicators, I hope to do better for myself and my paid newsletter readers.

One piece of wisdom I picked up from Bill Powers, the founder of the YouTube channel, Mining Stock Education, is that he’d sell some of his gold stocks and move them into property when he starts feeling smart about his gold stock trading. In other words, his euphoria is an indicator for where the market may stand and he lets that guide him in securing his gains.

It’s one thing to feel excited and discouraged by the rise and fall in the value of your portfolio. It’s another to let them scuttle your strategy. And the more you’re invested, the greater the potential impact on your emotions for obvious reasons.

That’s why it’s important not to invest beyond what you can lose. There are no guarantees in this space. Even big companies can shrink over time and become a small-cap company, like what we’ve seen with St Barbara Mines [ASX:SBM] in the last three years (read my recent article here).

Sometimes, despite your best research, you’ll invest in a company that not only fails to deliver but it ends up going broke. I’ve personally experienced these failures including Millennium Minerals, White Rock Minerals, Aurcana Gold Corporation, Wiluna Mining [ASX:WMC], Navarre Minerals [ASX:NML] and Calidus Resources [ASX:CAI].

You’ll notice some of these failures are quite recent. While such failures are painfully emotionally and financially, I wasn’t exposed to them so heavily that they’d cripple me. This is something worth keeping in mind.

Finally, remember not to let your failures haunt you so much you abandon investing in gold stocks, or investing altogether. You can learn from these mistakes and refine your analysis and trading strategies where possible.

Gold will have its cycle while driving the magnified moves for gold stocks. You must understand this is how they work. If you can benefit from learning about the dynamics, ride them to your benefit.

Ensure you check your emotions not to let them cloud or even usurp your better judgement.

Boarding call for the next gold-stock rally

I’m going to wrap up my series here. There’s plenty for you to digest in these six articles.

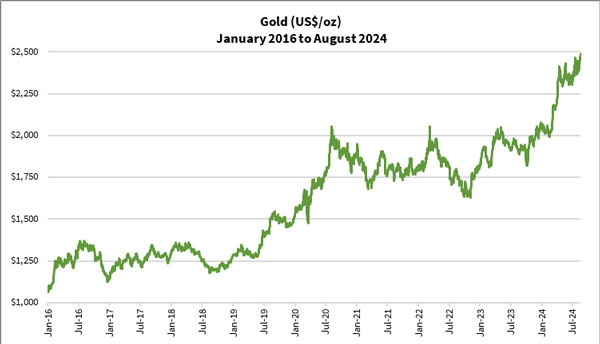

As you may be aware, gold broke above the pivotal level of US$2,500 an ounce last Friday in US trade. What it’s done these last eight years has been nothing short of breathtaking if you look below:

| |

| Source: Refinitiv Eikon |

Eight years ago, gold was around US$1,100. Four years later, gold traded above US$2,000 for the first time. Even though it took this long to achieve this milestone, gold’s rise has been relentless since the US Federal Reserve and other central banks ended its rate rise cycle in early-2023.

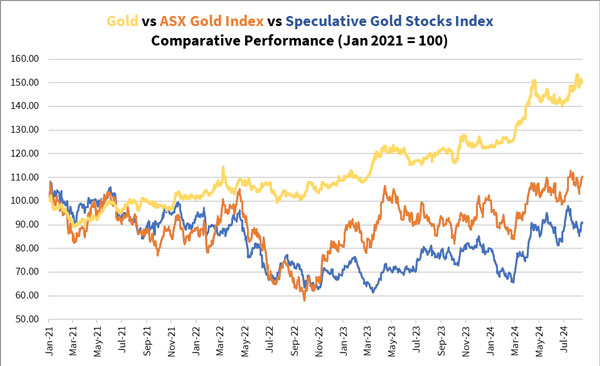

Unlike the past few gold bull markets where gold stocks responded quickly and rose with gold’s rally, they’ve fallen behind. Some smaller explorers and developers have made new lows even as recently as the last few weeks.

| |

| Source: Internal Research |

We might see the biggest catch-up in this space as gold’s recent milestone causes the market to finally pay attention.

And that’d be an opportunity to buy some gold stocks and put your newfound insights to the test.

Will you take this opportunity or not?

Two special offers — WOW!

If you want more convincing and you’re in Sydney, head over to The Australian Gold Conference next Tuesday at the Crown Towers Barangaroo and rub shoulders with some precious metals fund managers, company insiders and fellow gold stock investors. The event goes for two days.

There’s a special offer for you from the organiser, Kerry Stevenson. You can get $50 off the ticket by clicking on this link below:

https://events.humanitix.com/the-australian-gold-conference-2024?discountcode=FATTAILGOLD

And if you’re interested in signing up to my precious metals newsletter to help you set up a diversified portfolio containing bullion, precious metals ETFs and a range of gold stocks, click here for my latest briefing on the gold market.

Have a good week and see you at The Australian Gold Conference if you’re attending! Looking forward to it!

God bless,

|

Brian Chu,

Editor, Gold Stock Pro and The Australian Gold Report

Comments