Shares in miner South32 [ASX:S32] have taken a hit today, plummeting 12.5% as issues at its Worsley alumina refinery cloud the company’s future.

As of this writing, South32 shares are trading near a four-month low at $2.99 per share. That puts its 12-month return at -22%, well behind the sector average.

The sharp decline comes as South32 warned shareholders about the future of its Worsley alumina refinery in WA, citing the state government’s stricter environmental stance.

Before today’s dramatic fall, the company’s stock had traded positively over the past quarter, gaining 35% since the end of March.

With today’s selloff, is the company too risky for investors to look at now, or is this a cheap pickup for investors interested in critical metals?

Source: TradingView

Worsley Refinery Concerns

South32 refinery worries stem from conditions imposed by Western Australia’s Environment Protection Authority (EPA) in early June.

South32 claims these conditions create ‘increased uncertainty’ for bauxite mine expansions, which are crucial for the refinery’s operations.

This concern has led the company to record a $581 million impairment on the project.

South32’s CEO, Graham Kerr, stated:

‘Several conditions recommended by the WA EPA create significant operating challenges for Worsley alumina and impact its long-term viability. Several of the recommended conditions go beyond reasonable measures for managing environmental risks.’

The WA government’s tougher stance came as increased pressure has been placed on WA Premier Mark McGowan since a WAtoday expose last year.

The article, which you can read here, showed that Perth’s drinking water was at risk of contamination due to refinery and mining in the region.

The company plans to appeal against these conditions, which include requirements for land rehabilitation and annual emissions limits.

Q4 Financial Highlights and FY24 Performance

Despite the Worsley setback, South32’s June Quarterly update saw some positive developments.

The company achieved 98% of its FY24 copper equivalent production guidance and remains on track to deliver forecasted FY24 Operating unit costs.

Strong sales were recorded in the June 2024 quarter, capitalising on higher commodity prices and releasing working capital.

Aluminium production remained largely stable year-on-year, with Hillside Aluminium achieving record production.

Cannington payable zinc equivalent production increased by 10% in FY24 despite tough weather impacts.

However, shareholders concerned about other production woes and lower guidance for FY25 largely ignored these positive notes.

South32’s Manganese production missed targets due to lower grades and impacts from Cyclone Megan, while lower copper grades impacted its Sierra Gorda site.

Looking ahead, South32 revised its FY25 production guidance lower for several operations:

- Alumina production guidance was reduced by 5% due to these environmental concerns

- Sierra Gorda payable copper equivalent production guidance lowered by 7%

- Cannington payable zinc equivalent production guidance decreased by 9%

In total, the company will impair approximately $955 million post-tax for FY24 as it also suffered from plunging zinc prices.

Is this a temporary setback for South32, or does it signal deeper issues for the diversified miner?

Outlook for South32

South32’s challenges at Worsley highlight the increasing importance of environmental considerations in the mining industry.

As the government tighten regulations, other miners may face similar hurdles in the region.

Investors should monitor how South32 navigates these regulatory challenges, as it could set a precedent for the broader mining sector in WA.

Despite these challenges, South32 holds a fairly diversified portfolio, which could provide some resilience in the future.

However, today’s sharp reaction suggests investors are wary of the potential long-term impacts of these costs.

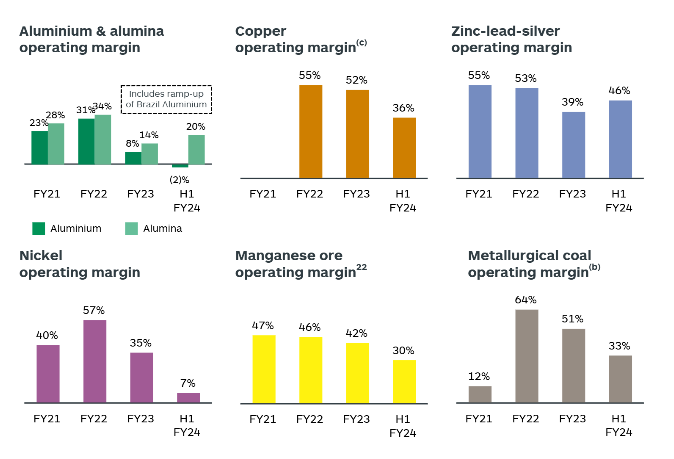

We’ve seen the company’s margins compress over the past few years, which could be a concern for those looking into the future.

Source: South32 Half Year Presentation – Feb 24

Also hurting the share price is a much weaker aluminium and copper futures market, with both falling around 5% last week.

The tumble came as China’s latest big policy meeting failed to offer any new major stimulus to the struggling economy.

Longer-term opportunities in both of these critical metals could make South32 a stock worth putting on your watchlist for a good entry.

But for now, beware of catching the falling knife.

Finding Opportunities in the Resources Sector

While South32’s struggles may cause concern, it also shows the dynamic nature of the resources sector.

While copper and aluminium are down for now, Gold, on the other hand, is flying.

At Fat Tail, our resident gold bug, Brian Chu, has been looking at the longer-term potential of gold and one particular market you need to watch — China.

While markets remain volatile, Wall Street has turned to gold, sending its spot price up 18% in six months.

But before Western markets warmed to gold, China had put the shiny metal at the centre of its grand strategy.

Click here to learn more about China’s Doomsday Vault and a trade that could define your portfolio in the future.

Regards,

Charlie Ormond

For Fat Tail Daily

Comments