Vancouver-based gold, silver, zinc, and tin producer SSR Mining [ASX:SSR] — and owner of the largest silver mine in Argentina — has been inching up in the share market today after releasing news of its Puna project in the Jujuy Province of northern Argentina.

SSR revealed that 27 of 48 holes reported targeted extension of the Chinchillas mineralisation to the east, northeast and at depth while also intersecting mineralisation at the Melina zone and Socavon Del Diablo.

The miner’s stock was moving up just over 2% by the early afternoon on Tuesday, with its share price trading for around $22.03 at the time.

SSR has gone up 9% in the past month. However, in the year, its down 24% and is below the industry average by more than 19%:

Source: tradingview.com

SSR Mining Explains Latest Puna Mineralization

Reporting from Denver early on Tuesday, the miner announced results from 48 drill holes completed at the Puna project from August to December 2022.

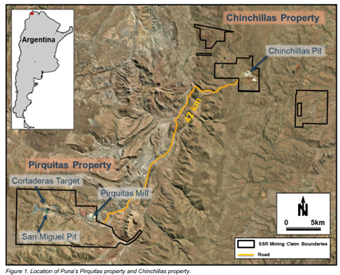

The project includes both the Pirquitas and Chinchillas properties, both located in the Jujuy Province of northern Argentina, with the open pit silver-lead-zinc mine at Chinchillas and nearby Pirquitas processing plant, which is used to process Chinchillas’ ore.

This exploration programme focuses on resource expansions, new discoveries, and reconciliation drilling at Chinchillas– resulting in the first exploration drilling in the area since 2016.

SSR reported that of the 48 holes investigated, 27 held targeted mineralisation to the east, northeast and at depth.

Project drilling was also found to intersect the Melina zone and at Socavon Del Diablo, two separate targets adjacent to the existing Chinchillas infrastructure.

SSR says these intersections show potential to add to the ore which is already mined from the main Chinchillas deposit.

The group also said two more drill holes have been completed at the Cortaderas target on the Pirquitas property.

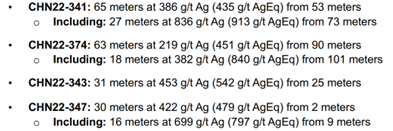

The miner provided the following highlights for its recent 2022 exploration drilling programme:

Source: SSR

The president and CEO of SSR Mining, Rodney Antal, commented:

‘Puna has been a tremendous contributor to the SSR Mining portfolio over the last two years, generating solid production and strong free cash flow. This update features the first exploration drilling activity completed at Chinchillas since before the mine commenced production and demonstrates mineralization from near-mine and in-pit step-out intercepts that bode well for potential extensions to Puna’s current Mineral Reserve life.

‘In addition, high-grade intercepts at the Melina and Socavon Del Diablo targets indicate the potential for additional open pit mining opportunities immediately adjacent to the main Chinchillas pit, while positive results from the Cortaderas target at the Pirquitas property could present a longer-term development pathway for further mine life extension at Puna. We have expanded the Puna exploration budget to 15,000 meters in 2023 as we aim to accelerate Mineral Resource conversion and expansion efforts.’

Source: SSR

Australia says to ‘drill baby drill’

Many in the resources industry are making raging bull market-like gains regardless of recession fears, interest rates and wider market actions.

This can be described as an alternate universe, the universe of booming drillers.

And guess what? More booms are marked to happen for many other metals.

It’s the ‘new golden age’ for junior explorers who get in early.

Aussie mining is at its best right now, but who, where?

There are small caps primed to grow into mid-to-large caps, but how do you tell which ones?

It’s a big universe, and you may need a little help – that’s where our commodities expert James Cooper comes in.

He’s found six ASX mining stocks heading to top the charts for 2023.

Regards,

Mahlia Stewart,

For The Daily Reckoning