Oh my God.

I have a wife and two daughters. We’re currently selling our house.

You would not believe how many trips to the tip, charity store and storage unit I’ve done to declutter the place.

I vaguely thought I had a streak of “minimalist”. Ha! Yeah right.

You name it…I’m dragging stuff from all four of us around town.

Golf clubs, squash racquets, teddy bears, bicycles, bookshelves, sewing machine, winter clothes, summer clothes, basketball gear, dancing gear, garden tools, old furniture, pictures…it never ends!

And whenever I get to the new place…I’ll drag most of it back from the self storage unit I’m renting.

Maybe I’ll just leave it all there…and see if anyone in the family notices.

I’m using Storage King as it happens.

Mainly because there’s one nearby…but also because I researched the stock a while back for Catherine Cashmore’s old service.

Self storage is part of the general Real Estate Investment Trust (REIT) sector.

I like keeping tabs on these guys for general clues to the general economy.

Did you know that some of them – Vicinity Centres ($VCX), Scentre Group ($SCG) and Stockland ($SGP) are hitting 52 week highs?

Yep. They are.

Can we deduce something from this?

Yes, I think we can.

If commercial property firms are rising, then the economy can’t be too bad. It means rents and leases are solid, or the market would be dragging them down.

We also know interest rates are falling, and this is a tailwind for REITs because they carry 25-35% debt usually, relative to their equity. Lower rates boost their earnings.

REITs went through the wringer in 2022.

I can tell you a bit about investor psychology from this, actually.

A wealthy friend of mine asked me about REITs back in 2020/1. I gave him some suggestions – including the three above.

Fairly quickly they were up 20%. Suddenly his esteem of myself went up.

It didn’t last long.

In 2022, I warned him the market was going to come under pressure. I advised him to sell, hedge or prepare for a downturn.

He poo pooed my suggestion. “I’m in for the long term,” he told me.

A year later he was pissing and moaning about his portfolio after the ASX bear market. “I don’t look anymore.”

It’s easy to say you’re in for the “long term” when the going is generally good. It’s harder when your portfolio is taking a hiding.

“And those REITs,” he said down the phone one day. “They’re shit.”

I didn’t agree. They were a victim of circumstances of the time…and that would pass eventually.

I advised him that the downturn was a superb opportunity to buy up the market, including the REITs, while it was down in the dumps.

As a very wealthy man, he had an investing super power: the ability to be patient, and not need immediate cash flow.

He didn’t listen. It all seemed too scary, at least for him.

I’ll give him credit for one thing though. He never sold his REITs. He was rich enough not be that bothered.

He banked the income from them while the market slowly recovered.

And now he’s reaping the capital gain rewards…because they’re higher now than when they first jumped up for him in 2021. Likely he can hold indefinitely.

Many industries on the ASX are “cyclical”. REITs are one of them. You can try and ride the cycle, in terms of timing.

You can power through it like my friend – if you have the guts and the cash to withstand the winter periods.

Or you can take a different path. That is to look for firms that are “structural” in their growth.

The idea is to find firms that can grow regardless of the wider economy.

REITs are dependent on a healthy economy. They need people spending, firms investing, credit expanding. That’s how they capture higher rents, and longer leases.

A firm, right now, like Nvidia, couldn’t care less about the general economy.

AI is a “structural” story that will keep growing even in a recession. There’s no stopping the train now.

The question you might like to think about: which type of investor do you want to be?

I know what type of investor my friend Murray Dawes is…a make money one! Murray uses a combination of technical and fundamentals anaylsis. He’s bringing his years of experience and outstanding track record to international stocks for the first time. You can see what he has to say here.

Best Wishes,

Callum Newman,

Australian Small-Cap Investigator and Small-Cap Systems

***

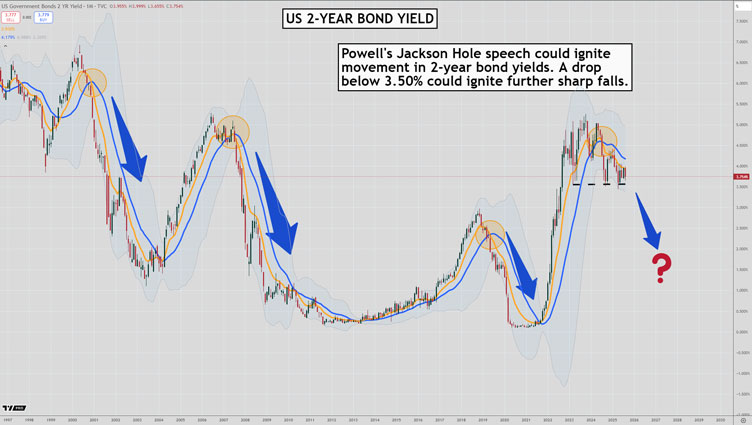

Murray’s Chart of the Day –

US 2-year bond yields

Source: Tradingview

[Click to open in a new window]

It feels like markets are in a holding pattern waiting for US Fed Chairman Powell’s Jackson Hole speech on Friday evening our time.

There is a massive tug-of-war going on between Trump and Powell.

The more Trump tells Powell to cut rates, the more Powell digs his heels in.

But there are signs that high rates are really starting to bite.

The recent employment numbers were terrible revisions that made it clear employment has been softening for a while.

James Hardies Industries [ASX:JHX] just released woeful numbers yesterday that saw the stock collapse.

They said the US real estate sector is weak and people are delaying doing work on their homes.

High mortgage rates have led to the highest inventory in single family homes since 2007. And we all know what happened after that…

So perhaps Powell is moving slowly and needs to get a wriggle on.

If he says as much in his Friday speech we could see 2-year yields dropping sharply.

Whether that also leads to a big fall in 10-year bond yields remains to be seen. As I said yesterday I think the yield curve is going to steepen further.

Especially if Trump installs a yes-man into the Fed to do his bidding.

Stocks could erupt higher if Powell says it’s time to drop rates, but he could also ignite a correction if he continues to remain stubborn.

So all eyes on Friday night. Grab your popcorn and hope for the best.

Whatever happens, one thing’s clear: the biggest market-moving events don’t always start on the ASX.

That’s why expanding your reach beyond Australia — and into global markets — could be one of the smartest moves you make as an investor this year.

Interested? You need to read about my Go North project now.

Regards,

Murray Dawes,

Retirement Trader and International Stock Trader

Comments