There’s much talk about how overbought the global markets are looking with each passing day.

The major market indices are setting new records, including our very own ASX All Ordinaries [ASX:XAO], which is also breaking into all-time new highs.

Those looking for value in this market are having a hard time uncovering opportunities.

But one place is offering exceptional potential.

A handful of companies have taken off. More are setting up recently, rising double-digit percentages in a day.

Some might be too late to chase now.

But if you’ve got the appetite for taking calculated risks for the potential of handsome benefits, now is your chance to jump on board to capture these opportunities.

Some of you are familiar with the assets I’m talking about.

Like me, you might’ve been invested in this for some time, watched many of them grind lower and wondered whether it’s time to pull the plug.

You guessed it. I’m talking about gold stocks.

And while I sound like a broken record, I think we’re in for a real treat.

How inflation and a rising US dollar spurred gold but smashed gold stocks

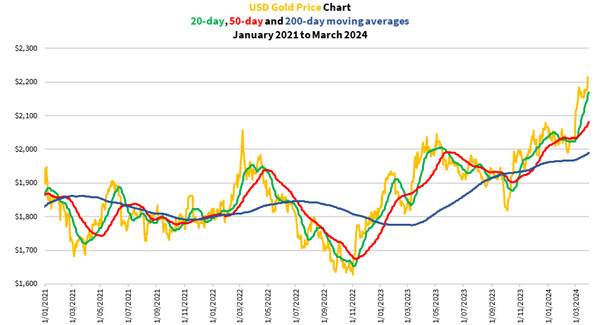

Gold’s now trading at record levels in almost every global currency. People are starting to pay attention as it sets new records, closing at just over US$2,250 an ounce overnight.

It’s increased almost 20% since the start of 2021.

|

|

|

Source: Refinitiv Eikon |

As you can see, gold traded between US$1,600–2,080 an ounce until last month when it started breaking out.

Things started heating up when the US Federal Reserve announced last month that it planned to cut rates three times this year.

Since then gold has taken off.

The figure above shows the price of gold in US dollar terms, but it doesn’t show how the dollar strengthened more than 15% against other currencies during this time.

Here’s how the US Dollar Index [DXY] performed during this period:

|

|

|

Source: Refinitiv Eikon |

The rise of the US Dollar Index from 2021 to late 2022 coincided with the aggressive rate rise cycle of the US Federal Reserve and other central banks seeking to combat inflation.

While central banks can claim to have controlled headline inflation, businesses and households have had to endure rising costs.

A valuation gap like you’ve never seen before

Mining companies have borne the brunt of rising costs that have eaten into their profit margins. Gold stocks weren’t an exception.

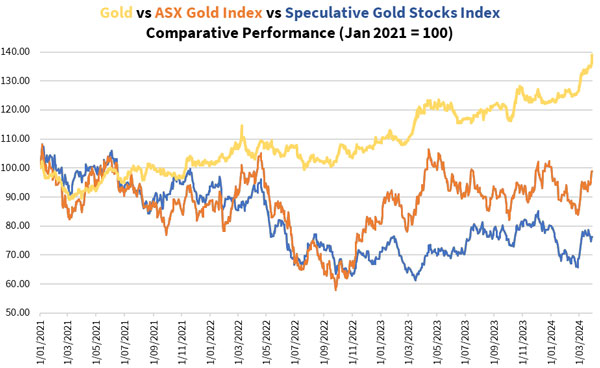

Let’s have a look at the growing gap between gold and gold mining stocks below:

|

|

|

Source: Internal Research |

As you can see, while gold producers have recovered much of their losses since late-2022, smaller explorers still trade well below their levels in 2021. This gap is especially unusual when gold has gained strongly.

I wrote about this recently, highlighting how the rising price of oil in 2021–22 and the border closures have contributed to runaway operating costs.

Notice how the gold stock indices (orange and blue lines) are starting to move higher and attempting to close the gap between gold and equity performance.

Gold stocks continue to hold above their October 2022 and March 2023 lows.

They’re now embarking on a strong upward move.

To me, gold stocks look ready to play catch-up with the underlying gold price.

Now these are the gold stock indices.

But if you dig into the individual companies, you’ll find some have delivered eye-watering moves recently.

Which is what I want to talk about next.

Breaking out – When some gold explorers jump, they soar

I’ve written about how the more established gold producers have largely recovered the losses sustained in the recent bear market.

These include; Northern Star Resources [ASX:NST], Perseus Mining [ASX:PRU], Emerald Resources [ASX:EMR], Westgold Resources [ASX:WGX] and Bellevue Gold [ASX:BGL].

But gold explorers haven’t followed YET. In fact, many are still trading close to their all-time lows.

A precious few have jumped out of the gates. Some have started to take off, delivering jaw-dropping returns.

Let me give you two names.

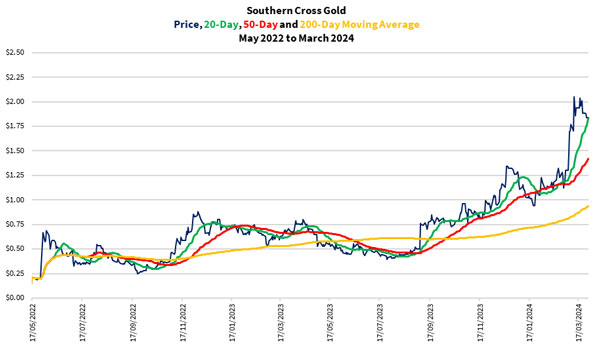

I’m sure some of you have heard of Southern Cross Gold [ASX:SXG].

An explorer based in Central Victoria; it happens to be one of my best picks!

My readers have enjoyed almost 300% returns since buying it last August. They’ve booked part profits recently and are now playing with the house’s money.

Let me show you the meteoric rise of this company since it listed in May 2022:

|

|

|

Source: Refinitiv Eikon |

The reason for its stunning performance is they’ve drilled several exceptional holes at Sunday Creek, located near Kilmore which is one hour’s drive north of Melbourne.

These holes indicate the potential for a sizable high-grade gold and antimony deposit.

While sentiment has all but dried up for gold explorers over this period, Southern Cross Gold was one of the rare companies that managed to keep the light flickering in this space.

Investors have enjoyed substantial rewards.

Though there could be more to come as the company prepares to release its maiden resource estimate in the coming months.

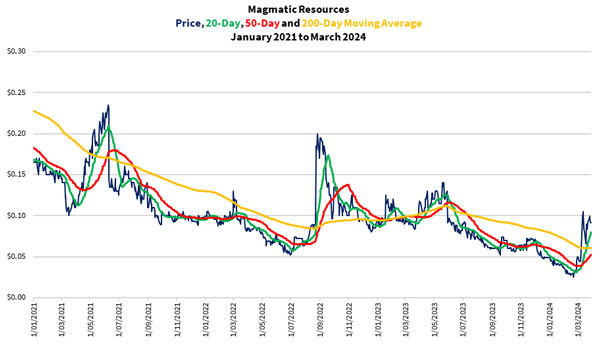

Another company is Magmatic Resources [ASX:MAG].

This company’s share price jumped twice, once in 2021 and another in mid-2022. You can see it below:

|

|

|

Source: Refinitiv Eikon |

These jumps happened when it announced massive copper and gold veins stretching hundreds of metres at its Kingswood prospect in Central New South Wales.

However, unlike Southern Cross Gold, the good news wasn’t enough to stem the declining investor sentiment in this space. The share price made new lows in mid-2022 and then again earlier this year.

Its fortunes changed in late-February as investors bought into the news that Fortescue Mining [ASX:FMG] would invest into the Kingswood project as a joint venture partner.

The price has since jumped almost 250%! All this within a month.

Of course, not all my picks have performed as well as the two above. And there are no guarantees that these stocks will continue on an upwards trend. Gold explorers are some of the riskiest stocks on the market.

Our offer to you to join in this potential rush!

Now these two companies are among the first to blast off.

But many others are stirring from a prolonged lull, rising by double-digit percentage points over a few days. Some are able to hold these gains, a sign that suggests this space is heating up.

That’s why, in response to surging activity across the gold space, we’ve reopened our event, Gold Strike 2024.

Even if you have watched it, I suggest watching it again.

Everything I outlined in that presentation is now playing out.

This is an exciting time to consider investing in gold explorers.

Which company could soar next and repeat the performance of Southern Cross Gold or Magmatic Resources?

I’ve analysed this space and prepared a shortlist of companies I believe have strong potential.

That’s why I invite you to check out the event and consider signing up.

The offer closes at midnight tonight so I hope you get onto it now!

God bless,

|

Brian Chu,

Editor, Gold Stock Pro and The Australian Gold Report