Households will have to chop firewood or even burn rubbish to keep warm.

I’m not talking about Ukraine where there’s a conflict raging — it applies to places that aren’t at war such as the US, the UK, and much of Europe.

All this would be avoidable if not for our complacency, bad planning, and certain people acting in bad faith.

The Green Revolution and its threat to bring down Western civilisation

The world has been in a downward trajectory for several decades. But nothing compares to where it’s headed since late 2019.

Mounting national and household debt have crippled the global economy. Global manufacturing is concentrated in Asia, with China taking the lion’s share.

The Wuhan virus outbreak in early 2020 brought the biggest economic shutdown we’ve ever seen, saddling the world with more debt, not to mention soaring inflation.

It was this ‘catastrophe’ that inspired the Founder of the World Economic Forum, Klaus Schwab, to announce that it was the perfect opportunity to implement ‘The Great Reset’.

This was meant to be the Fourth Industrial Revolution to transform society into a top-down technocracy (a system where unelected experts rule over society, aided by artificial intelligence).

Most of us are familiar with how this is playing out — indefinite national emergency to allow governments to act as virtual dictators, an atmosphere of fear and control, and mandates to keep you in line.

All this has resulted in a crippled global supply chain.

Within ‘The Great Reset’ was another movement that’s now about to unleash further chaos in the world.

Remember Greta Thunberg?

This diminutive teenager from Sweden, whose father is an actor and mother an operetta, was the poster child of the movement that inspired schoolchildren worldwide to skip school and stage protests about climate change.

History will remember her for that well-choreographed act (she comes from a family of professional actors) at the UN Climate Change Action Summit in September 2019. She berated world leaders and dignitaries about not doing enough to rid the world of fossil fuels.

Up until that point, organisations worldwide, government and private, had spent hundreds of billions of dollars to develop clean energy technology. But Greta’s petulant speech pushed the green revolution to move at breakneck speeds.

Many countries closed fossil fuel power plants, heavily subsidised clean energy infrastructure, and announced a gradual phasing out of petrol-powered vehicles. The ESG (environmental, social, and corporate governance) framework turned against the fossil fuel industry, creating barriers to obtain mining permits and accessing funds.

In times of peace and stability, such an abrupt change would pose a danger to economic and social well-being.

When you throw in a crippled global supply chain and the Russia-Ukraine conflict, we have a humanitarian disaster.

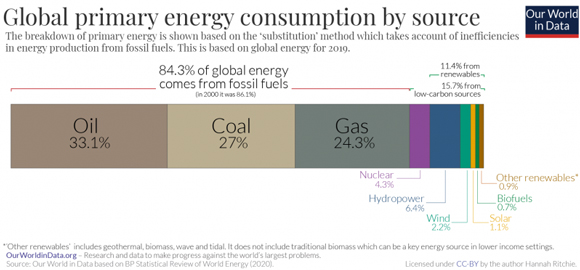

The harsh reality is that there simply isn’t enough baseload power generation from clean and renewable energy sources. In 2019, almost 85% of the world’s energy usage came from fossil fuels:

|

|

|

Source: Our World in Data |

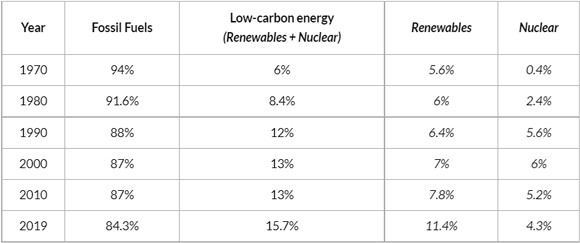

Looking back in time, the transition out of fossil fuels has been slow, as you can see in the figure below:

|

|

|

Source: Our World in Data |

Therefore, the plan to phase out fossil fuels at its current pace will result in devastating consequences.

In a conversation with my fellow editors yesterday morning, someone joked (darkly, I’ll add) about how the Green Revolution is China’s ‘Great Leap Forward’ gone global.

Bad science and NIMBYism

What I’m going to discuss here will upset some of you. But I believe it needs to be said.

You don’t have to agree with me, but please indulge me.

Climate change is borne out of poorly conceived science. It’s highly political with a lot of money at stake.

If you think the science behind controlling the pandemic was questionable, it pales in significance next to ‘climate science’.

Let me start with this — climate science is NOT settled science.

No science is ever settled.

This very statement reveals how disingenuous the climate change proponents are.

Not to mention there’s a vast record of them making big calls about global warming, rising sea levels, the disappearance of snow, and the increase in the frequency and ferocity of storms over the last four decades.

OK, you may say that my cited article was dated in 2018 and it’s different now.

Remember the east coast bushfires in late 2019 and reporters talking up drought and climate change? Meteorologists talked about how the drought would last longer and rain wouldn’t come in mid-May 2020.

It came three months earlier in a massive deluge. Previously burnt-out areas were flooded.

I’m sure ‘climate scientists’ can use this to back up their stance.

Yes, only if they can call it before the fact.

The other issue about the Green Revolution movement is that the leading proponents don’t practise what they preach.

Take the likes of US ‘Climate Czar’ John Kerry and Hollywood actor Leonardo DiCaprio, for starters. These two ambassadors lecture people about how fossil fuels emits carbon dioxide and other greenhouse gases.

But how do they travel to the conferences and summits?

Private jet.

Do you know that John Kerry has flown more than 48 times since January 2021? I wonder how many trees he has to plant to offset his carbon emissions!

And don’t forget how Former President Barack Obama, Former Vice President Al Gore, and all-round ‘expert of everything’ Bill Gates, own waterfront properties.

Rising sea-levels, anyone?

So, which should I believe — the ‘settled science’ or the proponents whose actions don’t measure up?

Action speaks louder than words.

There are many who are on board with ‘climate science’ without checking who’s behind it and what’s beneath the hood. They’re often well-educated individuals who live in comfortable surroundings and may even stand to gain in this transition. There’s usually NIMBYism (Not-in-My-BackYard) at play.

Their good intentions have sowed a massive storm.

How you can avoid the coming energy crunch

It’s clear that there’ll be at least a billion people who’ll face a freezing winter in the coming months. Their governments are unable to supply enough fuel and electricity due to their own doing and by circumstances beyond their control.

Even as the EU is backtracking on banning gas and keeping nuclear reactors open, it isn’t enough. The Nord Stream 2 gas pipe explosion and their dogged antipathy towards Russia will cost them dearly.

I expect fossil fuel prices to rise sharply in the coming months. And it could stay high for some time unless the Russia-Ukraine conflict eases and the West lifts their sanctions on Russian oil and gas.

Make no mistake, this global energy crisis isn’t going away soon.

You don’t want to be a victim of this crisis.

Early next week you’ll hear from my colleague, Greg Canavan, who has a strategy to help you capitalise on this. Stay tuned.

God bless,

|

Brian Chu,

Editor, The Daily Reckoning Australia