Too often investors swing from headline to headline, making reactionary decisions.

But if you want to dabble in the commodity market, you need a strong stomach for risk…and to think long term.

My friend — and editor over at Whiskey & Gunpowder in the US — Byron King pointed out the difference between investors and governments a couple of years ago.

Investors think months…government think years.

Though — as Byron once told me — the Chinese government thinks in centuries.

They are a centrally planned economy. Their government doesn’t plan for months or years…they make strategic moves based on the outcome multi-decades from now.

And importantly it’s all lead to the rise of ‘China Inc’.

Think in decades, not years

The US-led trade war followed by the coronavirus hasn’t interrupted the Chinese government’s long-term thinking. Simply put, the Middle Kingdom is more focused on the long-term needs of its people.

Take oil, for example.

China is almost entirely reliant on external sources for the stuff.

While they have made strategic partnerships with non-US allies, it’s less about annoying the US and more about ensuring they can run their cities.

China is working towards ending the need for outside sources to keep things umming inside.

Part of ending the reliance on oil, is switching entire cities to electric energy.

Shenzhen for example, has moved their 16,000-public fleet to all electric vehicles. In the months to come, all of Shenzhen’s 22,000 taxis will be electric too.

Oh, and these are all supported with 40,000 charging stations around the city.

And that’s just one city.

In 2018, there were 425,000 electric buses in the world. Almost 99% of them were in China.

To boot, China is in the process of building several ‘electric Detroits’. That is, building mini cities that are electric car making hubs. Mirroring what the US city Detroit was back at its peak.

China is actively moving away from worrying about where the energy source comes from to keep a billion people going.

And this is just the beginning…

How to Survive Australia’s Biggest Recession in 90 Years. Download your free report and learn more.

China Inc funds Africa

We talk a lot about how Australia has hitched their economic wagon to China.

Two-way trade totals $235 billion a year.

Yet here’s something you may not know.

China’s two-way trade with Africa sits at $310 billion.

These are all trends Bryon King has tried to alert investors to in the last couple of years. And if he’s right, China’s investment in Africa is only going to increase.

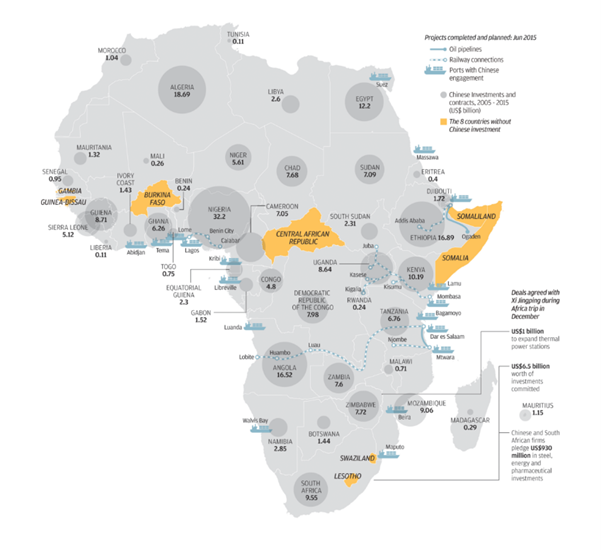

Take a look at this map of Africa:

The only places China hasn’t spent money

|

|

| Source: Visual Capitalist |

See all those orange sections?

They’re the only countries inside Africa China isn’t doing business with.

There is a total of 54 countries that make up Africa, and China hasn’t invested in just eight of them. That’s right, China have effectively spent money on 75% of the African continent.

More to the point, one site estimates that China has more than 10,000 companies operating in Africa alone.

See all those little blue ships around the coast of Africa? They are ports with ‘Chinese Engagement’.

The thing is — and this is what Byron is at pains to point out — China isn’t just going there and digging up rocks.

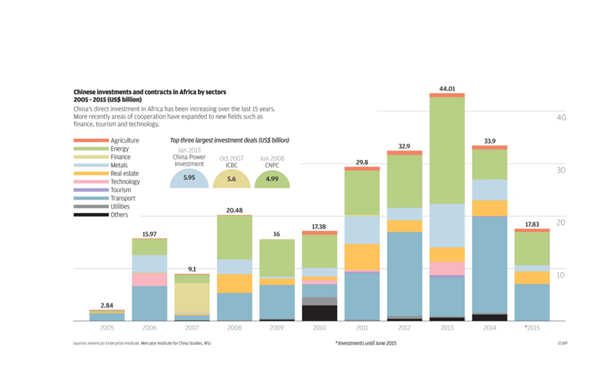

China’s USD investment in Africa

|

|

| Source: Visual Capitalist |

China is building roads, dams, train tracks, investing in agricultural and technology in the country as well as critical infrastructure.

The rise of this relationship between the two is the power of ‘China Inc’. That is, the Middle Kingdom will ensure that its future needs are met, no matter how.

Where does Australia fit?

Australia’s relationship with China is a tenuous one. And this isn’t just because of Australia being dragged in the US’ trade war with them.

The Chinese Communist Party have been making strategic moves into countries with resources and very similar commodities. In fact, as Callum Newman and I discussed earlier in the week on our You Tube channel, frankly, Aussies may not be China’s dominant iron ore supplier for much longer.

As Cal points out, ‘grade is king’ and the Middle Kingdom wants a higher grade of iron ore. Check out what he had to say over here.

Cheers,

|

Shae Russell,

Editor, The Daily Reckoning Australia

Comments