Investment house Washington H Soul Pattinson and Co [ASX:SOL] held a shareholder briefing in Brisbane today, reporting pre-tax year-to-date net asset value of $10.6 billion and said that its net assets had outperformed the All-Ords Accumulation Index with an increase of 1.4%.

For the first half of the year, the company hit $475.7 million in regular group profit after tax, a 38.4% increase on the same time the year before. Statutory net profit was $453.0 million.

The SOL share price had dropped 1.5% by the early Tuesday afternoon, trading for $32.16 a share.

Longer-term metrics remains strong, with a 16% gain in the year so far, 25% up in its sector over the last 12 months, and 27% on the broader market:

www.TradingView.com

Soul Pattinson shares group performance update

Earlier this morning, investor behemoth Washington H Soul Pattinson reported highlights for the company’s operations and financial metrics both year-to-date and in comparison with the first half of fiscal 2023 with the first half of fiscal 2022.

Soul Pattinson said that its pre-tax year-to-date net asset value had reached a grand total of $10.6 billion, while its net assets had outperformed the All-Ords Accumulation Index by increasing as much as 1.4%.

The investing group, which boasts a long history of unmissed dividend payments since 1903, reported that its ordinary dividends have now increased from 11 cents in FY01 to 72 cents in FY22, at a CAGR (compound annual growth rate) of 8.5%.

For the first half of the year, the company hit $475.7 million in regular group profit after tax (NPAT) — a 38.4% increase on the same time the year before.

As for statutory net profit, there was a $1.1 billion difference on the prior period, as the group calculated $453.0 million compared with the $673.6 million loss taken a year ago.

The group explained that its regular group NPAT did not include particular one-off events, but is a good reflection of the group’s underling performance from its major investments.

As for the major growth in Statutory NPAT over the first half of the year, this was said to have been boosted off a non-recurring impairment, as a result of the group’s Milton merger which had majorly impacted the prior period.

For the whole of the group’s portfolio position as at the end of April, performance was supported by continues sales across large-caps, emerging companies, and properties.

Soul Pattinson also focused on private equity investments, and new investments with attracted risk-adjusted return and solid cash generation.

SOL has a year-to-date retun rate of 15.7% based off its current strategetic investments portfolio, which holds a value of $5.2 billion.

It’s large-caps portolfio is tracking a 7.1% year-to-date return at $2.8 billion, and private equity value is at $839.6 million, with $113 million in property.

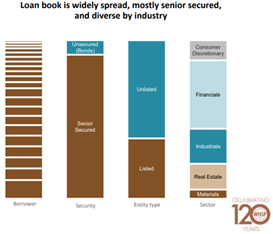

The group’s structured yeild is weighted at an average IRR of 15.5% per year and a weighted average cash yeild of 12.1% annually.

Source: SOL

Jim Rickards’ Sold Out book offer — grab your copy now

Prices in general are skyrocketing while packaging is shrinking, and some items appear to be missing altogether.

Is it all just inflation, COVID ramifications, and market volatility, or is there more to the story?

Thing is, these are just some of the seemingly unrelated signs pointing to something bigger.

Mere ‘inconveniences’ are just the start.

Geopolitical expert Jim Rickards has been making very apt, on-point predictions for decades.

And now he’s predicting ensuing financial chaos — yes, more so than there is right now.

He explains it all, offering a unique perspective that should not be ignored, in his book, SOLD OUT: How Broken Supply Chains, Surging Inflation, and Political Instability Will Sink the Global Economy.

You can grab a free copy when you sign up for The Daily Reckoning Australia, also free, right here.

Regards,

Mahlia Stewart

For The Daily Reckoning