Charlie Heard sat waiting for a fare at the Lorne taxi rank when an elderly woman approached him.

Would you be interested in a long fare? She asked.

Thinking she meant Melbourne, Charlie promptly said yes.

I want to go to Darwin…and back, she said.

Charlie hesitated.

This was the 1930s, the time of the Great Depression. He needed the money.

But, on the other hand, a trip like that would take months and be very dangerous. Who would take care of his wife and young children while he was gone? he thought.

Three weeks later Charlie, Miss Ada Beal, her friend, and their nurse packed up Charlie’s 1928 Hudson convertible and set off to Darwin.

They drove from Geelong through South Australia passing Oodnadatta and then onto Alice Springs.

Three Innovative Fintech Stocks to Watch Now. Discover more.

Imagine their journey. Things were quite different from today.

There were no mobile phones, no sat nav, or Waze. Instead Charlie used a compass to guide their way.

The landscape probably looked quite different back then as they braved the elements. There weren’t that many roads back then. Charlie had to use a tennis net to get through sand dunes.

There weren’t many people around either. No hotels, side of the road restaurants, mechanics, or convenient gas stations. Instead, they braved the elements, hunted to eat, and camped at night.

To refuel, they relied on the camel train, a camel network that got fuel and supplies to isolated parts of the country. Charlie had to telegram ahead and then pick up fuel at a set spot, usually behind a rock or a tree.

Charlie and his passengers safely returned home after 12 weeks of travel and 11,000 km.

I remember reading about this story a couple of years back, while I was driving down the Great Ocean Road.

I imagine Charlie remembered that adventure for the rest of his life, not only because the fare he received was enough to set him up with a garage, but also because it must have been quite an adventure.

While not as adventurous as Charlie’s journey, there’s much I remember from my first drive down the Great Ocean Road. The history, the 12 Apostles, the scenery.

But there’s something else that stuck in my mind too.

While in certain stretches of the trip there weren’t many coffee shops, gas stations, and even cell reception, there were quite a few solar panels around.

As I said, that was a few years back. It’s likely they are even more common now.

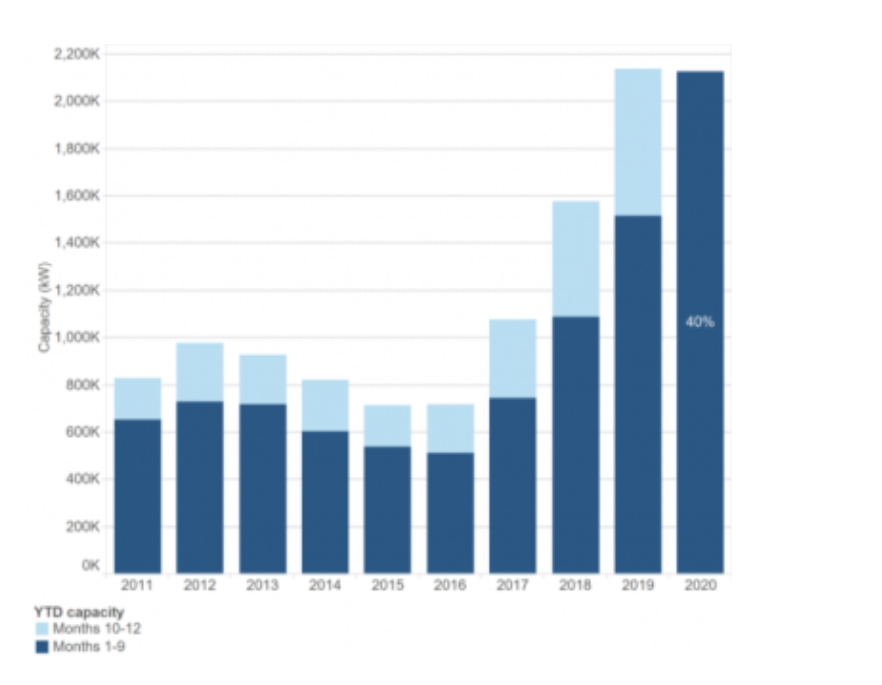

Solar panel installation is growing here in Australia. According to SunWiz, this year set a record with more PV solar kWh capacity installed in these last nine months than in all of 2019.

|

|

| Source: SunWiz |

SunWiz expects this trend to keep growing with more people working from home as a result of the pandemic and higher energy bills.

And it may very well be, especially if solar costs keep getting cheaper.

I mean, in the last decade solar costs have dropped by 82%.

Solar is the ‘new king of electricity’, said recently the International Energy Agency (IEA) in their 2020 World Energy Outlook.

Why?

Well, the main reason is because of all the cheap debt around.

As they said (emphasis added):

‘Renewables grow rapidly in all our scenarios, with solar at the centre of this new constellation of electricity generation technologies. Supportive policies and maturing technologies are enabling very cheap access to capital in leading markets. With sharp cost reductions over the past decade, solar PV is consistently cheaper than new coal- or gasfired power plants in most countries, and solar projects now offer some of the lowest cost electricity ever seen. In the STEPS, renewables meet 80% of the growth in global electricity demand to 2030. Hydropower remains the largest renewable source of electricity, but solar is the main driver of growth as it sets new records for deployment each year after 2022, followed by onshore and offshore wind.’

The energy market is shifting. While oil companies are plagued by asset write-downs, renewables are going strong as their economic case gets stronger…even through the pandemic.

The way we power our homes, our transport, and our industry is changing. Things will most likely look much different in the next 10 or even five years.

Best,

Selva Freigedo,

For Money Morning

PS: We believe these rapid fire market opportunities are a fantastic way to grow your wealth. Which is why you’ll find us talking about the big trends that can uncover them. If that is something up your investment alley, then click here to learn more.

Comments