[ASX:RIO] flagged inflationary pressures, ‘significant COVID-19 absenteeism’, and a weaking economic outlook in its June quarter release.

RIO shares fell 3% on Friday, with the mining giant down 25% over the past 12 months.

Fellow miner BHP was also down, as key commodities like iron ore and copper continue to tumble.

RIO also flagged ‘considerable’ headwinds in the key China market, as China deals with constrained labour and a ‘slowing external environment’.

Source: Tradingview.com

Rio’s Q2 Production Results

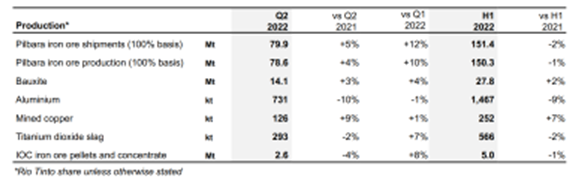

Rio Tinto provided an update on highlights for the second quarter for 2022.

RIO’s Gudai-Darri plant made its first ore delivery in June, and the company now expects Gudai-Darri to meet its 2023 full-capacity target.

Operations at the company’s Pilbara site produced 78.6 million tonnes this quarter, which is a 4% increase on 2021.

Rio reported shipments totalled 79.9 million tonnes, an increase of 5% on the same time last year. The company’s shipment guidance is on track to deliver 320–335 million tonnes.

However, aluminium production only saw 0.7 million tonnes in its latest quarter, a 10% decrease on Q2 2021. The company holds July strikes accountable for the reduced capacity, which effected the Kitimat smelter located in British Columbia.

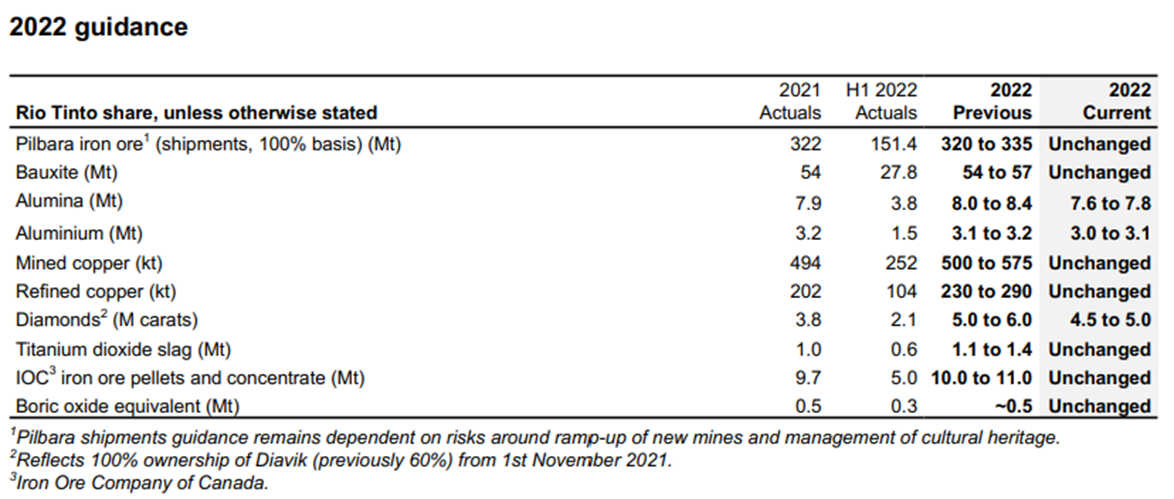

Rio has now lowered its guidance to 3.0–3.1 million tonnes from the previous 3.1–3.2 million.

Rio’s copper production totalled 126,000 tonnes, up 9% on Q2 2021, which RIO attributed to higher recoveries at Kennecott, Escondida, and Oyu Tolgoi.

Source: Rio Tinto

Rio Tinto CEO Jakob Stausholm commented on RIO’s quarter:

‘We strengthened our operational performance at a number of sites, which we will now replicate across the portfolio. The delivery of first ore at Gudai-Darri, our first greenfield mine in the Pilbara for over a decade, increases mine capacity and supports production of our flagship Pilbara Blend.

‘We also fired the first draw bell at the Oyu Tolgoi underground project in June, and started producing scandium and tellurium. These critical minerals are being extracted from existing waste streams at our titanium operation in Quebec and copper operation in Utah, without the need for new mining.’

RIO splashes the cash on exploration

RIO spent $367 million on exploration and evaluation in the first half of 2022, 13% higher than the first half of 2021.

Rio said the increased spending was due to ramp up activities in Guinea, Argentina, and Australia.

As for capital expenditures, RIO commented:

‘Capital expenditure for 2022 for our existing operations remains unchanged at around $8.0 billion. Capital expenditure for 2023 and 2024 is still expected to be between $9.0 and $10.0 billion annually, which includes the ambition to invest up to $3.0 billion in growth per year, depending on opportunities. The guidance includes cumulative investment of $1.5 billion to decarbonise our assets from 2022 to 2024.’

RIO’s outlook

Rio reported higher rates of inflation had impacted the company’s closure liabilities and, by extension, underlying earnings:

‘This resulted in increased charges of approximately $400 million pre-tax within underlying earnings compared with the first half of 2021, including a $300 million increase in amortisation of discount, with the remainder impacting underlying EBITDA.’

Looking outward, RIO offered its views on the global macroeconomic conditions.

Rio noted that the economic outlook has weakened due to multiple factors: the Russia-Ukraine war, tighter monetary policy, and China’s strict COVID-19 restrictions.

‘Prices for our commodities decreased in the quarter, amidst growing recession fears and a decline in consumer confidence. Trade disruptions, food protectionism and the global focus on securing energy supplies continue to put pressure on supply chains, which will need to be significantly eased before inflationary pressures subside.’

Source: Rio Tinto

Inflation buster stocks

As Rio’s quarterly update shows, few are immune to inflationary pressures.

Households and businesses are feeling the pinch.

But some businesses are better placed to deal with inflation than others.

In fact, some stocks have the potential to be ‘inflation busters’ in the current environment.

Recently, we have released a research report on five inflation buster stocks for 2022.

If you want to read it, you can access the report, for free, here.

Regards,

Kiryll Prakapenka,

For The Daily Reckoning Australia