Ramsay Health Care [ASX:RHC] has seen shares jump by 5.47% this afternoon, trading at $57.69 per share. The moves come after a series of announcements this past week that has seen interest spike in Australia’s largest private hospital owner.

It’s been a volatile year for Ramsay as a looming takeover bid by private equity firm KKR Credit Income Fund [ASX:KKC] has sent stocks swinging wildly since its announcement in June last year. After news of the potential takeover play, shares peaked at $84 per share in April.

However, the year has seen the deal deteriorate and the share prices with it — with shares down by 10.83% in the past 12 months. A result that has seen it sitting around the middle of the pack for the ASX healthcare sector.

Source: TradingView

Deal or no deal for Ramsay

The big news today that sent shares up was that Ramsay and its Malaysian partner, Sime Darby Berhad, are again considering the sale of their Asian joint venture Sime Darby Health Care. Ramsay commented:

‘The decision has been reached following the receipt of significant inbound interest in RSD at values that are in shareholders’ interests to explore.’

The news of a possible sale comes after David Thodey was named chairman of RHC yesterday. He will assume the role in November, taking over from long-time head Michael Siddle who has been with the company since 1968 and chairman since 2014.

Mr Thodey is known for his roles as former CEO of Telstra Group [ASX:TLS] and current chairman of Xero [ASX:XRO].

Ramsay made another announcement stating that it has successfully obtained $1.5 billion in newly committed revolving bank loan facilities from some of its significant relationship banks.

On Wednesday, Ramsay reiterated that there was no guarantee that the sale would occur. Shareholders will not be holding their breath after similar talks fell through last year.

In March 2022, Ramsay granted exclusive due diligence to Malaysia’s IHH Healthcare in a deal that could have been worth approximately $1.8 billion.

By September, Ramsay had walked away from the deal, offering no formal reason. People involved in the JV process claimed the due diligence struggled as IHH members disrupted hospitals and staff that were still dealing with COVID surges.

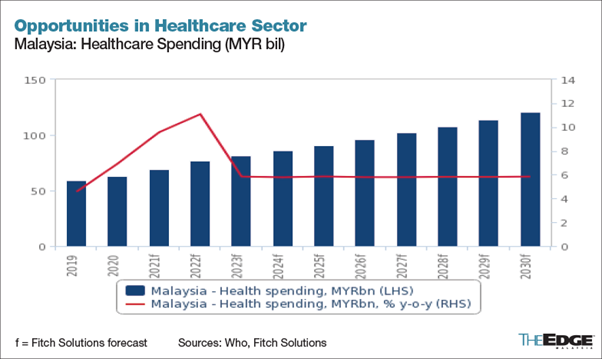

Malaysia has seen not only significant growth in its healthcare sector after pandemic-related reinvestment but a growing number of medical tourists coming into the region.

Source: Fitch Solutions

What’s next for Ramsay

The dust has finally settled after the failed takeover bid by KKR last year which had ruffled feathers in both companies — with both parties blaming each other for the unsuccessful bid.

KKR was especially unhappy with the result, going on to question the company’s prospects, saying:

‘In addition, the FY22 results portrayed an uncertain trading outlook for the Company, with a number of ongoing challenges impacting Ramsay’s performance including continued soft patient volumes and adverse operating costs associated with elevated surgical procedure cancellations, staff shortages, absenteeism and inflationary cost pressures.’

Ramsay’s latest quarterly report also highlighted ongoing struggles with surgery backlogs due to staff shortages, but the outlook certainly isn’t as dire as KKR portrays.

The joint venture has seen healthy revenue growth of 12% in the past six months. Locally, Ramsay Australia remains well-positioned to take advantage of a return to pre-pandemic operations.

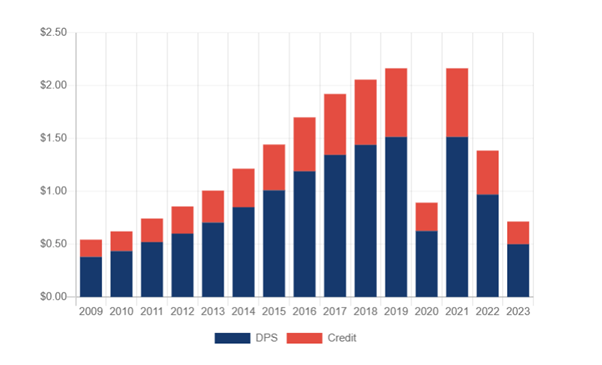

Investors should be aware that dividends remain low for shareholders at 50 cents per share, with the company promising a range of 60–70% statutory net profit ‘as the operating environment normalises’.

Source: Market Index

With bearish signs around the market, investors are on the lookout for defensive stocks that will pay healthy dividends to ride out the uncertainty.

But where can you find bargain stocks paying good dividends?

Bargain stocks 2023

Markets are starting to realise inflation will be sticking around a while longer, with rates rising, bond yields increasing, and the overall market beginning to slow and dip.

What’s really driving things home is the repeated dismal results being posted by companies in earnings season.

Johns Lyng Group [ASX:JLG] fell by 12.8% this week after posting disappointing earnings yesterday, taking quite the knock after a run of green growth in recent times.

Some companies have better news, but they can be hard to find in the wider scope of things. It’s a big sea of crashing ASX-listed stocks out there.

But our small-cap expert Callum Newman has done the hard work for you.

He’s found five of what he calls ‘the best stocks to own in Australia right now’.

And the best part is that right now, they don’t even cost that much.

Click here to discover Callum’s top five Aussie bargain stocks.

Regards,

Kiryll Prakapenka

For Money Morning