Dear Reader,

The media is bustling with articles full of stories of housing unaffordability woes.

The ABC ran with a story this week headlining that ‘Real estate across Victoria has never been more popular or so expensive’.

It reminds me of a cartoon I saw a few years ago that featured the creation of the ‘world’s first completely reusable newspaper’.

The headline — ‘HOME PRICES RISE’.

‘You’ll never need another one!’

At least, not for most years within the land cycle.

|

|

|

Source: Dilbert.com |

Having said that, we’ve never seen a boom quite like the one we’re seeing now.

All markets across Australia — both regional and city — are experiencing record rises.

In Melbourne, the median house price is now $1.125 million.

That’s up 18.9% over the year.

In regional VIC, prices are up 27%. The median price is now a record $565,000.

It’s the biggest annual increase for 21 years.

How to Survive Australia’s Biggest Recession in 90 Years. Download your free report and learn more.

Prices have ballooned more than $1,500 dollars a week over the last 12 months!

Real estate agents in Geelong are reporting desperate homebuyers are queueing outside agencies to secure newly released blocks of land:

‘There was probably 50–80 people out the front — there was only 30 blocks for sale.’

From the sound of it, you’d think there’s a shortage of land zoned for residential development in Victoria.

Except, there is more than enough land zoned for development to comfortably accommodate everyone who desires to build a home.

The problem is that developers control the supply of land — not government.

The big home builders will never build and sell housing at the fastest rate to meet demand.

That would be the worse business plan imaginable.

Instead, they’ll build at the rate that’s most profitable.

This generally results in drip feeding subdivisions onto the market in staged releases, to keep prices high and maximise profits.

The mainstream media focuses on the unfortunate homebuyers priced out of their favourite suburbs — but it forgets that the housing story in Australia isn’t about providing homes.

It’s all about making monopolists wealthy.

The biggest beneficiaries are the finance sector that have a licence to mortgage the earth and reap from the interest.

At $9.1 trillion, residential property is Australia’s biggest asset class.

Significantly larger than any other asset class.

Over the last 12 months, the cost of land alone (without the buildings on top) has increased by $1.72 trillion.

97.1% of that is residential land.

In other words — we’re experiencing the biggest land boom in recorded history.

The average rise in land values over the past decade has been 7.7%.

If that continues, we could expect to see land prices at $11.4 trillion in 2026.

Over at Cycles, Trends & Forecasts, we said it would be the greatest real estate boom in history back in 2019 — prior to COVID.

But what I’m seeing on the ground has exceeded all my expectations.

I’m witnessing properties selling more than $100K-plus above neighbouring properties in the span of a few weeks.

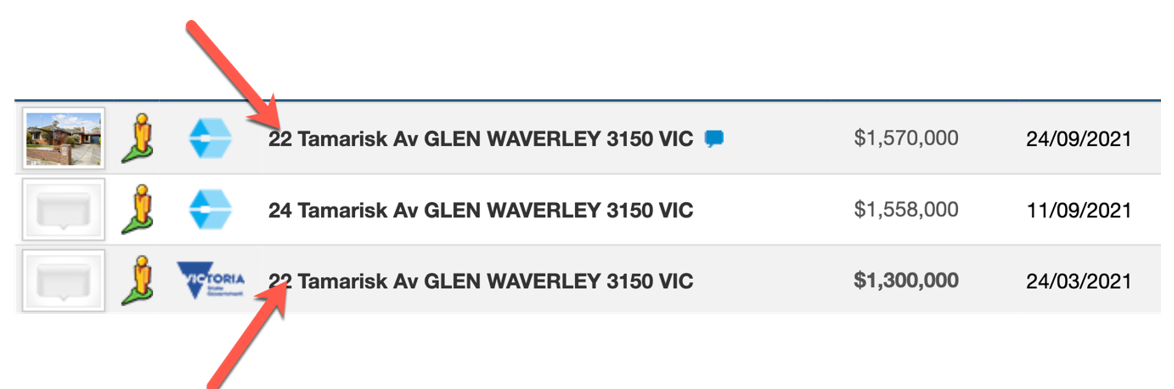

Here’s a good example:

|

|

The owner of number 22 Tamarisk Av flipping their house back onto the market after witnessing how rapidly the market was rising mid-last year.

The world’s first reusable newspaper will be accurate for a few more years yet — the boom should last until 2026.

After which, we’ll likely experience the biggest housing bust that Australia has seen since the early 1990s.

Why am I so confident?

Regards,

|

Catherine Cashmore,

Editor, The Daily Reckoning Australia

PS: Australian real estate expert, Catherine Cashmore, reveals why she thinks we could see the biggest property boom of our lifetimes — over the next five years. Click here to learn more.