In today’s Money Morning…some retail investors approach their holdings like a punting account…success or failure and the investment learning curve…whoever’s portfolio is doing the best wins the game…and more…

You have to be at least 18 to invest.

But yet again, retail investors are being likened to toddlers in a playpen.

Take, for instance, these quotes from the Australian Financial Review today.

‘I do think there is a gaming effect in financial markets at the moment…For some retail investors, there is a range of trading that has an entertainment effect. If you ask: ‘What value people are getting out of buying particular shares, or digital currencies?’

Continuing:

‘They can’t get out, they can’t travel or go to the movies, and so people are bored. Some people play computer games, where they kill aliens. But other people buy shares or bitcoin instead of playing computer games.

‘I think there is definitely more entertainment value being attributed to markets than has ever been.’

Anyway, here’s my response to ‘one of the country’s most highly regarded financiers’.

First of all, who buys digital currencies?

Buy real crypto, there’s a difference. So this financier sounds befuddled already.

Second of all, you think employees at the big funds — value, growth, or otherwise — just sit around making super serious decisions all day?

Maybe the value ones, they could definitely have a more stoic and austere approach to investing.

But let’s just quickly check in on how the value funds are doing this year:

|

|

|

Source: Morningstar |

I pulled these numbers from the Morningstar Fund Screener site (sorting for value funds by performance) and it reveals some interesting things.

Collins St Value Fund and 360 are smashing it, clearly. Then the one-year returns fall off dramatically.

Every other fund after that is an ethical fund.

I wonder how many of these ethical funds hold ASX-listed lithium stocks?

Now I’m not completely writing off value investing, just to be clear.

Its day in the sun may well come.

But the broader point here is to push back against the quote at the start, which infantilises retail investors who have done well off of the most exciting growth companies since March.

You see, there’s a deeply psychological element to trading and investing.

And some retail investors certainly approach their holdings like a punting account.

However, you can bring an element of seriousness to your investing without being a value stoic.

Put another way, you can go after the most exciting growth companies on the ASX while also being mature and level-headed.

Set stop-losses to manage risk, avoid hype in forums, Do Your Own Research (DYOR), and read a diverse set of outlets (hopefully this one).

In a similar way, we aim to do the same thing in our recommendations for subscribers of Exponential Stock Investor.

I’ll give you an inside scoop on two examples of how previous recommendations played out and what we learned from them.

Success or failure and the investment learning curve

I’d classify this one as a success.

Way back in early 2019, we could see the fintech wave coming.

Big Four bank stocks are slowly going the way of the dodo and this was all part of our Great Bank Unbundling thesis.

So we really liked personal loan-focused lender Wisr Ltd [ASX:WZR], which we’ve covered extensively here.

Anyway, we put out the recommendation in March at 5.8 cents.

We subsequently took half profits at a 344% gain, and then closed out the position at 13.5 cents for a total gain of 229%.

It was a good result, and we were happy to do this in April when uncertainty in the market was still strong.

Credit risk was big on our agenda at the time.

But we don’t always get it right, and here’s how you can get it wrong as an investor (while still being level-headed).

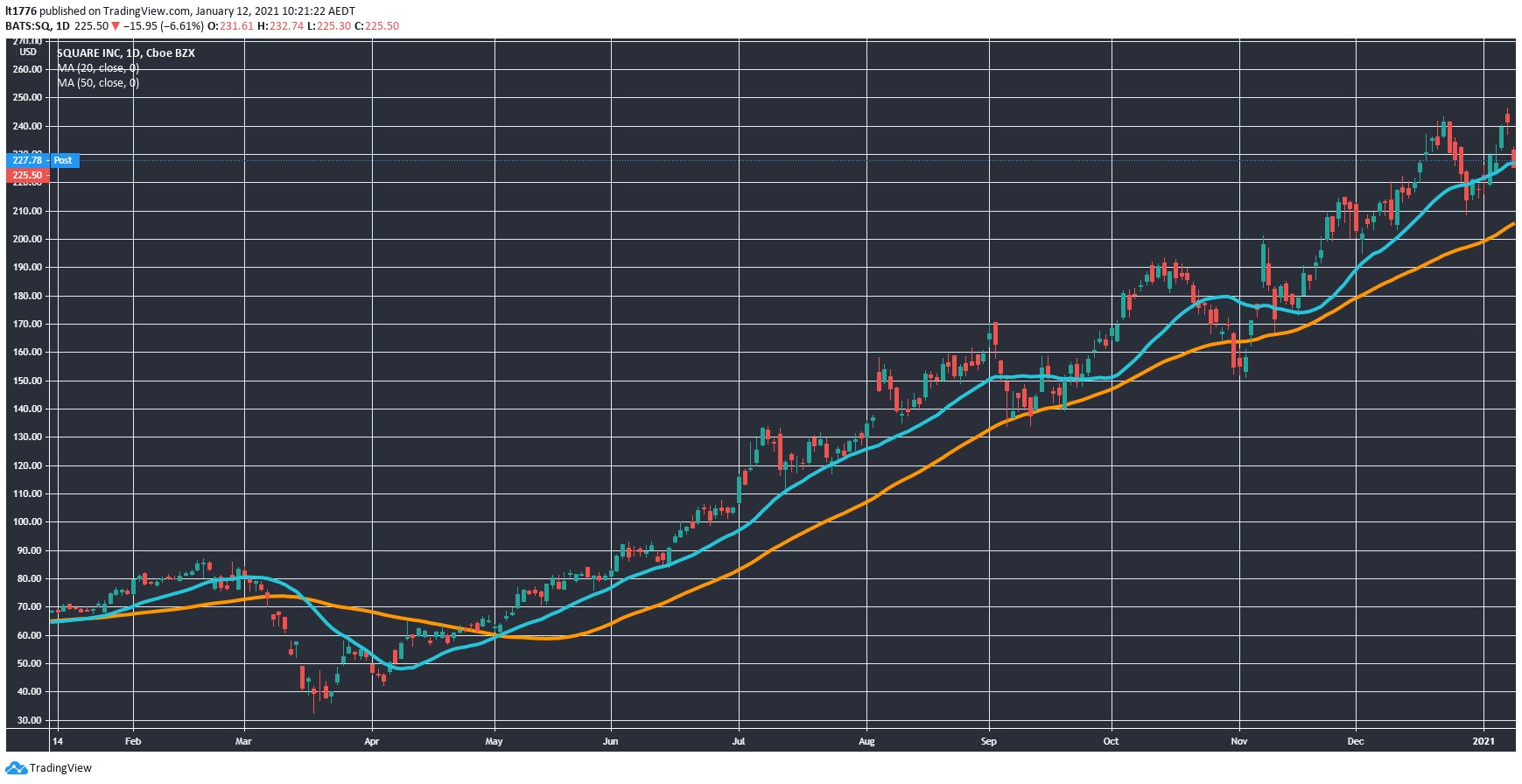

That is, on the same Great Bank Unbundling thesis, we really liked the look of Square Inc [NYSE:SQ], at an initial recommendation price of $65.

The platform which facilitates bitcoin investing for a younger generation would be a hit we thought.

But we were cautious and set a stop-loss of $41 to manage risk.

We wound up having to close out at a 24.4% loss.

Take a look at the SQ share price chart now:

|

|

|

Source: Tradingview.com |

Sitting pretty at $225.50, at time of writing.

We got it completely wrong.

But we learned from the mistake, and I think it’s making us better stock pickers.

Stick to your convictions where appropriate, have a proportionate risk appetite, but also don’t get carried away.

I’m confident retail investors have the capacity to do the same with their holdings, regardless of what the bigwig at the start says.

So, to the retail investors out there, particularly the ones doing well, you aren’t children.

The big funds envy you and you should be proud of your success in the last 12 months.

Whoever’s portfolio is doing the best wins the game.

Regards,

|

Lachlann Tierney,

For Money Morning

Lachlann is also the Editorial Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.