I have been writing in the Daily Reckoning Australia on and off since 2012. That’s getting up there in terms of time.

Much of that time I’ve spent writing about the Australian housing market.

Mostly I’ve been bullish all the way, despite the bears, naysayers, and doomers.

I’m no shrill for the industry. There are no commissions, paybacks, or quid pro quos for me from any of it. I just call it how I see it.

The story I’ll share with you now is that the march of property is almost certainly higher.

Why so?

The financial muscle of Australia’s self-managed super fund sector is getting better access to leverage into the market.

The Australian Financial Review reported the other week…

‘Non-bank lenders are diving headfirst into controversial lending arrangements that allow self-managed super funds to leverage investment properties, after an exit from the sector by mainstream lenders and amid a powerful upswing in house prices following the COVID-19 crisis.’

I sent this article to a friend of mine. He’s asset rich but has no ‘job’. He lives off his dividends and rents.

Astonishingly, the Big Four banks won’t give him a loan to buy his next property.

He can’t tick one box on a form. This is opening up a huge niche in the market for ‘non-banks’ — not regulated in the same way as CBA, ANZ, etc — to service customers like him.

Look at the context of today’s market. Term deposits return nothing. Bonds are useless too. That leaves property and shares to generate capital gains and yields.

Stay up to date with the latest investment trends and opportunities. Click here to learn more.

Self-managed super funds are highly likely to go for these types of loans in droves.

Neither the Royal Commission nor a global pandemic has stopped the property party from getting going again.

What will people fear now to keep their money out of the market? Assets — any assets — can only peak when everybody is ‘all in’ and there’s no one left to buy.

There are plenty of people still to buy in property.

In my view, the boomer generation is going to pour money into the Australian property market.

But you don’t have to believe me. Clearly the share market is signalling the same thing.

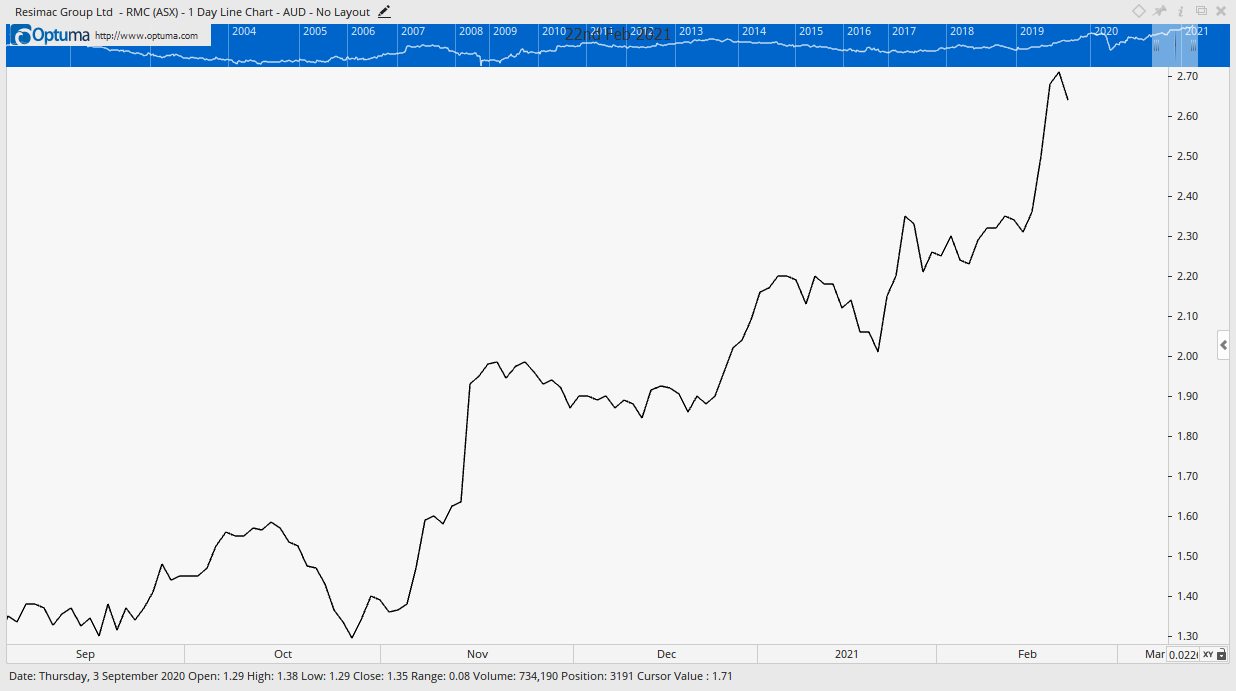

Look at the chart of non-bank Resimac Group Ltd [ASX:RMC].

|

|

|

Source: Optuma |

It is up 36% since late November last year. That’s when I recommended it to subscribers of Cycles, Trends & Forecasts.

My friend and colleague Greg Canavan expressed some doubt when he saw the issue. He wondered aloud: Hadn’t it risen too much already in recent trading?

Not to me. Back in November, it wasn’t even above its pre-COVID high. And yet its last results showed the business was performing better.

This is where knowledge of the real estate cycle can be so potentially profitable in the share market.

There was no doubt in my mind that real estate would keep heating up. That made a position in Resimac relatively low risk.

No trade or investment is a winner until it’s in your pocket. So, we’ll see what the market decides when Resimac release their next set of results.

I’m not saying it’s a buy now, either. The meat of the recent move has already happened now. And there are risks to this idea, regardless of the broader upswing in property.

They’re at a competitive disadvantage, like all non-banks, to the big banks because they can’t access the RBA’s cheap money spigot.

However, there should be enough meat from borrowers locked out of normal financing for them to run a profitable business for the foreseeable future.

The broader point is more important. There is a staggering number of ways to monetise the property market…on the ASX.

It’s a fantastic way to build a sturdy portfolio base that doesn’t need daily monitoring.

You put your capital in the market with an eye to the dividends but back the cycle to deliver capital gains over the medium to long term.

The latest issue of Cycles, Trends & Forecasts is due to go out before the end of the month. I’m very excited for my latest investment idea.

It’s one of the few big blue chips that hasn’t really recovered since the COVID crash.

But every indication suggests it’s now bottomed out and will build back up to its former highs — and beyond — over the next five years.

My suggestion? Call our customer service team on 1300 029 501 and buy a subscription to Cycles, Trends & Forecasts.

You not only get an idea from me every month on how to monetise the property boom on the share market…you get Australia’s premier real estate expert Catherine Cashmore as well.

How’s that gone lately? Catherine told us last year to buy in Perth. Recent data shows rents are up 10%.

Hello. Perth is going to boom.

I’ve put the real estate cycle at the centre of my investment paradigm since 2012. 11 years is a good stress test to see if something works.

There’s nothing I suggest more for your wealth than to put the results to the test yourself.

Best wishes,

|

Callum Newman,

Editor, The Daily Reckoning Australia

PS: Australian real estate expert, Catherine Cashmore, reveals why she thinks we could see the biggest property boom of our lifetimes — over the next five years. Click here to learn more.