In today’s Money Weekend…no one else wants them…bond sell-off accelerating…Tesla’s tyres deflating…and more…

As I write this article the ASX 200 is in freefall, down 170 points, and I wouldn’t be surprised for the selling to continue for the rest of the day.

The bond market is seeing strong selling pressure in the US and that has spread to our bond market.

You can’t say that you haven’t been warned because I said a couple of weeks ago:

‘If yields keep rising at the current pace there will come a time when stocks will be forced to sit up and take notice.

‘That moment hasn’t come yet and the rally in everything continues. But it pays to keep one eye on the bond market while contemplating how your portfolio looks going forward if commodities and yields keep moving higher.’

Last week I gave you a detailed look at my bearish technical view of the gold price and gave you targets to US$1,610 if US$1,764 can’t hold. The gold price is currently US$1,767 and real rates are exploding higher as the bond rout continues.

I think the moons have aligned for a disorderly descent in the price of gold towards my target.

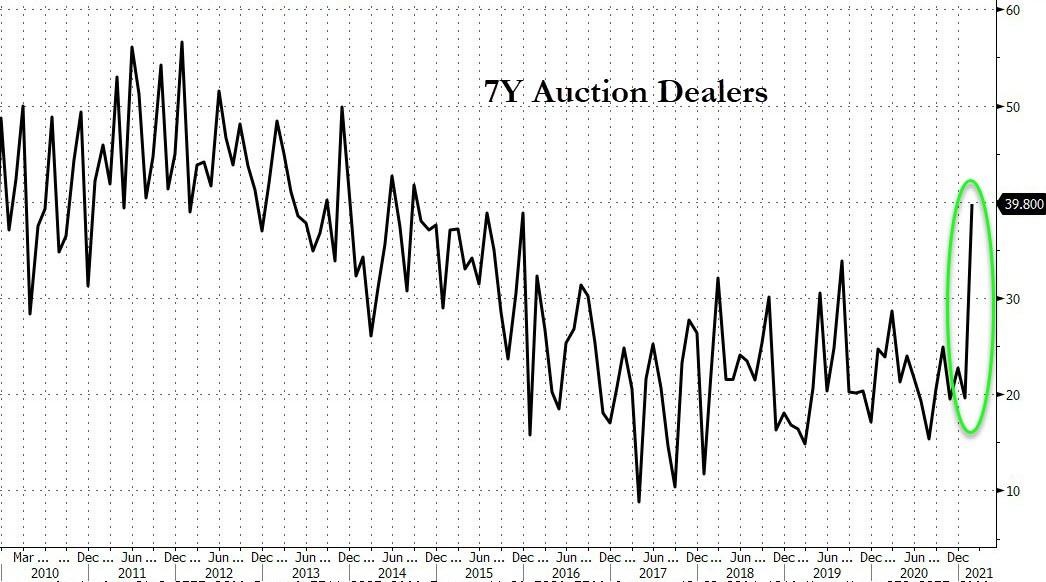

A terrible seven-year bond auction on Thursday saw dealers stuck with nearly 40% of the issue due to the lack of demand from indirect bidders (foreign and international monetary authorities, such a central banks, often place bids for Treasury securities indirectly through another entity).

Stay up to date with the latest investment trends and opportunities. Click here to learn more.

That was the highest percentage that dealers had to take since 2014:

No one else wants them

|

|

|

Source: Zerohedge.com |

The seven-year pricing printed at a yield of 1.195%, which was over 4bps wider than expected.

The awful result for the auction saw a flash crash in the belly of the curve with the 10-year bond yield jumping to 1.6% before buyers stepped in.

That’s a 13% increase in US 10-year yields in one day!

The chart below is showing a daily chart of US 10-year bond yields. The price of bonds moves inversely to the yield, so if the yield is going up the price of the bond is going down.

Bond sell-off accelerating

|

|

|

Source: Tradingview.com |

You can see in the chart above that US yields started trending higher after the US election.

The slow rise in yields wasn’t upsetting equities because many saw the rise as a bullish sign that growth was back on track and therefore company profits would follow.

That may be part of the story, but what if the market is also reacting to the Democrats being in power and promising to pump prime the economy with as many printed dollars as necessary?

As long as the US Fed keeps giving the government the green light that rates will be kept near zero indefinitely, there is nothing to stop Biden from opening the spigots.

The only thing that will keep him honest is if the market thinks the inflation genie is about to be let out of the bottle.

Who would want to own a US bond for 10 years yielding 0.5%, as they were last year, if you think inflation is on the horizon? No thanks.

Commodities are taking off like a rocket and there is plenty of talk about this being the next commodity supercycle.

The US Fed has already signalled that they will allow inflation to run hot for a while to make up for the long period where inflation has tracked below their target.

The immense monetary and fiscal support enacted in response to the pandemic could end up causing economies to overheat. The V-shaped recovery is taking shape and the COVID vaccination rollout is gathering steam.

But the blank cheque written by central banks will apparently be there for the next three years!

Something has to give, and at the moment it is the long end of the yield curve which is BIG news.

Even the RBA’s experiment with Quantitative Easing is coming under pressure. They have decreed that the three-year bond yield should stay at 0.1%.

They have plenty of firepower to force that outcome but the yield on the three-year bond blew out to 0.15% yesterday. Cracks are appearing.

Long duration assets such as the big tech stocks in the US are finally seeing some serious selling pressure after an utterly astounding rally since the crash.

Tesla’s tyres deflating

|

|

|

Source: Tradingview.com |

Tesla Inc [NASDAQ:TSLA] rallied 1,100% since the crash last year. There may be plenty of hype about their bright future, but there may also be lots of hot air related to expectations that rates will stay near zero as far as the eye can see.

The stock has already fallen 25% from the all-time high and the selling is gathering steam as bond prices fall.

There are many other tech stocks in the US that have had similar nose-bleeding rallies so a further jump in bond yields from here could see a larger correction than many expect.

We have been through events like this many times in the past and the end result is always the same.

The US Fed will watch things unfold and if the selling pressure in the long end of the yield curve becomes too extreme they will pull a bazooka out of their pocket and announce yield curve control.

When that happens things will turn on a dime and it will be time to buy as much gold as you can get your hands on.

Navigating the future will be tricky because there will be unintended consequences from keeping rates at zero bound indefinitely. Problems such as the steepening yield curve will crop up and the US Fed will play whack-a-mole trying to keep things from blowing up.

That’s why Greg Canavan is running a special event next Thursday called Life at Zero.

Just click on this link to sign up for this completely free event. Greg has been a mentor to me over the years. Our philosophy on the markets and trading is incredibly similar and I would highly recommend that you listen to his thoughts on how to build wealth during this unprecedented period of financial repression.

Regards,

|

Murray Dawes,

For Money Weekend