Given I’m travelling today, and all the hype surrounding silver and platinum, I thought I’d share a piece I wrote to my paid readers at Diggers & Drillers earlier this week…

Silver and platinum… What are they to investors?

Like gold, they’re both considered precious metals.

But, unlike gold, they have heavy application across industry as raw materials.

That’s why investors often consider them ‘hybrid precious metals.’

They’re for the fine-art jeweller but also the heavy industrial manufacturer.

And if you’ve been following the media hype over the last couple of weeks, you’ll know both metals are stealing the limelight from gold.

Some even suggest that this latest move could mark a major ‘top’ for gold.

And that it’s ultimately bad news for gold investors. That’s because some cynics say silver only rises at the ‘very end’ of the precious metals bull market.

But as I told my paid readership group earlier in the week, I don’t buy it!

Silver’s latest move is simply the commodity cycle in action.

To detail what I mean, let’s step back in time and take a long-term perspective…

| |

| Source: Trading View |

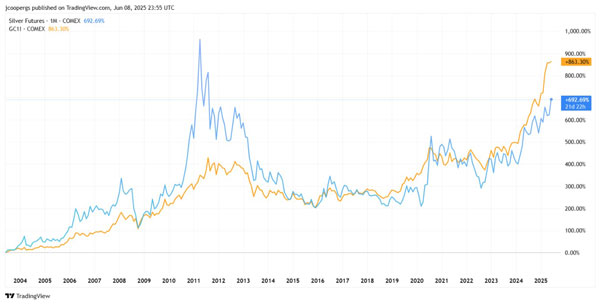

This chart shows TWO commodity cycles.

The first is to the left, which began in the early 2000s and culminated in 2011. Note, the massive ‘blow-off’ top in silver (light blue line) in 2011.

That past example is why some align a ‘silver surge’ with an ultimate peak in the gold market.

But some key points to consider…

Using 2003 as our starting point, silver outperformed gold for most of the early 2000s commodity cycle—almost ten years!

Today, silver is simply closing the gap on gold’s recent outperformance.

And that’s why I don’t believe we’re headed for a 2011-like blow-off top, as some fear.

But don’t let these commodity-specific moves fool you…

The critical aspect here is the commodity cycle.

That’s what everyone misses when certain commodities start popping higher, excitement builds, and a bunch of favourable demand and supply opinions begin to emerge.

Yet, all those fundamental drivers have been there, waiting to emerge.

It’s the turning of the cycle that puts these things in action, driving commodity prices higher.

This underlying force pushes everything higher, including energy, food, industrial metals, and precious metals.

But hang on, isn’t gold a ‘bearish’ hedge on global growth?

Surely it would be impossible for ‘growth commodities,’ like oil and gas or copper, to rise alongside gold?

After all, gold depends on financial oblivion, the opposite of global growth!

But that’s conventional thinking. Reality is much different.

Whether it’s gold, grains, germanium or galena… all commodities tend to rise and fall alongside the commodity cycle.

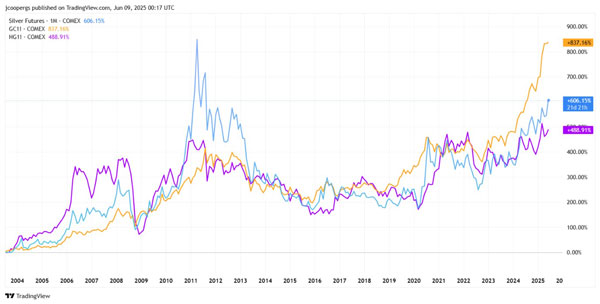

If you have any doubt, look how closely gold, silver, and the world’s primary ‘growth’ commodity, copper (purple), have traded over the last twenty years:

| |

| Source: Trading View |

Each has vastly different ‘demand drivers.’

Gold is a store of wealth in times of uncertainty, whereas copper is used throughout construction and manufacturing.

One depends on hardship, the other benefits from prosperity!

Yet history shows they trade side-by-side, from peak to trough, from stagnation to inflation, from boom to bust.

This is what history shows.

All commodities (including gold) steadily rose over the early 2000s commodity boom.

Meanwhile, all metals peaked in 2011, including gold, silver, and copper. Marking the culmination of the last commodity cycle.

Then, five years later, all commodities bottomed in 2015 and 2016.

Gold was the first to rise from this deep bear market, breaking higher in 2019. But silver and copper followed closely.

Since then, most commodities have remained well above their 2016 cyclical lows but are still far from a rampant bull market.

Gold is the exception, having surged past its 2011 peak last year.

But that’s the role gold often plays… leading in the cycle.

And in my mind, that’s the most critical takeaway from silver’s price action.

New leaders are emerging in this cycle, but that doesn’t spell the end for gold.

All commodities wax and wane over these multi-year events while trending higher… That’s how I would view the gold market today.

Commodity bull markets are not an all-or-nothing event where one commodity surges at the expense of all others.

Instead, they expand together, just blooming at slightly different times.

As I’ve outlined, proof exists in the early 2000s commodity boom, and before that, the 1970s.

Each cycle brings with it higher prices across the full commodity spectrum.

And once you can look at this sector through the ‘lens of the cycle,’ you’ll understand the vastness of opportunities in this market.

Especially among those commodities that have yet to make their first major move!

If you’re interested in learning more about those specific company opportunities leveraged to higher commodity prices, you can join me here.

Until next time.

Regards,

|

James Cooper,

Editor, Mining: Phase One and Diggers and Drillers

Comments