Renascor Resources [ASX:RNU] shares fell on Monday following a progress update on RNU’s Siviour Battery Anode Material Project.

RNU shares were down 5% in late afternoon trade, trading at 28 cents a share.

Despite today’s fall, Renascor shares are still up 90% over the past year.

What is causing RNU shares to slide today?

Source: Tradingview.com

Renascor’s Siviour Project progress update

Renascor announced its Battery Anode Materials Study (BAM) has increased its yields in PSG (purified spherical graphite).

Improvements in purification processes have brought an overall increase in production capacity to 28,000 tonnes a year.

Discussions with SA’s Department of Energy and Mining have begun for extending production capacity, which could bring 150,000 tonnes of graphite in each year.

CEO David Christensen stated:

‘Our Project’s development looks well timed. We are seeing increasing evidence that the anode market will continue to see strong upward price pressure, reflecting what we have seen on the cathode side of the battery, with lithium, nickel and other battery metals all having experienced extraordinary price growth in the last 12 months.’

RNU said it’s advancing toward a final investment decision for the ‘world’s first integrated, in-country mine and PSG operation outside of China.’

Graphite market remains strong

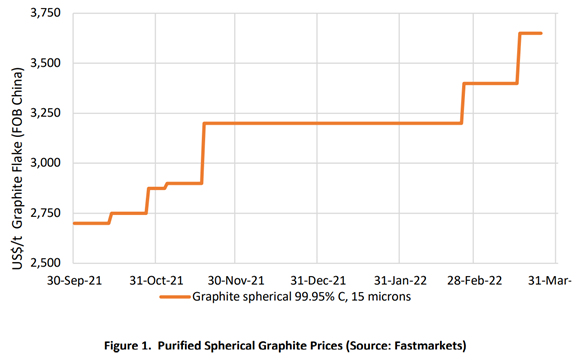

Renascor highlighted the fact that the graphite market ‘continues to experience upward price pressure’.

Fastmarkets reported that purified spherical prices rose 40% to $3,500–3,800 per tonne in the last six months.

With overall market conditions favourable, Renascor said it continues to talk with ‘leading battery anode material customers’ about potential PSG offtakes.

Source: Renascor Resources

Is this why RNU shares are down? Possible patent trouble

RNU today also touched on the issue of an opposing patent brought forth by an unnamed competitor.

The patent relates to protection of existing graphite extraction processes.

RNU aimed to reassure the market by saying it doesn’t see its project being affected if the patent is passed.

However, RNU has seen fit to lodge a counterargument in the hope of preventing it.

As Renascor commented today:

‘Renascor recently became aware of an application seeking patent protection over certain previously known and published procedures for purifying graphite.

‘In Renascor’s view, the pending patent application is overly broad and relates to processing procedures that are not novel or inventive to merit patent protection.

‘Renascor (as well as at least one other industry participant) has now opposed the pending patent application to protect and preserve its flexibility to use these processing procedures (or similar), should it wish to do so.

‘Irrespective of the outcome of the pending patent application, Renascor does not anticipate the Siviour Project will be adversely impacted.’

Now, irrespective of how this patent issue resolves itself over the coming months, it is clear that battery metals like graphite and lithium are key for the energy transition.

And if you are interested in investing in lithium specifically, you can check out our latest research report on three overlooked lithium stocks with potential to immediately cash in on booming lithium prices.

You can read the research report here.

Regards,

Kiryll Prakapenka,

For Money Morning