Spare a thought for the Victorians that are starting to look like Tom Hanks from Cast Away.

But the rest of Australia is getting on with life, and the recent federal budget gave the ASX a little jolt over the last two weeks.

With a number of measures which should make things a bit easier for smaller companies in certain industries, I expect the shift to growth will continue for the foreseeable future.

I previously flagged the performance of the relative outperformance of the S&P/ASX Emerging Companies Index [XEC] compared to its bigger peers in the ASX 200 [XJO] and the Small Ordinaries [XSO].

This is the kind of market where you need a practiced hand — an out-and-out stock picker.

Last Friday, my colleague Ryan Clarkson-Ledward wrote about a recent piece in the Australian Financial Review profiling Thomas Rice.

Rice is a stock picker for a number of ultra cashed-up Australians, include Atlassian founder Mike Cannon-Brookes.

A 52.6% return net of fees through to September.

These are rookie numbers.

Good, but still not incredible.

Four Innovative Aussie Stocks That Could Shoot Up after Lockdown

Index ETFs could disappoint, while some themes look attractive

For years, ETFs with low fees dominated many Australian investors’ portfolios.

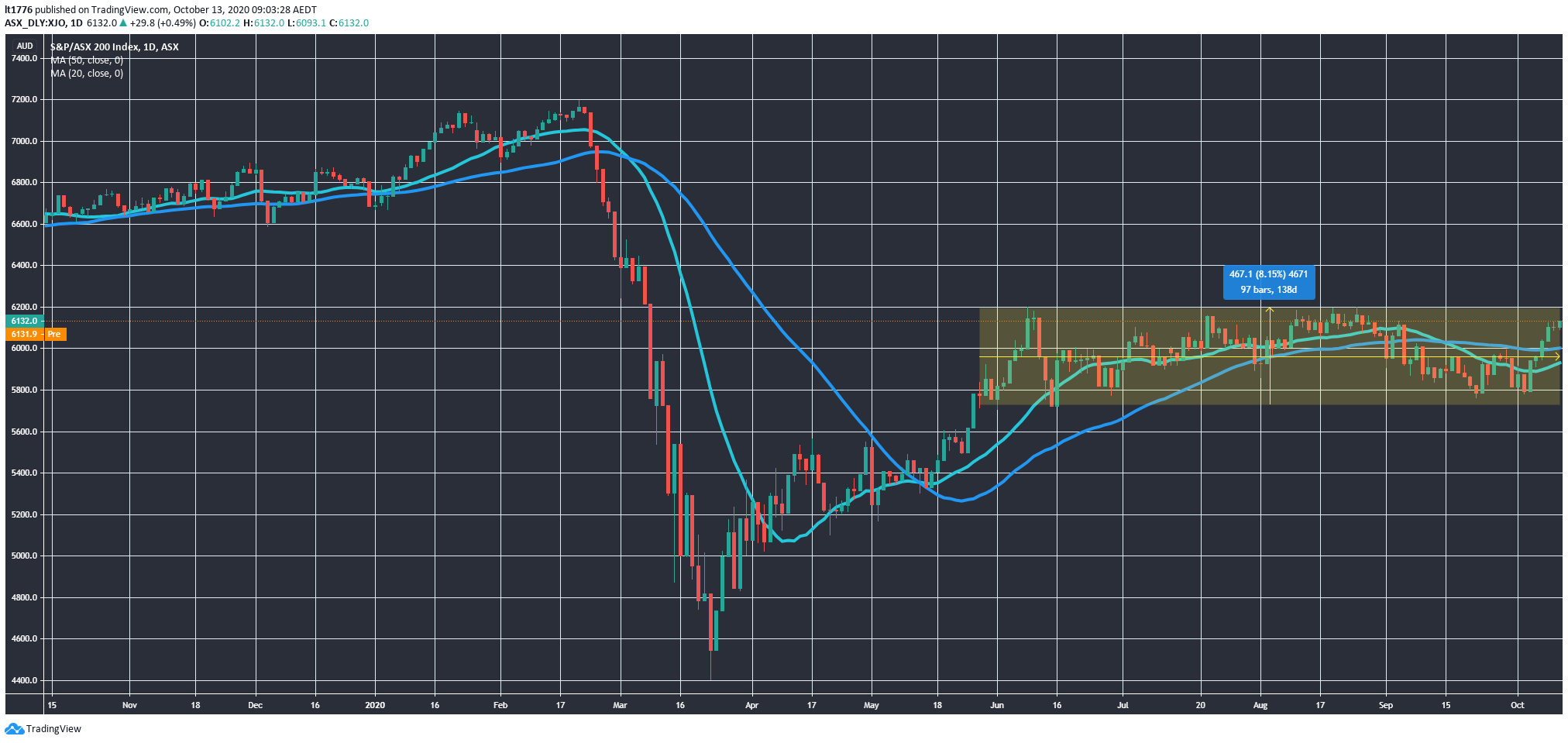

But the ASX 200 [XJO] is now into its 17th week of a sideways movement!

|

|

| Source: Tradingview.com |

Despite the jolt the budget gave the index, it’s still in a tight range of less than 9%.

The moving averages show an index that is flatlining.

Zero momentum is to be found here.

I’m not denying you can’t find some compelling themes in ETFs.

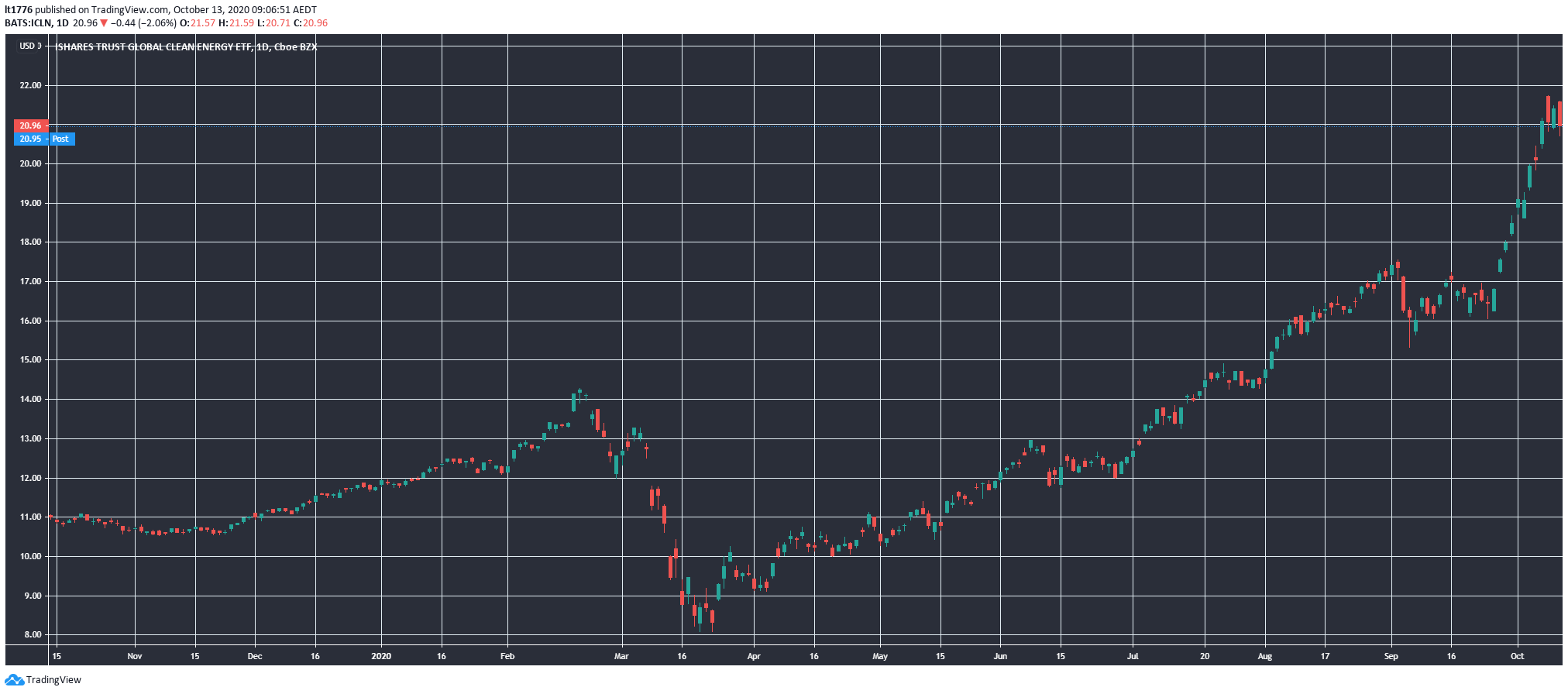

Such as the iShares Global Clean Energy ETF [NASDAQ:ICLN]:

|

|

| Source: Tradingview.com |

Or the BetaShares Global Cybersecurity ETF [ASX:HACK]:

|

|

| Source: Tradingview.com |

But boring old index ETFs might not cut it anymore if this sideways trading persists.

And a lot of it comes down to this…

Small-cap stock picking is an exercise in filtering and heuristics

As one small-cap fund manager said recently in the Australian Financial Review:

‘There is definitely a lot of momentum in some of these small cap, micro cap stocks you do need to be quite careful about. On the other hand, there’s some absolutely fascinating, interesting companies that have been doing really well that deserve to do so.’

And:

‘Every management team is trying to sell their story and portray their business as a fantastic investment opportunity. Where we earn our money is to sift through all those great sales presentations and just go, ‘I don’t believe in that as much as I believe in this.’ It’s all relative to a certain extent.’

Relative, subjective, filtering, heuristics, ‘art form’ — call it what you like.

But given the immense amount of uncompiled data on small-caps out there, you eventually develop a way of sorting the good from the bad.

I’ll give you one example.

Ryan Dinse and I were looking at a stock in our Exponential Stock Investor service.

We were growing wary of it, not just for its financials but also its lack of transparency.

Then one day I was looking over their most recent investor presentation.

I found a glaring typo, and that was it from me.

We cut it the next day.

If management and staff could let this small error slip through, what were they doing with investors’ capital?

It’s not the typo theory of stock valuation, but it was indicative of how we thought the company was run.

You get a tingling ‘Spidey sense’ when you start to think things are going wrong.

To a degree, it’s a similar thing when you get the sense a company could go on a big run.

You don’t want to be blinded by enthusiasm, of course.

Immense opportunity in this space

Look at it like this:

Small-cap stock picking is like thinking about what other people will think about before they think about it.

It’s a tongue twister, but ultimately it’s about anticipating the run.

The classic ‘buy when others are fearful and sell when others are greedy’ mantra applies.

Large winners wipe out a number of small losses quickly if you know what you are doing.

Obviously, there is more risk in the volatile world of small-caps.

But if you have a strategy and an eye for quality, there’s immense opportunity.

Ryan Clarkson-Ledward’s Australian Small-Cap Investigator service recently closed a position on a ‘buy now, pay later’ stock.

He locked in a 767% gain.

That’s a pro number.

You can learn all about Ryan’s track record and methodology right here.

Ryan is a highly capable, hard-working stock picker with a proven track record.

If small-caps are what get you excited to invest, Australian Small-Cap Investigator is a must have resource.

Regards,

|

Lachlann Tierney,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.

Comments