The Secos Group Ltd [ASX:SES] share price is up 6.5% after the investor presentation outlines its sustainable packaging growth plans.

SES shares were exchanging hands for 24 cents per share at time of writing.

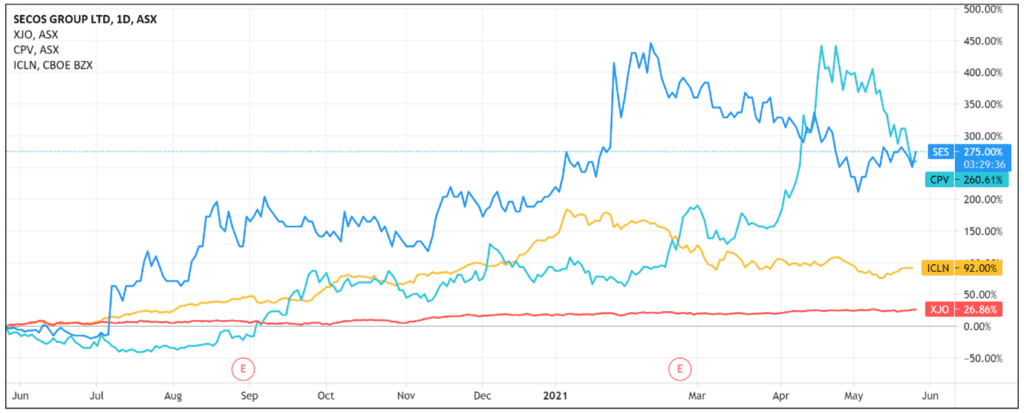

The global push for green initiatives has accelerated over the last few years. In step with this acceleration, Secos has posted strong gains over the last 12 months.

SES’s one-year return is more than 270%, outperforming the ASX 200 benchmark by 250%.

The plastic problem

According to the Department of Agriculture, Water and the Environment’s ‘Australian National Plastics Plan 2021’, our use of plastic is set to double across the world by 2040.

This poses a large environmental problem, as much of the plastic we use is single use.

For instance, one million tonnes of Australia’s annual plastic consumption is single-use plastic.

On top of that, only 13% of plastic is recycled, with 84% sent to landfill.

Such profligacy is not sustainable.

The Department of Agriculture, Water and the Environment cited research suggesting that by 2050, plastic in the oceans will outweigh fish.

By 2025, it is predicted that 99% of seabirds worldwide will have ingested plastic.

The problem is large.

So what is Secos’s role in the solution?

Secos and sustainable packaging

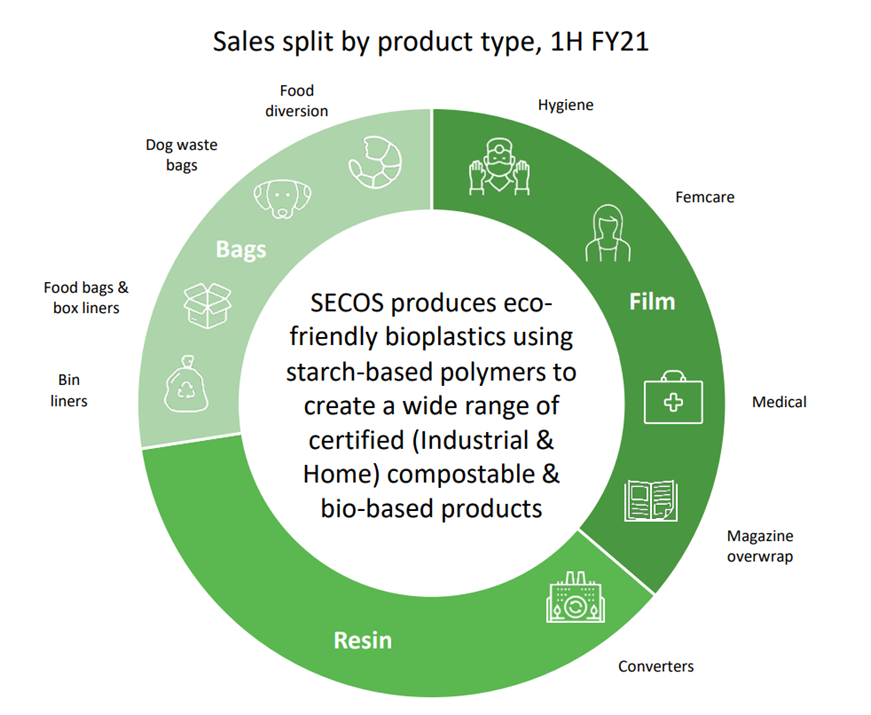

Secos develops and manufactures sustainable packaging materials.

SES produces ‘eco-friendly bioplastics’ to create compostable and bio-based products.

Source: Company presentation

Secos believes it is well positioned to help Australia achieve the target outcomes outlined in the National Plastics Plan 2021, including an industry target of 100% of packaging being either reusable, recyclable, or compostable.

SES believes that its compostable plastics materials will find plenty of demand as more enterprises sign on to Australia’s national packaging targets.

In today’s investor presentation, Secos also stated that its vertical integration offers a ‘unique competitive advantage due to the ongoing demand for new compostable products.’

What is the packaging company’s addressable market?

According to research cited by Secos, compostable production capacity is anticipated to grow at 31% per annum from 2020 to 2023, which is 10 times the conventional plastics growth.

Additionally, anticipated growth in the bioplastics and biopolymers market is projected to hit US$27.9 billion in 2025, up from US$10.5 billion recorded in 2020.

Based on this market opportunity, what is SES’s growth strategy?

The most concrete strategy outlined in today’s presentation was boosting production capacity.

With bigger capacity, Secos is aiming for $100 million in sales ‘over the next three to four years.’

To achieve this sales target, Secos will continue to invest in ‘state of the art R&D capability to extend commercialisation of new products and applications.’

In terms of outlook, Secos stated that full-year profit is ‘on track with strong growth expected to continue into FY22.’

While Secos stated it has a strong balance sheet with more than $12 million in cash and zero debt, investors will likely note the figures from its most recent quarterly cash flow statement.

For the quarter ended 31 March 2021, Secos posted a net cash loss from operating activities of $1.64 million, with cash and cash equivalents at quarter’s end of $12.51 million.

This cash burn rate could mean Secos may tap the market for a capital raise in the near future to fund its sales and production capacity targets.

If green investing interests you and you think green initiatives have potential as attractive investments, then I recommend reading our energy expert Selva Freigedo’s report on the renewables revolution.

In the report, she outlines three ways you can capitalise on the $95 trillion renewable energy boom.

Download your free report now.

Regards,

Lachlann Tierney,

For Money Morning