Are you paying attention to gold right now? I hope so.

The move this year has been phenomenal.

Why?

Well, it’s worth remembering the reason for investing in gold in the first place.

Gold is one of the oldest and most successful forms of money because it worked so well as an independent store of value.

I mean, Venetian gold florins retained their purity (and purchasing power) for over 400 years back in the 13–17th century.

When we moved off the gold standard for good in the 1971 ‘Nixon shock’ money has never been the same.

As you have probably experienced these past few years, life is getting more expensive.

A dollar doesn’t go half as far as it did even two years ago.

That’s part of the reason for gold’s surge. Gold is a way to vote with your wallet and move some funds into a proper store of value money.

And as I’ll show you shortly, gold investors are reaping the rewards right now (with more to come!).

But my colleague Ryan Dinse has come up with a strategy to protect and grow your wealth that is unsurpassed in recent years.

He recently showed me a way I could have grown a $2,000 a month investment into $2.4 million in just 8 years!!!

It blew me away.

And I think you’ll be very interested in learning about it could have been done.

If so look out for a special presentation coming your way tomorrow where Ryan will explain it all.

But back to gold…

As I said, the gold price is shooting the lights out right now.

Here are the key price milestones achieved:

US$2,100 on 4th March

US$2,200 on 28th March

US$2,300 on 5th April

US$2,400 on 12th April

US$2,500 on 19th August

US$2,600 on 20th September

US$2,650 on 25th September.

In other words, booming up for six months straight!

Naturally, gold is stirring buying interest in gold mining companies.

Here’s an observation.

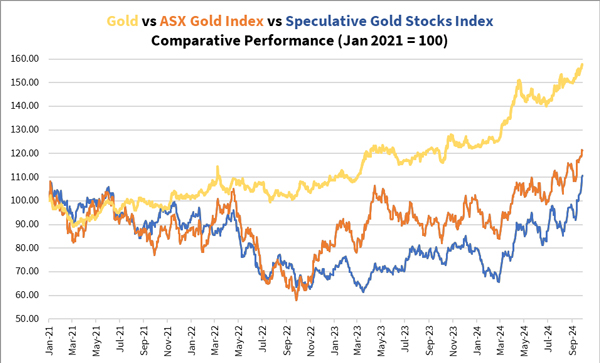

Those holding gold ETFs and bullion have enjoyed better profits, generally, than most gold stock investors in the past four years.

That’s because gold stocks are still trailing the physical metal since 2021 as this figure shows:

| |

| Source: GoldHub Australia |

That said, I expect gold shares to overtake gold as the momentum behind them grows.

You can look at finding opportunities to take advantage of this outlook. But how? Do you buy and hold or trade momentum?

Remember, not all gold stocks are equal.

So today, we’ll look at ways to hopefully increase your odds of selecting a winner.

Here’s what you need to know…

Long-term growth or cyclical plays?

Some gold producers are better at managing their business than others.

They do this by controlling costs, allocating capital sensibly and targeting quality deposits and exploration targets.

In other words, some gold shares are ‘buy and hold’ propositions, and others are only good as momentum plays when gold goes for a run.

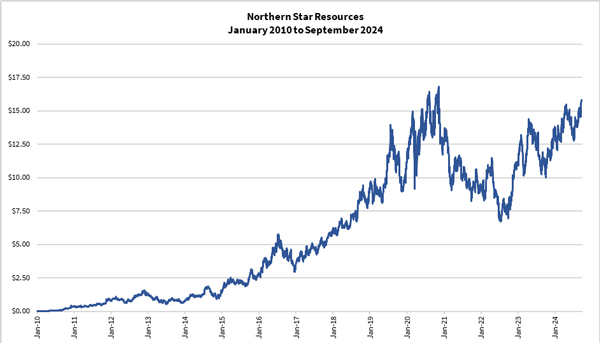

Northern Star Resources [ASX:NST] is a good example of the first category. It’s grown significantly since 2010 (three gold price cycles), as you can see below:

| |

| Source: Refinitiv Eikon |

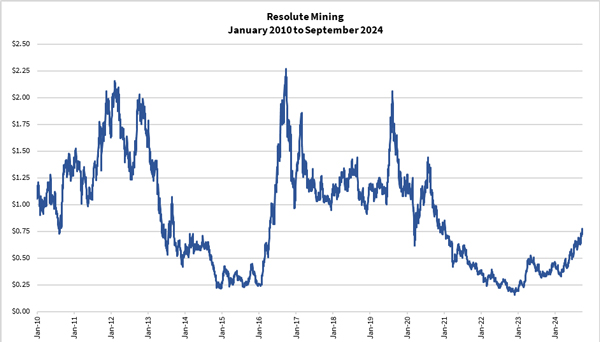

Meanwhile, a producer called Resolute Mining [ASX:RSG] historically tends to rise with a gold bull market before giving back most of those gains afterwards:

| |

| Source: Refinitiv Eikon |

As you can see, both companies offer opportunities to benefit, but in different ways.

For Northern Star Resources, you can enjoy exciting benefits accumulating shares over time. Meanwhile, you could have benefitted considerably by buying Resolute Mining shares during the bear phase of the gold price cycle (2012-14, 2017-18 and 2021-23) and selling them in the gold bull market (2016, 2019-20).

A buy-and-hold investor would’ve lost more than gain with Resolute Mining because it’s trading below what it was worth in 2010.

How fundamental metrics complete the puzzle

So what key factors differentiate companies like Northern Star Resources and Resolute Mining?

Management and asset quality matter… but that’s vague.

Various metrics can help us infer these. Even then it’s not as straightforward as you’d expect. But it’s worth a try.

Recently, I delved deeper with my colleagues and found interesting insights into selecting gold shares to give you the highest odds of success.

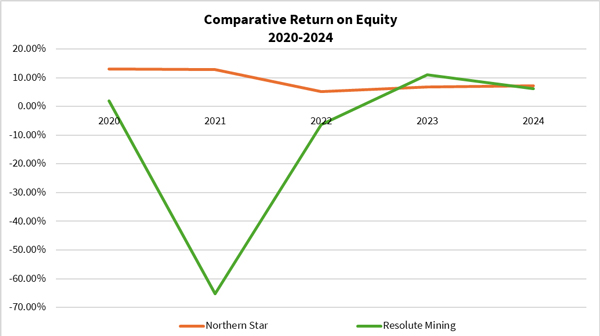

Firstly, companies generating a positive return on equity usually enjoy a longer-term increase in their share price. This is because their assets generate excess value to grow their business.

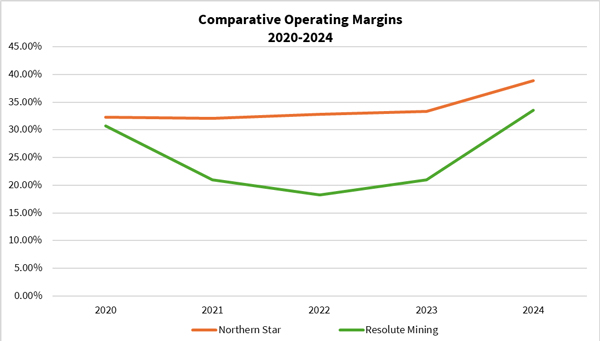

Secondly, companies wishing to grow their assets must generate more than 35% operating margins. The annual depletion of mine assets and replacing ageing plant and equipment can take up 20-25% of sales revenue.

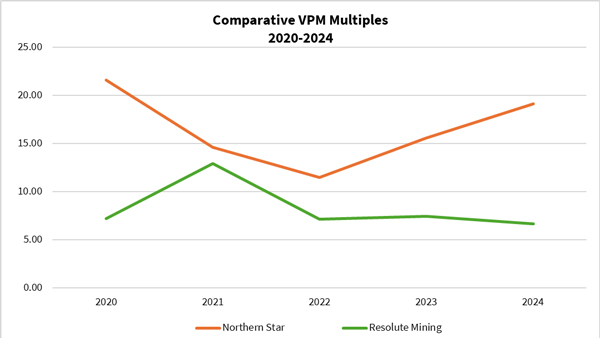

Thirdly, companies with larger operations attract a higher multiple to their earnings because their size often increases their efficiency.

Factors to avoid include companies expanding by selling new shares and diluting their capital, writing down non-performing assets or when they have a significant proportion of dormant assets.

This is the return on equity for NST and RSG in the last five years:

| |

| Source: GoldHub Australia |

This is their operating margins as a % of sales revenue:

| |

| Source: GoldHub Australia |

Finally, here’s their Value to Profit Margin multiple (similar to the Price to Earnings Ratio):

| |

| Source: GoldHub Australia |

These two companies illustrate my observations. You can see why investors have preferred Northern Star over Resolute Mining over the long term.

However, not all companies are as clear-cut.

And this is where experience matters. It helps me discern which companies are worth holding for longer and which to trade.

That’s why I continue to invest and refine my analysis to bring you potential outperforming opportunities.

Of course, it’s over to you to decide whether you want to give my service a shot to help build you a potentially winning gold and gold stocks portfolio.

Check out The Australian Gold Report here. . .

It’s important to protect your wealth.

In case you haven’t realised, gold mining industry insiders have kicked off a wave of buying as gold started taking off. We’ve seen several mergers happen since 2022. Last year, transactions between companies topped more than AU$30 billion, culminating in the biggest merger to date when Newmont Corporation [NYSE:NEM] bought Newcrest Mining.

There’s more coming as gold continues this phenomenal run. If you want to take part in it, let me work with you to find quality companies to consider adding to your portfolio.

Here’s a presentation I’ve recently prepared. Make sure you watch it until the end for the special offer!

God bless,

|

Brian Chu,

Editor, Gold Stock Pro and The Australian Gold Report

Comments