Critical metals and clean energy developers in the emerging lithium-ion battery and EV sector, Queensland Pacific Metals [ASX:QPM] soared by 24% in share price earlier today.

The jump came after the group announced a new collaboration agreement with a collective of German suppliers, such as Plinke GmbH, Andritz Separation GmbH, and Siemens Ltd, regarding the supply of capital and equipment for the group’s TECH Project.

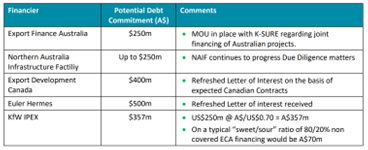

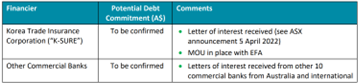

QPM says the total indication of funding as part of the debt process exceeds AU$1.4 billion.

QPM’s shares were trading for 13 cents at the time of writing — leaping by 33% in the past month and 18% so far in 2023:

Source: tradingview.com

Queensland Pacific’s German deal

Following a German trade delegation in Australia, Queensland Pacific drew up a contract with a collection of German suppliers as a ‘collaboration agreement’.

So far, Queensland Pacific has been working closely with the German suppliers for the feasibility study and ongoing engineering work for the shared interest in the TECH Project.

Now QPM is working closely yet again with the German suppliers to ensure the promised equipment will meet the project’s specific requirements.

As part of the agreement terms, QMP stated that it expects the German suppliers to:

-

‘collaborate to advance the TECH Project for the mutual benefit of all parties;

-

‘collaborate to ensure that proposed equipment to be supplied will be designed and constructed to meet the requirements of the TECH Project;

-

‘work towards providing performance guarantees for their equipment; and

-

‘identify the quickest pathway through to construction and commercial production.’

On top of these expectations, once current optimisation test work, engineering, and commercial negotiation are passed, the suppliers will be expected to provide construction and commissioning assistance and organise visits to plants to check equipment and operations.

QPM has agreed not to undertake a competitive tender on the equipment offer.

The companies are all currently completing design work and negotiating the commercial terms as part of due diligence processes.

The group has already received a receipt of financial support from two German financial intuitions, Germany’s Export Credit Agency (ECA) for an amount of approximately AU$500 million — a Letter of Interest to provide a tied loan guarantee — and AU$357 million from KfW IPEX-Bank, in debt financing split between the Euler Hermes guaranteed debt and non-ECA guaranteed debt.

It has been outlined that the total indication debt funding as part of the debt process will exceed AU$1.4 billion of conditional funding support as expressed by the interested financiers.

Dr Stephen Grocott, CEO of QPM, commented:

‘We have long identified that our German partners would be well positioned to supply commercially proven equipment required for the TECH Project. We have been actively engaged with Plinke, Andritz and Siemens throughout our feasibility work. Formalisation of these relationships through the Collaboration Agreement is a clear demonstration of each companies’ intentions and support for the TECH Project. This validates QPM’s strategy of sole-source partnering with leading equipment and technology suppliers. Furthermore, the conditional support received from Euler Hermes and KfW IPEX represents another milestone to our debt financing process. We are delighted they have the potential to provide loans and loan guaranteesto support the financing of the German supply contracts.’

Source: QPM

Australia’s drilling campaign

Did you also know that many in the resources industry are making raging bull market-like gains regardless of recession fears, interest rates, and what the wider market does?

More booms are marked to happen for every single metal that can be found on the period table.

There are small caps primed to grow into mid-to-large caps, but how do you tell which ones?

It’s a big universe, and you may need a little help. That’s where James Cooper, our commodities expert, comes in.

He’s found six ASX mining stocks that are heading to top the charts for 2023.

Regards,

Mahlia Stewart,

For The Daily Reckoning