I’m back in the Southern Highlands after a rather eventful 10 days in Melbourne.

Let me tell you about my journey back home from Sydney last Friday.

Normally that’s nothing worth writing about.

Hop in my car, take the motorway out of Sydney, get on the Hume Highway, take the turn off at Mittagong and I’m in the Southern Highlands.

It’s a 90 minute journey.

Now last Friday was a bit different. I had a few errands to do inside the city as I wanted to make the most while I was there.

I experienced the usual gridlock and congestion driving between my destinations from the Eastern suburbs to the CBD then out to the west.

Just as well I moved out of Sydney two years ago. I don’t have to deal with this too often.

After ticking off my to do list in the late afternoon, I set off on my homebound drive. It was just after 4pm so I figured I’d be able to beat the evening rush.

No problem.

Except, as I was planning to get onto the M4 motorway westbound, I saw the traffic was crawling.

I decided to take the parallel road a few kilometres on, hoping to bypass the bottleneck.

As I listened to the radio, it turned out that the bottleneck was more serious. The entire westbound section was closed for several kilometres due to a freak accident between a truck and a car.

That was the beginning of the almost three-hour odyssey home.

For two hours, I was one of possibly tens of thousands of drivers and commuters frantically trying to find alternative routes to head west.

Arterial roads turned into a parking lot.

At some intersections, we waited for several rounds of traffic lights before we started moving. Let alone pass the intersection.

Add to that the hot and humid evening. You can imagine how flustered I was by the time I got home.

I’m sure many felt the same. I can only hope that it was the worst moment of their weekend and everything got better afterwards.

Three years of pain for gold stock investors

Gold investors can certainly relate to my journey home last Friday evening.

Just take a look at the producers. They took a pounding in 2022 but then started to stage a recovery from October 2022.

Stocks looked set to stage a breakout by the end of 2023. A major bull market setup was on the cards:

|

|

|

Source: Refinitiv Eikon |

Yet, expectations deflated in 2024, another selloff has brought the sector down.

It’s like being stuck in the arterial roads inside Sydney. You’re moving but not really getting anywhere fast.

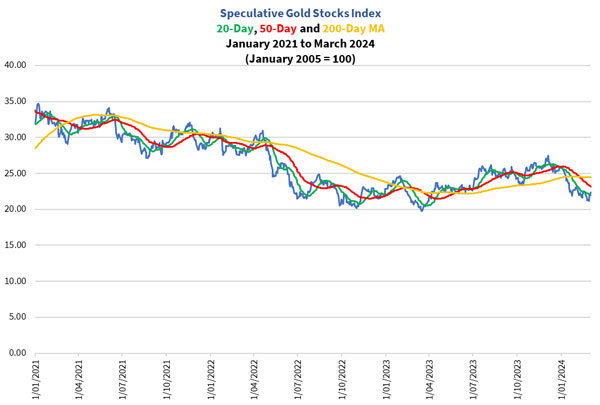

As for gold explorers and early-stage developers, it was even more frustrating.

Have a look at the figure below where I use my unique Speculative Gold Stocks Index to track their performance:

|

|

|

Source: Internal Research |

Now I’m not writing to lament or complain.

I’m personally very bullish about the future of gold stocks, especially gold explorers and early-stage developers. These are trading at values I haven’t seen for years.

Rising costs, falling profit margins and

plummeting sentiment

But what’s caused the extended gridlock in this space?

As you can see below, gold in US dollar terms (green line) has been stuck in a trading range for almost 12 months.

|

|

|

Source: Refinitiv Eikon |

Yet, gold is making new record highs in Australian dollar terms (yellow line).

But that doesn’t matter much. The market focuses on US dollar gold for its headlines.

The second point worth noting…gold producers haven’t delivered.

We can blame some of that on global lockdowns. A combination of border restrictions, worker absenteeism and equipment breakdowns stifled performance.

The price of gold went up. But so did costs.

Most of you remember how the price of oil traded at over US$120 a barrel in mid-2022, months after the Russia-Ukraine conflict broke out.

Add to that the aggressive rate rise cycle by central banks worldwide, and the mining industry was on its knees.

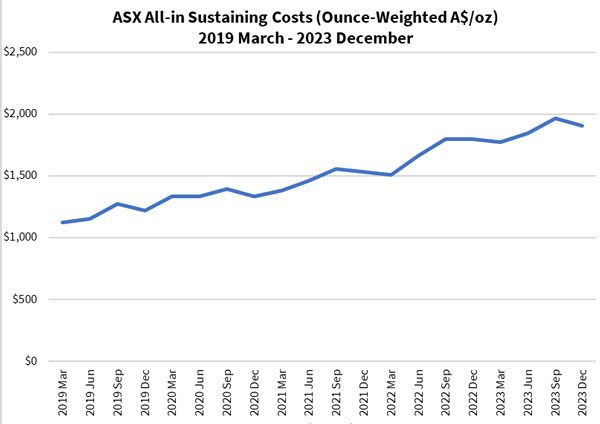

Let me show you how the average production cost for ASX-listed gold stocks increased since 2019:

|

|

|

Source: Internal Research |

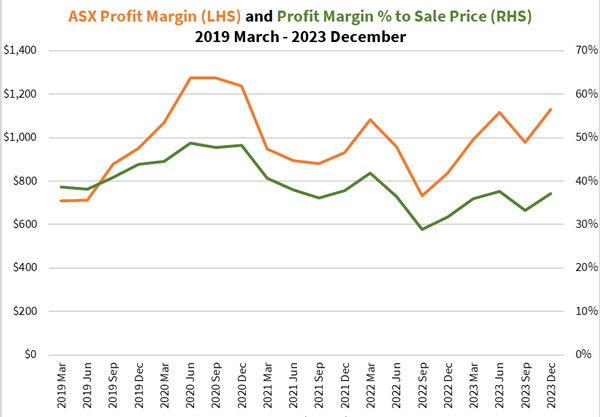

And here’s the average profit margins of these gold producers too:

|

|

|

Source: Internal Research |

In 2020, when fear gripped the world, gold producers experienced a sweet spot. Gold soared and oil plummeted.

This reversed in 2021–23 as the global economies reopened but on limited capacity.

Western nations also united in sanctioning Russia on its oil and gas exports. That certainly didn’t ease the pain.

As you can see above, miners profit margins were squeezed significantly.

Mind you, I am showing you the average.

Larger producers make this falling margin look modest. Mid-tier producers and especially the smaller producers were bitten harder during this period.

All this combined to create a perfect storm for gold stocks.

Yes, we have had a three-year gridlock.

Fortunes await those who move ahead

Even now, the market sentiment is in the pits.

That was why I’ve been upbeat since last October. I was seeing exceptional value.

With a rally into the final quarter of 2023, it looked like a bull market was in the making.

You know the story. The selloff into 2024 dampened the mood.

So much that some of you who checked out my ‘Gold Strike 2024’ decided to sit on your hands for now.

I can understand why. There’s still time for things to turn around so you didn’t feel the need to rush.

Those who pressed the button and jumped on board, I tip my hat to you.

You understand that the odds are stacked well in your favour.

I hope that you’ll enjoy the rewards. You’ve moved ahead and all fortune be with you.

All we need is gold to break above and hold US$2,100 an ounce and we could see a chain reaction of events to trigger a gold stock bull run.

In fact, gold just broke above that overnight. Let’s see if it holds.

And it’s just as well we’ve prepared a presentation for you called ‘Gold Fever’, so you can learn about how I use the techniques used by mining investment legends to build my wealth with gold stocks.

This time round, I’m sharing these with you so you too can potentially get the chance to ride the bull market in gold stocks when it comes. Click here and enjoy!

It might be happening right now so act quickly!

God bless,

|

Brian Chu,

Editor, Gold Stock Pro and The Australian Gold Report