Life360 [ASX:360], the San Francisco-based tech firm, released its first-quarter financial results this morning, and investors are responding with disappointment.

Shares in the family tracking platform were down by over -7% in this morning’s session. Prices have since recovered slightly, down around -3.36% to trade at $14.98 per share.

The drop came after the company reported a net loss of US$9.8 million for the quarter and failed to convert as many free users to paid subscribers as some had hoped.

The company’s main service is a family tracking app that has become especially popular with parents who use it to monitor their teenage drivers — with around 66 million monthly active users.

The company’s stock is still riding high, having risen over 55% in the first few days of March after it announced the introduction of advertising into its free user base.

Life360’s shares are still up by 148% in the past 12 months, so will today’s setback slow its momentum? And when will the company turn a profit?

Let’s dig in.

Source: TradingView

Life360 Q1 results

The company released its unaudited financial results for the quarter ending 31 March, which showed that its total quarter revenue was up 15% Year over Year to US$78.2 million.

Subscription revenue also increased by 19% over the same period to reach US$61.6 million.

Life’s cash flow also turned positive for the first time, reaching US$10.7 million, an improvement of nearly US$20 million.

Despite these positive signs, the rising share price valuation and hopes of new investors were dashed by the US$9.8 million net loss.

Despite the setback, Life360’s CEO, Chris Hulls, remained optimistic about the company’s future and defended its decision to list on the ASX.

In an interview with CNBC today, Hulls praised Australia’s relatively large investable capital compared to its population size, saying:

‘People think of Australia as a small little country, but in terms of investable capital, it’s massively disproportionate to their population.’

In his quarterly statement, he also outlined what he saw as the company’s ‘path to profitability,’ again mentioning the advertising to free users.

‘Last quarter we introduced a new advertising offering which is now live in production with U.S. members and early results are promising.’

‘We have completed the development work that allows for programmatic ads, and expect to be set up for direct sales at scale by the end of June.’

Life360 continues its ‘path to profitability,’ a common trajectory for tech companies that often endure high upfront costs and initial years of financial losses.

The company hopes to capitalise on its products’ scalability, where exponential growth in user adoption can lead to substantial profits without similar cost increases.

The company reported a new quarterly record of 4.9 million new monthly active users (MAUs), giving some hope of scaling out.

However, many of these users may only be using Life360’s free services, as the report notes only 32,000 were ‘net Paying Circle additions’ in April.

So, what’s the outlook for the company from here?

Life360 outlook

While the first-quarter results have disappointed investors, Life360 says it remains committed to its long-term strategy, banking on the potential for its scalable technology to drive future profitability and growth.

For many who have recently bought the stock, the results may be disappointing, but it may still be too early to judge its profitability.

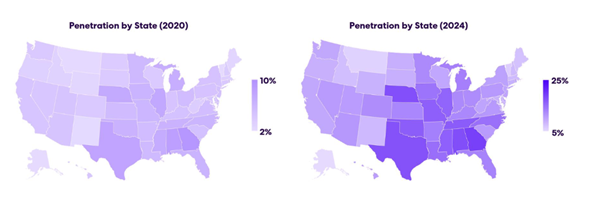

The company only launched its full triple-tier product to Australian and New Zealand members in late April, and it claims it still has ‘significant runway remaining in US penetration’.

Source: Life360

Some scepticism remains about its ability to retain its current daily active users growth, which is around 31% YoY growth.

While this could be harmed once its advertising fully rolls out, growth in both the US and global markets remained steady.

However, the company’s first-quarter of hardware units was a notable blackspot in its financials, with fewer units shipped and a lower average price.

In the face of mounting losses, the company will need to demonstrate its ability to convert its growing user base into sustainable revenue streams and achieve profitability in the coming quarters.

For shareholders, keeping an eye on its US performance is key to assessing how quick its path to profitability will be.

The next stock to jump

In the last mining boom, a 2-cent share went to $10 in just five years.

That’s an incredible 50,000% return from Fortescue Metals.

But finding those kinds of winners is never easy.

Our geologist and resources expert, James Cooper, set out to find the next big disruptors in Australia’s mining sector.

And he has five candidates that could emerge as victors in 2024.

A new mega-theme is developing in mining, and we think five companies will be at the forefront of it.

The signs are all there, and you only have to follow the big miners’ actions to see that the smart money is heading this way.

If you want to learn more about what’s in store for Australian mining and the best stocks to consider for this next trend.

Then click here to learn more about the next breakout stocks.

Regards,

Charlie Ormond

For Fat Tail Daily